How to Retire Early in 5 Steps

Achieving early retirement is not really as difficult as most people think. But it certainly is not for everyone. Some may not like not being able to work and stay at home, some may not be ready for the simple retired life, some may feel anxious about finances (even if their corpus is as big as they wanted it to be). Going into early retirement requires the stomach to handle all those and much more. For most, it may be fulfilling to work and keep themselves busy that way. For the rest, these 5 steps will help you get started on your journey to early retirement.

Note that early retirement does not mean not working, it just means you don’t need to work for money. You work when you feel like it and for the cause that you believe in and it gives you happiness. You can be as busy or as free as you want and are not constrained by project deadlines, long commutes and daily meetings. One day you may be working until your body hurts, the next day you may be working until your brain hurts and the very next day you may be sitting in an easy chair watching the birds and drinking a cup of hot chocolate.

Now back to those 5 steps I have been talking about –

Step 1: Start Early

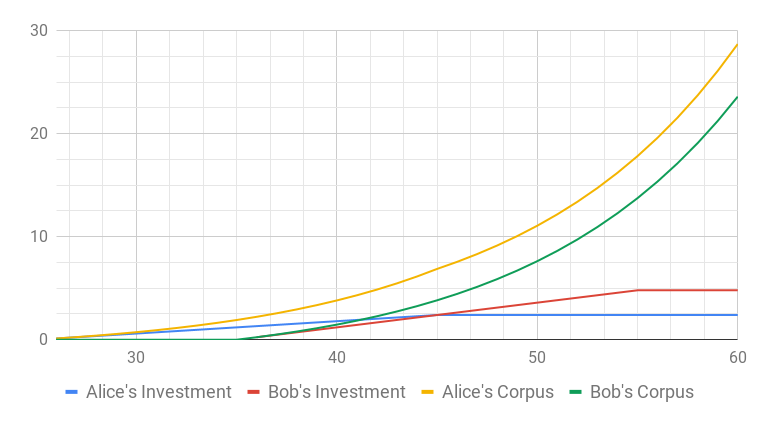

Whether you are planing for early retirement or not, in the end you will need money to live. You will not be able to work for ever or even not be able to find work for ever. So start investing early. This is especially important for early retirement. You must have all heard of the story of Alice and Bob or a variant of it. Alice starts investing Rs. 10,000 from the age of 25 to 45 and stops investing. While Bob starts investing twice the amount from the age of 35 to 55. In the end, both Alice and Bob have invested for 20 years. However when they retire at the age of 60, Alice has a retirement corpus of Rs. 2.87 crores, while Bob has only Rs. 2.21 crores in spite of investing Rs. 20,000 per month (twice of Alice’s investment).

Moral of the story is start early. It matters a lot in the long run. Read the post on time value of money to understand why this is the case.

Step 2: Rid Yourself of Debt and Save Aggressively

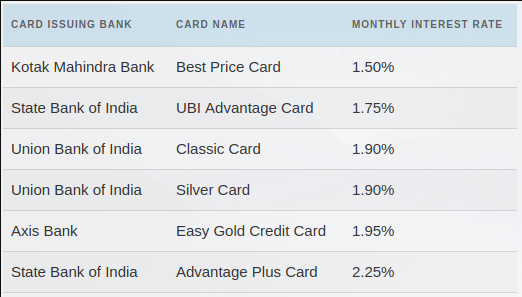

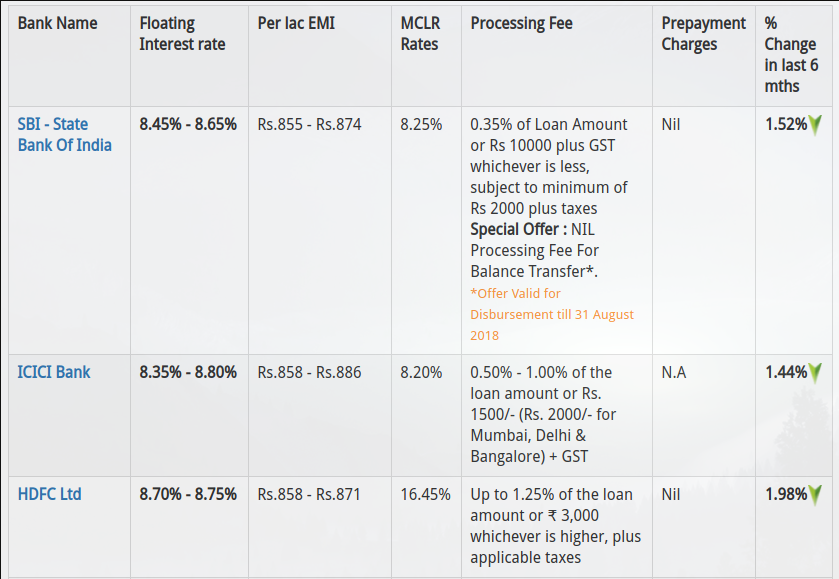

If you are planning for an early retirement, just starting early is not sufficient. You will also need to save aggressively. Get out of debt as soon as you can. You have a car on EMI? Get rid of the loan. Personal loan? Oh my! Why would you have it? Get rid of it. Check your monthly outflows and get rid of all kinds of debts. Debt is almost always bad, except for a home loan which has a tax benefit and is usually offered at a lower interest rate. Start with the EMI with highest interest rate, usually your credit card, then clear each debt one by one. Home loan is the only one you can leave alone not only because it will be a huge amount, but like I said earlier, it has some tax benefits and the interest rate is not usually very high.

