Retiring In A Bear Market

I already wrote a bunch of posts about 4% rule on my blog. Most recently I explained how early retirement might work during a prolonged recession. You have also seen how 4% rule is working out for me. Then there is that topic about whether 4% rule actually works in India given the high inflation, which we found out might actually work better in India. But then why should we stop the discussion there? Let us talk about retiring in a bear market. Actually I am not going to do any analysis, but will just point you to an interesting article I read recently.

Nobody can predict if there will be a bear market soon after you retire. You plan well and just retire and it might feel intimidating to live through a bear market or worse yet a recession. But what does the past tell us about retiring in such unfavorable conditions? According to the article, “research shows that even people who retired in the worst time to do so since 1926 would have made their money last 30 years by sticking to certain rules”. Even those who retired during the 2008 recession have done well provided that they managed their money well. That is certainly comforting to know. While the study is done in US, it still applies to Indian markets like we discovered with the 4% rule.

When you start your retirement with losses, you will be eating into your savings instead of eating out of the interest produced by the principle. If this continues on for a few more years then the principle becomes so small that even if there is a bull run after that, the interest produced may not be able to sustain the expenses. As an extreme example, lets say in the first year of retirement, your corpus drops by 50%. If you have 100 lakhs, it drops to 50 lakhs. If your annual expenses are 5 lakhs, then the corpus left after the first year will be 45 lakhs. Now even if there is a 10% gain in the market, the interest which is 4.5 lakhs, is still less than your annual expenses of 5 lakhs. So you will continue to eat into your savings. Not a good situation to be in. Of course that is an extreme example.

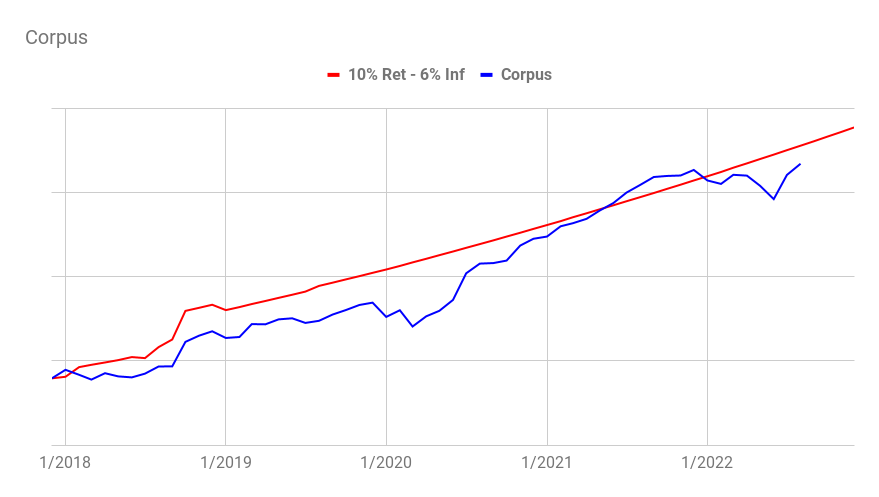

According to the article, supposedly the first 5 years are a pivotal period for determining a sustainable lifestyle in retirement. By that token, I am actually not in a good period since the first 5 years of my retirement are fraught with poor returns as you will soon see. I am somehow still surviving. Although I have not completed 5 years in retirement yet, I am very close to it. While I did not have losses, you will notice in the graph below that my corpus has been below my projection for almost 4 years out of the last 4.5 years.

So how did people who retired in 2008 manage a good retirement even with a huge crash in stock market in the US? Supposedly “As long as you didn’t panic and sell your stocks in 2008 you’d be doing fine today” using a 50:50 asset allocation. Other important suggestions are listed below.

Cut spending

One should try and reduce their spending during recessionary periods which was also the suggestion (see #3) in my post. By the way, the article suggests that 4% rule has worked well to have protected retirees from running out of money even in the worst 30 year period since 1926. The worst of them supposedly was from 1966 to 1995. And even in that case, if you continued through with 4% rule you would still have a decent 30 years of income. However, a small change in spending will have a big impact. For example spending 3.8% instead of the 4% rule will help you keep keep money even after 30 years.

Manage volatility

Another interesting suggestion from the article is that one should try to reduce their exposure to equity asset class to 20-30% when they retire and then slowly increase it to 50-70%. They did not mention how long one should take to go from 30% to 70%. Those taking the opposite approach, i.e. having more in equity, say 60% when they retire and then reducing the allocation to 30% had poor results. Incidentally, I have been doing the wrong thing. My allocation to equity went down from 43% to 15% during the first 3 years in retirement. This cannot be good news for me now can it? And yet, here I am doing fine as of now. Only time will tell if my missteps will cause heartburn in the future :).

Use other assets

One final suggestion is to use other assets to provide you income when markets are on the decline. This could be in the form of reverse mortgage or in Indian context gold :).

Conclusion

All the suggestions seem very practical and sane. So if you are worried about retiring in a recession or bear phase, keep those suggestions and the research in mind. Life is never ever about exact outcomes. It is more about adapting to changing situations. If we all know exactly what will happen tomorrow and are fully prepared, it would be a dull life. Won’t it?