Should You Be Worried About Inflation

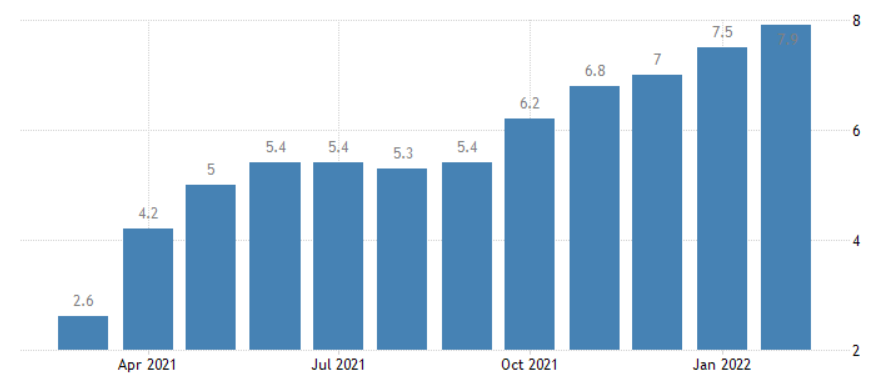

For the past few months we have been hearing about the increasing inflation in the US. Is it possible that the same could happen in India and should we be worried? First lets try to understand the severity of inflation in the US. The inflation number in the US used to hover around 2% for the longest time. But it has shot up to as high as 7.9% in February 2022. That is almost 4 times as high as the average! That does hurt. It is a number not seen in 40 years! In India, the inflation is still not that high, so we don’t have to worry as much as our friends over on the other side of the world. Still, it is always useful to do a thought experiment and see if it is a topic of concern.

First of all, no one can actually tell you what your inflation is. You will have to do the calculation yourself. The numbers published by the government is based on some assumptions of how much we are going to spend on each category. For example, India’s CPI (Consumer Price Index) gives a lot of weightage to food and beverages which accounts for 46% of basket of CPI. So unless your food and beverages expenses are nearly 46% of your total expenses, the CPI number will differ from your inflation. For most people, our expenses don’t match at all with the components and weights of CPI. And CPI is the governments inflation index. When you hear inflation is going up, that is what everyone is talking about.

What I am trying to say is that checking the news about inflation may not matter much to us because we have to track our inflation. May be we spend more on school fees or medical expenses or housing. Whichever category is the biggest in our expense will influence the inflation. If I spend a lot on technology for example, then my inflation will actually be much lower or even deflationary. The reason is that technology is becoming cheaper every year. Our phones, TVs, laptops etc have been becoming cheaper every year. So for the person whose expense has a bigger pie allocated to gadgets will see their inflation grow slowly. For a person whose expenses are mainly in the form of medical expenses, their inflation will be much higher than government published numbers.

One way to calculate your inflation could be by tracking your expenses for few a years and check your real inflation. But of course your inflation will keep changing because where you spend will keep changing at different stages of life. When you don’t have kids, there are no school expenses. But later in life, school expenses will start. Later, you may be spending more on EMIs, then on medicines. So based on those categories your inflation will keep on changing. So none of the numbers published by the government or the numbers you calculate yourself will ever be accurate for the future. There is no point worrying about the inflation you hear on the news.

However, there are a few things that you can do with your inflation number.

- You can reduce your expenses (if they are discretionary type) in those categories where the inflation is higher during certain times. If flight prices are going up too fast, skip a few vacations until the prices come down etc.

- You can change the corpus needed for your goal depending on the inflation numbers. For example if your inflation is more or less than what you initially used for your retirement corpus, you can revise the number and change your investment accordingly. You may have to increase your investments or may be you can retire earlier depending on which whether the new inflation number is more or less than your original number.

- You can make some tactical calls by playing with duration funds. If you did not understand the last statement, don’t worry, it means you should not attempt it anyway.

In summary, don’t worry about the inflation numbers which are going to come in the future. Just know your inflation and make some good decisions based on it. As I already said, the inflation differs from person to person depending on where the person is spending. I have already written a couple of posts on inflation. My laptop inflation was 0% and our electricity bill inflation was 4.6%. Our total inflation has been less than 6% for the last 4 years. Your mileage may vary.