Real Estate Investment vs Equity Investment

While you know my aversion to real estate investment in India, I don't discourage anyone from investing in it. If you don't mind the corruption related to property deals, you might make more than simply investing in equity and debt mutual funds. But before you decide which way to go, make some informed decisions. In this post I will try to simplify some calculations which can help you guide in the right direction. I will also mention some risks involved in each of those asset classes.

Buying a property

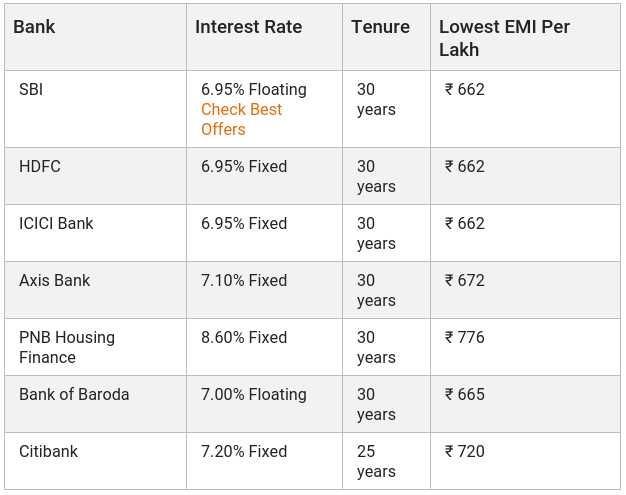

Lets take an example to make it easy. You will have to plugin your own numbers but lets say I want to buy a house/apartment for Rs. 50 lakhs. I want to take a loan of 80% and do a 20% down payment. Further, lets assume the loan rate is 8%. You will have to find the home loan interest rate from your bank, but going by the current numbers, lets say it is 7%. Duration of home loan is 20 years or 240 months. Using these numbers, the EMI turns out to be Rs. 31,012. You can find out EMI by typing in the formula =PMT(7%/12, 240, 5000000*80%) in a Google Sheet. Of course you will need to use your own numbers.

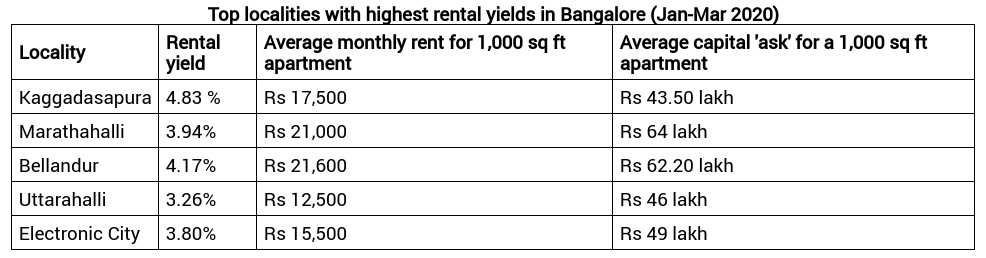

I am assuming that this property is already constructed and handed over. In this case I can start collecting rent from day 1. Assuming a rental yield of 4%, I would be receiving a monthly rent of Rs. 50,00,000 * 4% / 12 = Rs. 16,667. So the effective EMI I will be paying every month is Rs. 31,012 - Rs. 16,667 = Rs. 14,345.

Finally, I assume the property value to grow at the rate of 8%. This is the most difficult of them all to figure out. The place where I live grew at a rate of 6% over the last 10 years. So you will need to have some expertise to know which areas have a possibility of growing fast in the future. Assuming 8% rate of growth, at the end of 20 years when the home loan is finally paid off, your property will be worth Rs. 50 lakhs * (1 + 8%)20 = Rs. 2.33 crores.

Investing in Equity and Debt MFs

If you had invested in mutual funds (MFs) using the 70:30 asset allocation strategy, will you have made more or less than Rs. 2.33 crores? Lets find out. Instead of making the down payment of Rs. 10 lakhs for the house, I will invest in MFs. Then every month, instead of paying the effective EMI of Rs. 14,345, I will invest that amount into mutual funds. Furthermore, lets assume the investment returns is 10%. Eventually at the end of 240 months (20 years), I am left with a corpus of Rs. 1.82 crores. You can use the formula =FV(10%/12, 240, 14345, 1000000) in a Google Spreadsheet to get the number.

So you will make only Rs. 1.82 crores using mutual funds against the Rs. 2.33 crores that you could have made using real estate. Seems like real estate is winning by a good margin here.

Conclusion

With the numbers that I used, it does seem like real estate is a better investment. But if I buy the property in a wrong location, where the growth rate is not 8%, things will change quickly. For example, take the location that I currently live. The growth is 6% or less. If I use that number then the real estate would be worth Rs. 1.60 crores which is less than what my MF investments would have given me. So it all depends on the numbers that you use. I made a Google Spreadsheet with the calculations mentioned in this post. Feel free to make a copy and edit it to fit your requirements.

Other things to consider

I have made a few assumptions and simplifications in the process. For example, I assumed that you will be immediately be able to rent out the property after buying it and that it will be fully occupied over the duration of the loan. I did not include any maintenance costs or property tax. Selling real estate is much harder, so it is very illiquid compared to mutual funds. There are also risks of getting cheated if the documents are incorrect. Finally, I have used numbers on the higher side for rental yields and property growth. Especially if you consider an apartment, the growth rate will be no where near 8%. Land appreciates better than constructed house, but then you don't get rent.

You get tax breaks when you take home loan which is an advantage. Make sure you are capable of paying EMIs. That is to say, if there is a possibility of losing job or any income that is required to pay EMIs can turn out to be bad. Finally, in this post I assumed you will be using real estate as an investment and not to live in it. If you are planning to buy a house to live, then it is a different ball game all together. In mutual funds you have the risk of defaults, market conditions, interest rate movements etc. Choose your own poison.