Year In Review - 2019 Expenses

This is the continuation of my 2019 year in review series. See my previous post if you missed my returns report. As you probably know, I maintain two set of expenses -- one for monthly expenses and another for annual expenses. The monthly expenses include expenses that occur more frequently than once a year and the rest of the expenses go into annual expenses. Lets dive deeper into the report.

Monthly Expenses

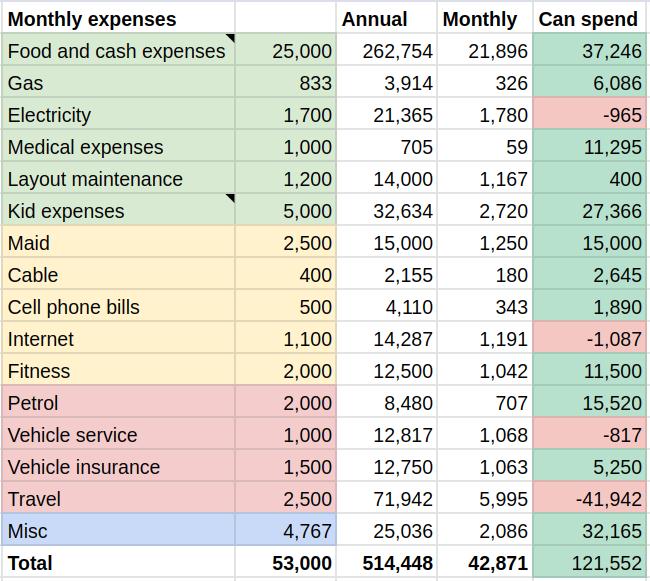

I have allocated a monthly budget of Rs. 53,000 for the year 2019. Below is the consolidated view of my budget, the actual expenses incurred on average per month, total expenses over the year and what is left out of the budget for each line item.

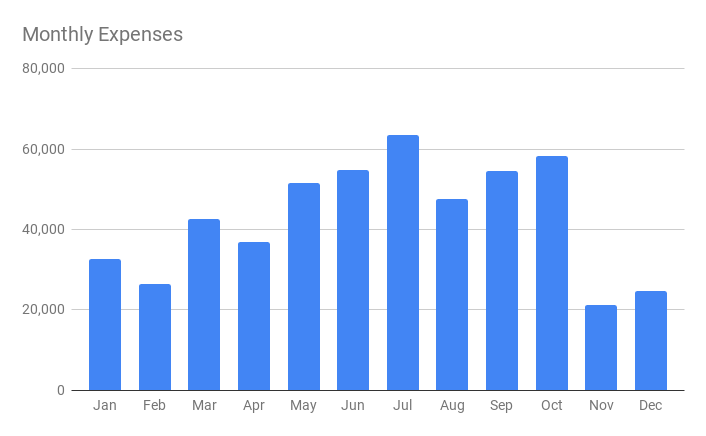

The expenses were Rs. 42,871 on average per month against the budgeted amount of Rs. 53,000. A good 10k less than expected. But some items went over budget, especially travel. Expenses ranged from Rs, 22000, all the way up to Rs. 64,000 during various months.

