Accelerate Retirement With Philosophy and Minimalism

This is the continuation of my earlier post. If you have not already read it, head on over there first.

In 2016, three things happened simultaneously that changed my retirement goals completely and my life style permanently

- First, I got introduced to Stoicism by sheer chance which changed my behavior and attitude towards life

- Next, I started to read more and more about leading a simple minimalist life which changed my life style

- And finally, I was having a great time with my daughter and wanted to spend more time with her, which led to me wanting to retire even more early

Introduction to Stoicism

I have never heard of the concept before and perhaps somehow stumbled upon a video about Stoicism. I don’t really remember the origins anymore, but it had a profound impact on my thinking. I have always been a believer in similar concepts – the universe operates in a web of cause and effect; do good and get back good, do bad and face the consequences etc. But the philosophy of Stoicism go beyond that and I love it. However it did not change my beliefs about God and I am still an atheist :).

How is this related to early retirement? Well one of the virtues of Stoicism is temperance – the exercise of self restrain and moderation in all aspects of life which includes cutting down on unnecessary spending.

Be a Minimalist

After reading about how minimalism can actually give more happiness than the constant “keeping up with Joneses”, I cut down my spending on unnecessary things by quite a lot. I don’t need to be socially important. Simple things in life, like spending more time with family at home, is much better than that exorbitant vacation where you are constantly racing against time to visit all the places and check off things just so you can post the pictures on Facebook. Vacation for most people is a rush, than to enjoy the moment. In any case, the minimalism mindset helped me retire early since my monthly expenses were not as high as I initially predicted.

Family Time

The final nail in the coffin happened as a result of my daughter. As I mentioned in one of my earlier post, we decided to home school our kid and I wanted to spend more time with her. It is surprising how spending a few minutes of your time with full attention will give you the opportunity to enter their beautiful world, which is always the best place to be. I love every minute I spend with her, and her world looks so different and colorful than mine.

Kids grow fast and I did not want to miss out any moment of her growing up. Once the kid grows up, the time will come when friends become more important than parents and this is usually the time when most parents get a chance to retire. End effect is that you missed out the important moments of a kids life when they most need you, and bother them when they least need you. I did not want to be that father. So early retirement is a must, and it needs to happen soon. I decided to retire before my kid turns 5, and that means I wanted to retire by end of 2017!

Retirement Planning

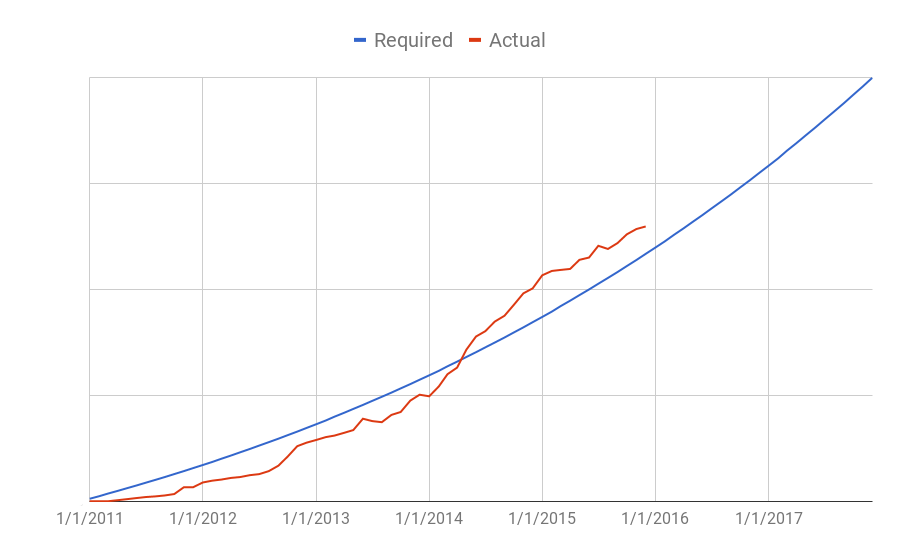

And so it began all over again. I had to crunch my numbers with the expectations that I will have much less expenses owing to minimalism, and a hard deadline of retiring by December 31, 2017. My spreadsheet was flexible enough that once I changed my required corpus to a smaller number and a new retirement date it spits out the new SIP (Systematic Investment Plan) numbers for each month and produced new graphs. I will publish my spreadsheets in an another post so others can benefit too. With my new corpus and SIP numbers, the graph looked like this –

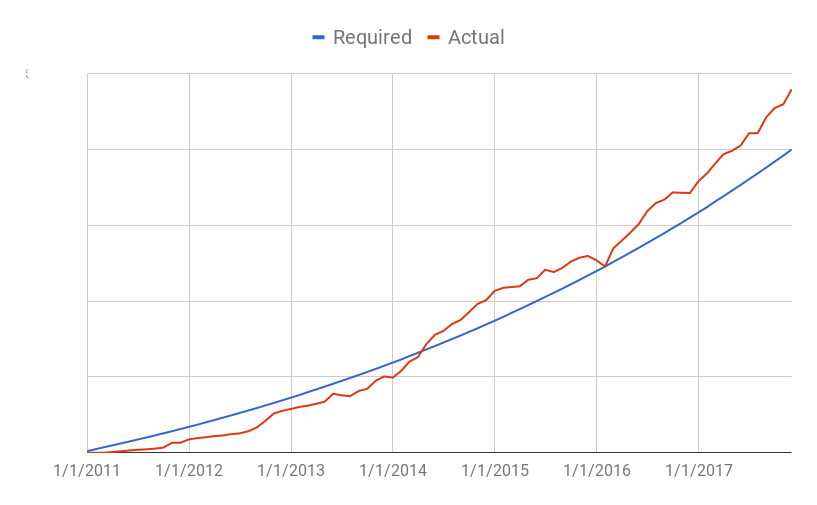

Notice how the “Actual” line is above the “Required” line by early 2016? My portfolio was doing good because the markets were performing well and also because I stepped up my investments starting in 2014. That was just the icing on the cake. The cherry on the top happened as 2017 unfolded and Indian stock market gave excellent returns. So I consider myself lucky that my retirement date coincided with the time when the market hit all time high. By end of 2017, my portfolio looked much better.

And if you thought that is how my work life ended and my retirement life started, then you would be wrong! There is still more to say, because I eventually retired mid 2018. The reasons behind the story in my upcoming post.