Once you have cleared most of your debts, target saving aggressively. This may be the hardest step for most people. We just get used to a certain style of living and as our income increases, so does our expenses. How is possible that a person who earns Rs. 10,000 per month is able to live happily, while a person who earns Rs. 1,00,000 is unable to save anything? I am not saying that you should be penny pinching, but consider where your expenses are going and think if it is really a need or is just something you want.

If nothing, try not to increase expenses even as your income increases and that should help. Most of the time the expenses are related to maintaining a social status. Get rid of that feeling. You get good salary, you move to a more upscale place, then to be socially relevant, you upgrade your car, then the budget for the kid’s birthday goes up from a small family gathering to a big hall full of people you don’t even like; you get my drift right? Forget all that and find ways to aggressively save as much as possible, especially early in your life. The compounding effect is more pronounced on your earlier investments than later ones.

Compound interest is the eighth wonder of the world

-- Albert Einstein

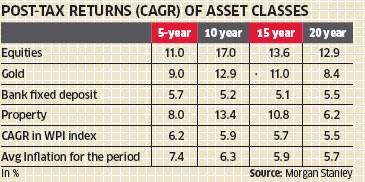

Step 3: Make the Right Asset Allocation

Alright, you started saving early and saving tons of money like there is no tomorrow, but where are you investing it? You should be investing where you will get a good return on investment. Equities have a good track record so far. People throw around big numbers like 20% returns on equity and such, but it is very rare to find such great returns. A 10-12% return is certainly achievable in the long run in equities. Unless you are expert in the field of stock picking (if you think you are an expert then that clearly means you are not), I would suggest you invest in some good equity oriented mutual funds. Equity oriented mutual funds have given a good return in the past. Some well know old funds like HDFC Top 100 has given a compounded return of 20% in 22 years! Just imagine, if you had invested Rs. 10,000 per month in the fund for the last 22 years, it would be worth 3.64 crores today and you would have invested only 26 lakhs over that time.

But don’t just invest everything in equity oriented mutual funds. Keep some emergency fund (to cover 6 months of expenses) in liquid mutual funds. Finally as you are approaching retirement, move a good part of assets into safer ultra short term, and medium term funds. More details on how to allocate between debt and equity funds based on various stages of your retirement goal and market conditions in The 70:30 Asset Allocation post. It is also good to have some investment in real estate if you are going to live in that house. Again, if you are an expert in the field, you can do real estate or gold investments or stock picking instead of mutual funds, but I would strongly advice against it.

Step 4: Plan a Simple Retired Life

This step is optional really, but if you want to retire as early as possible, you will certainly want to work on it. Many people think of retirement as a time when they will travel around the world and live a luxurious life. In fact when I told my friends that I retired early, most assumed that I would be travelling and would have saved up for all that. Really?! No way. That was not my retirement plan at all. I just want to live a simple life. I will travel sometimes (once a couple of years may be), but it is not going to be that expensive snorkeling trip, spending time in 5 star resort on a far off island and going on a cruise.

If that is your idea of retirement, then early retirement is probably not for you. Do rethink. I am happy spending time with my kid, watching a movie with family, working on my home projects and learning martial arts. Early retirement is really meant to be a time where you live by your rules instead of your employer’s. Just by adjusting your retirement expectations you can cut down quite a bit on your post retirement expenses and that means requiring a smaller corpus, which leads us to the next step.

Step 5: Determine How Much You Will Need

How much do you really need in retirement? It’s actually very easy; just follow the 4% rule. If you don’t know the 4% rule, just Google it. Basically it is a rule of thumb which tells you that you can safely withdraw 4% from your retirement corpus to have a steady stream of income during retirement while leaving enough in the corpus to support you through your retired life.

Corpus x 4% = Yearly expenses in retirement

Let’s take an example – say you need Rs. 50,000 per month in your retirement. That is Rs. 6 lakhs per year. Now, what should be the size of your corpus that will give you Rs. 6 L if you withdraw 4% from it? It should be 6 / 4% = 150 lakhs or 1.5 crores. The 4% rule was designed for US living and in India people often say 5% or even 6% will do fine too. In that case you will only need Rs. 1 crore of corpus. And this is assuming that you will not earn more income after you retire. But may be you can freelance and make some money on the side? Then the corpus can be even lower. I have a simple calculator to help you with this step. Give it a try.

Now that you have determined how much you need before you retire, just use steps 1, 2 and 3 to get the job done :).