Setbacks Help You Get Started

In my last post, I talked about how I put an end to my work life and transitioned into early retirement. In today’s post I wanted to talk about how it all started.

It was the winter of 2010 when I finally decided to move back to India after an 8.5 years stint in the US. The reasons were like most other people moving back to India – to take care of parents and to be closer to friends and family. Until that point, early retirement or even the thought of retirement or saving never really occurred to me. The move to India was smooth when it came to my work, because the MNC I was working for in the US has offices in India and the company was kind enough to transfer me.

Once I arrived in India, and joined work in January 2011, I immediately started to see how things are different. Projects moved slowly, major decisions could not happen here and had to depend on decisions made by the US counterparts. Projects routinely got shutdown and interesting projects moved to US. I would later find myself involved in 5 projects that were either shutdown, went into maintenance mode or moved out of India office. That was just in the 8 years I worked here. But even before I understood the gravity of the situation (which happened in the future), I was quickly figuring out that this is not the place I wanted to be. By March 2011, I decided that I should start planning for financial independence, because I did not want to work for someone. I want to do something on my own, where I will be in control.

Your time is limited, don’t waste it living someone else’s life. Don’t be trapped by dogma, which is living the result of other people’s thinking. Don’t let the noise of other's opinions drown your own inner voice. And most important, have the courage to follow your heart and intuition, they somehow already know what you truly want to become. Everything else is secondary.-- Steve Jobs

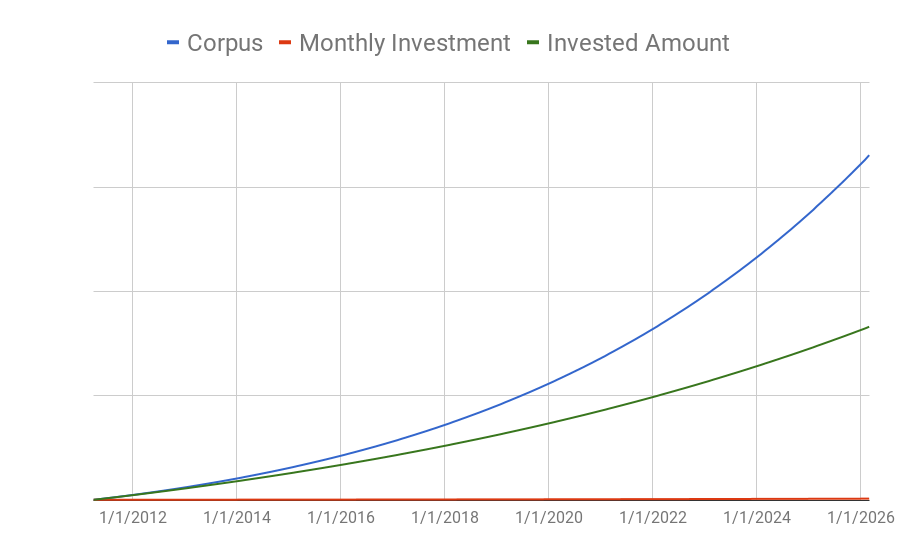

My original plan around that time was to retire by 2025, some 15 years later. So naturally, I started reading blogs about financial independence. After spending several days reading and understanding what early retirement is all about, I came to the conclusion that I needed a number for my corpus which would allow me to retire. I sat down to figure out how much I would need using various numbers for expected investment returns, inflation rate, how long I might live, expenses in retirement etc. Then I rolled up my sleeves to make some spreadsheets and graphs projecting the trajectory to arrive at my corpus.

I actually made two spreadsheets and graphs – one with the bare minimum corpus I can live off of and another one with the maximum corpus I can achieve. I will go into more details on how I arrived at my numbers and what variables were used in an another post. After this exercise, I arrived at how much I need to invest each month for the next 15 years to achieve my goal. I started investing and making some good progress. But the plan was to be short lived.

Projections made till 2025 assuming a constant 12% investment return rate

Projections made till 2025 assuming a constant 12% investment return rate

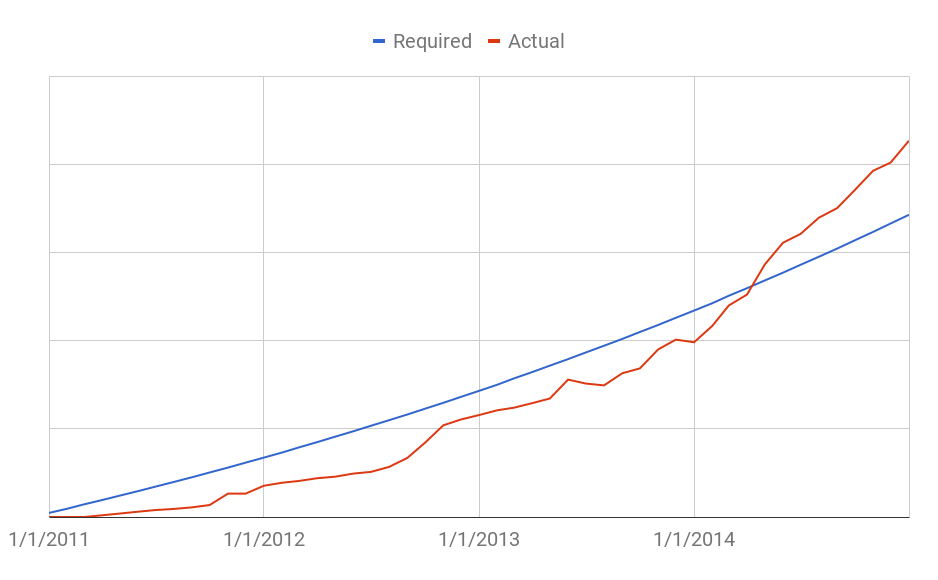

By the end of 2014, I went through a lot of ups and downs in life – both family and work related. This is probably one of the lowest point in my life. A project into which I poured my heart and sweat moved out of our office. I was leading the effort, but due to some office politics it was not to be under my control. By now I have already seen 4 projects go down the drain inspite of putting a lot of effort. I was seeing the gravity of the situation, which prompted me to do more planning and saving even more to move my retirement date closer. I re-ran the numbers, and this time I set my goal post at the end of 2020 instead of my earlier goal of 2025. Retiring 5 years earlier than planned is huge. Thankfully, end of 2014 was also a really good time in Indian stock market and I was confident that I will be able to reach my goal. You can see below how my portfolio is doing better than my projected number by end of 2014.

I am still not done with my retirement planning though! The final revision of my retirement goal came in early 2016 when I decided that I wanted to retire even more early. And the revised retirement date was to be end of 2017. More on that in part II of this blog post.