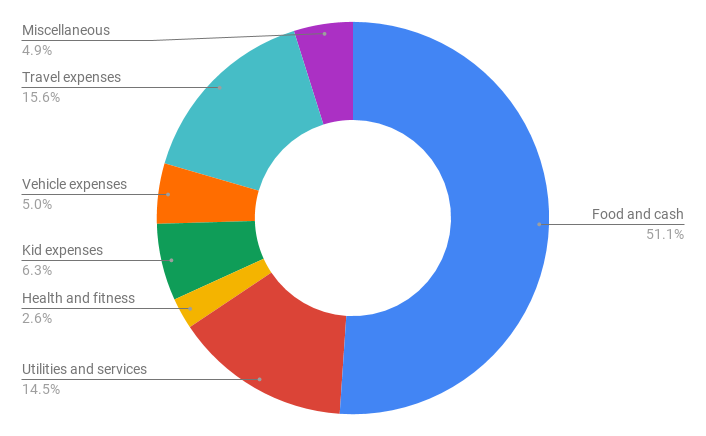

When it comes to where the money goes, well, it is mostly food and other basic household expenses (as it should be) at 51% of the budget. The next most expensive area was travel at 16%! We will come to it in a bit. Utilities and services (gas, electricity, cable, internet, maid, cell phone bills etc) also hit 15% which is fine. Kid expenses (toys, karate class, books etc) stood at 6%, while vehicle expenses (servicing, insurance) and miscellaneous expenses (clothes, gifts, fun world, parks etc) are around 5% each. There is a small 3% expense for health and fitness (my karate class and medical bills etc).

One of the expense that did not go according to my budget was travel. I overshot the travel budget by a large amount. Funny thing is that I did not travel anywhere all of last year :), it was mostly family (parents, wife, daughter, and sister) travelling around. Considering the changing expense dynamics, I revised the budget allocation a little bit differently for this year.

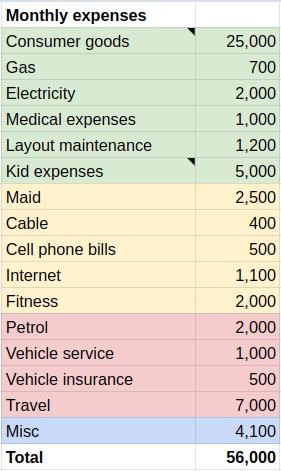

The first change that you will notice is that I increase the total monthly budget from Rs. 53,000 to Rs. 56,000 keeping inline with the inflation of around 6%. I did the same where my budget increased from Rs. 50,000 in 2018 to Rs. 53,000 in 2019. The other changes you will notice are in electricity buget which increased from Rs. 1700 to Rs. 2000. The electric company has been increasing the unit rate quite a bit and it breached my budget last year. Vehicle insurance budget was reduced from Rs. 1500 to Rs. 500 because I sold my other car, so less expenses now. And finally the biggest change came in travel budget which increased from Rs. 2500 to Rs. 7000!

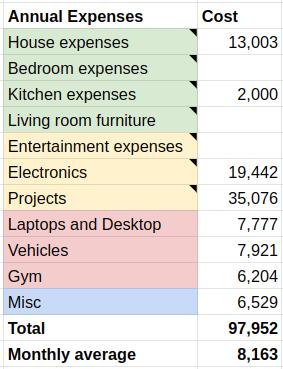

Annual Expenses

My budget allocation for annual expenses in 2019 was Rs. 3.60 lakhs. But the actual number came out to be a couple of thousands shy of Rs. 1 lakh. To tell you the truth, the real number was negative because I sold one of my cars and that more than compensated for the expenses. In my records it is a negative number, but for the sake of readers I left it out so you can see my actual expenses.

The usual repairs to vehicles, house upkeep, gym equipment upgrades, property taxes etc show up there. Some interesting expenses in electronics are the router and phone purchases. Some time during 2019 my mom's laptop's hard disk crashed, so I purchased a new solid state drive. Now the laptop performs like a champ. What a difference SSD makes! I also upgraded my laptop RAM (a post on this later I guess). That and a couple of other small purchases added up to the laptops and desktop section of expenses.

A few random expenses like passport renewals for me and my daughter, footwear, rechargeable batteries etc make up the miscellaneous expenses. Other than that, you will notice a big expense in projects section. That is mainly due to the fun home automation projects I work on, some electronics I bought for a friend's project, this blog's domain renewal and also due to organic garden and drip irrigation setup. A post on organic gardening is way overdue, but hopefully I will publish it soon.

Conclusion

That pretty much summarizes my expenses for 2019. So in summary, I was spending an average of Rs. 51,000 per month (combining the monthly and annual expenses together). Not bad at all. In keeping up with inflation, I increased the monthly expense budget to Rs. 56,000 per month for this year. No change in the annual expenses budget. How are your expenses? Do you spend more or less than me? Leave a comment!