Year In Review – 2019 Net Worth

The final post in 2020 Year in Review series, is my net worth. Like last year, I took stock of my investments and asset allocation. As a reminder to the readers, the idea is not to know how much I am worth, but mainly to understand my asset allocation. Even so, it is fun to check out the net worth, so here it goes.

Since I have retired, I don' t have PF anymore. I took out all my PF investments and moved them to debt funds because I am liable to pay taxes on the interest earned on PF after retirement. Moreover you never know when the government will change the rules for PF. Currently it is EEE which means the investment is exempt from taxes, the interest is exempt (while you are employed) and also the capital gain is exempt. But it can change any time. Also you are allowed a full withdrawal of PF after 2 months of unemployment. But the rule can change anytime and government may say you cannot withdraw until retirement age. I did not want to take changes and pulled out everything. I also paid off my home loan and I don't have any other liabilities to take care of. So liabilities is 0 and everything is just assets.

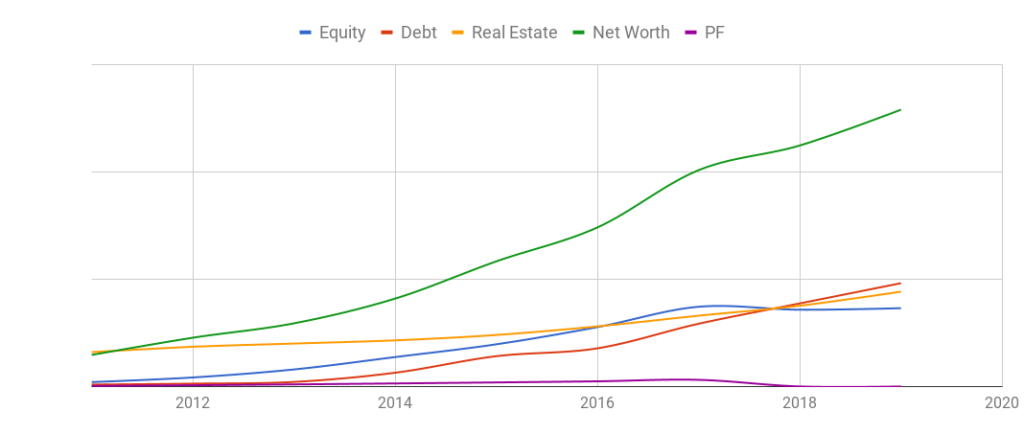

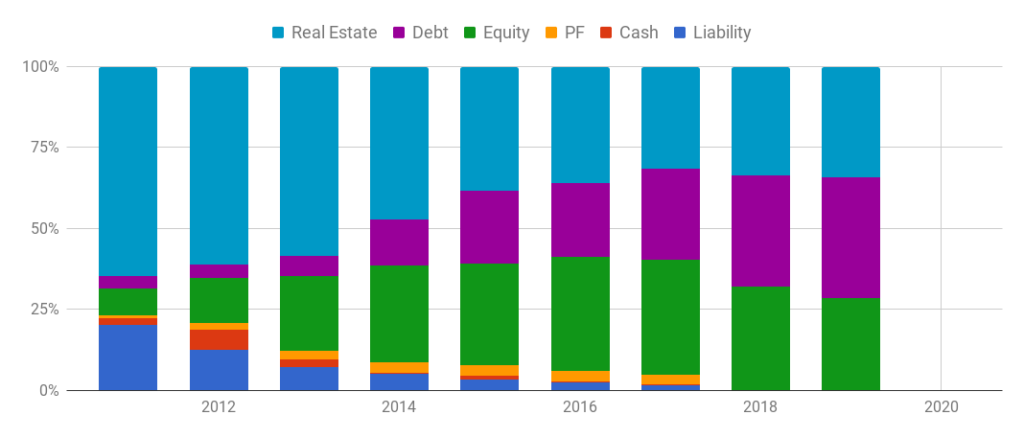

All the usual suspects out there. Real estate grew a bit more, PF is nil and the total net worth is in the upward trajectory thankfully. The more interesting parts are the debt and equity parts. Equity has been on the downward trend since 2017 because I am slowly exiting as the markets are heating up (or so I think) and I am not as comfortable owning equity. The debt allocation is creeping up. The chart below will be more useful when figuring out asset allocation.

In 2018, my real estate and debt allocation were about 34% each and the equity allocation was 32%. In 2019 the equity allocation was only 28% (and this includes the foreign stock that I own), while real estate was 34% and debt allocation was 37%. But hopefully 2020 will change things around. Lets see. I am not comfortable moving the needle any lower than 25%. If I take out the real estate component then the allocation to debt is about 57% and equity is 43% (including my US stocks). Excluding US stocks I own that I only plan to use for vacation and not for retirement, the debt is 84%! Not quite the 70/30 allocation, but that is the way it is for now.

All in all 2019 was a good year. I was still able to increase my net worth and I happy where I am. That concludes the year in review for 2019. Next update after another year :)