How and When I Decided To Retire

A friend and reader of my blog asked me this question -- I don't know if you covered this in the blog, but could you write about how you arrived at a number for net worth where you felt comfortable retiring. I have written about my retirement journey which is scattered across many posts. So I thought I should consolidate and revisit the topic for the benefit of new readers.

The way I decided I was able to retire was when I knew that my corpus (investments) has reached 25 times my annual expenses + some buffer. That basically is the 4% rule. It states that if you can meet your expenses by withdrawing 4% of your corpus then you can retire. Of course this may not work for everyone. Especially if the difference between your expected returns minus your inflation is low. That is a lot to digest. Lets break up.

The 4% rule

I was heavily influenced by the study that was done in the US over a 50 year period from 1926 to 1976. The study found that given the bond and equity returns during that time, a safe withdrawal rate would be 4%. That corpus while meeting your expenses will continue to grow and support future inflated expenses for a long time. So when I started my retirement planning, that is what I went with.

How it really started

Of course my journey did not really start with the 4% rule. Initially in 2011 I was just planning to retire at a certain year. I set my goal to retire by 2025 for reasons you will best understand by reading my old post on that topic. To retire by 2025, I needed to have some amount of money by that time. This is where the 4% rule came into the picture. The amount of money I should have in 2025 should be 25 times my expenses (inverting 4%) in 2025.

I build myself a calculator to figure out that number. Plugged in my expenses and age of retirement and out came the corpus I needed. I made another calculator that would tell me how much I needed to invest to reach the goal in 15 years. I started investing what ever the calculator told me.

When I retired

As years progressed and after my brush with minimalism and stoicism I figured that my expenses can be lower. This time my goal was not the year that I would retire. The goal would be the corpus. The day I have more than 25 times my expenses I can retire. So I wrote another calculator that would tell me how soon I can retire.

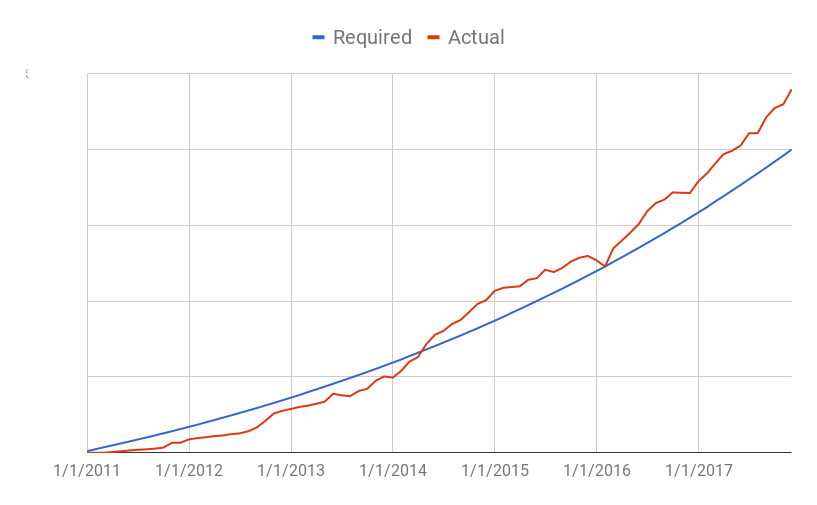

Eventually my corpus was larger than 25 times the expenses in 2017. I retired within a year of that (June 2018). Actually I had a bit more than I required (as you can see in the graph below) and that was my buffer in case things go bad. Which did happen in the form of COVID-19.

What was my corpus?

In 2017 when I was ready to retire, I anticipated my expenses to be around Rs. 80,000 per month (approximately Rs. 10 lakhs per year). I know that is quite high but read about the reasons in my monthly and annual expenses explained posts. So you can take a gander and guess what my corpus might have been. In reality though my expenses were Rs. 65,000 per month in 2020.

Does 4% rule work for everyone?

No it does not. This works if your inflation is quite a bit lower than your investment returns. For example, if you stash all your investments in fixed income (like FD, PF, Debt MFs etc), then you cannot reasonably expect the growth in your investments to out run inflation. At best the returns will be inline with inflation + 1%. In such cases you should go with 3% rule or even 2% rule. Instead I would suggest 4% rule and invest some good portion of your investments in equity all the time (see 70:30 asset allocation).

Conclusion

Hope that answers some of my reader's questions. If you'd like to know more, feel free to leave a comment or contact me.