Lumpsum vs SIP

Is it better to do a lumpsum investment or do systematic investment? Like many things in life, the answer is – it depends. There is usually no one good answer. But taking some examples we can see which works better in what situation. Of course these are just my opinions and they may not apply to your situation. Also, there may be many other cases which I do not cover. Finally, remember that whether you do lumpsum or SIP, in the long run the difference in returns will usually be miniscule unless you time the lumpsums very badly. With that out of the way, lets get to some examples.

One of the simplest case is when you are a salaried person. It just makes sense to invest every month because you receive salary every month. Even if you like to do tactical investments like trying to buy low, you still have to invest the savings in a FD or other fixed income until you do a bulk transfer. That investment into fixed income funds is still SIP. There may be situations where you receive a bonus which will probably be a lumpsum investment. However, if the bonus is quite substantial like say more than 3 months of salary, I would suggest spreading out evenly over a few short months (no more than 6 months). You have to choose SIP even in cases where you receive any other monthly income like rental income.

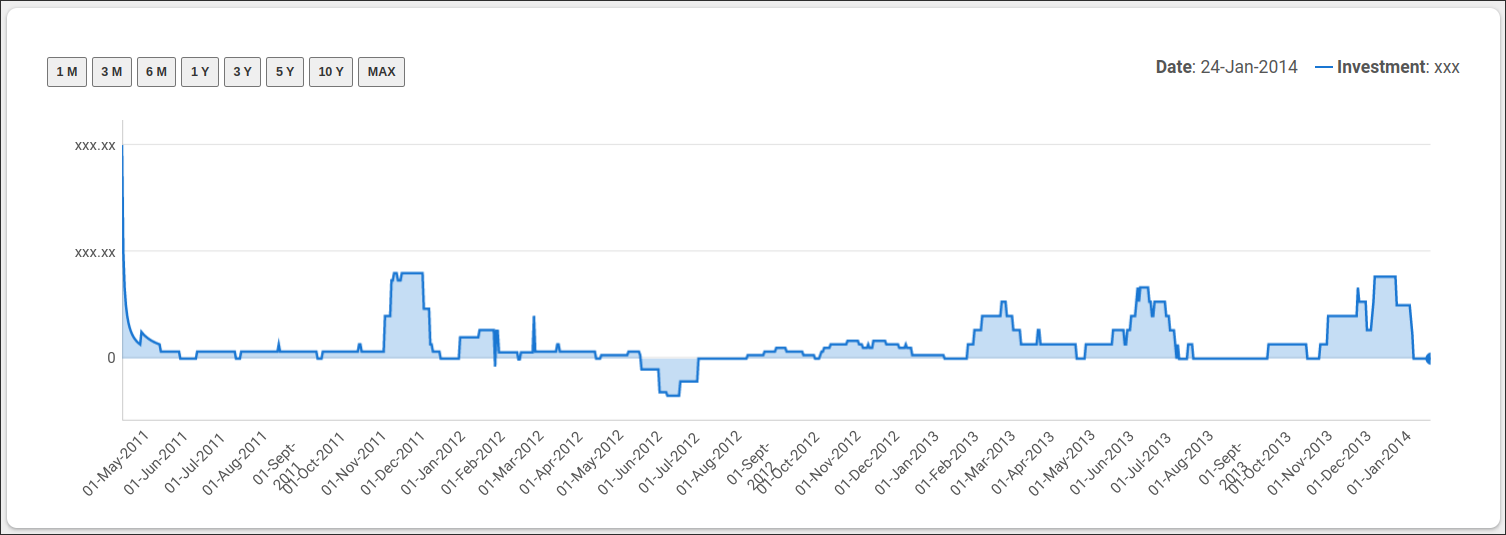

I have done every kind of the above combinations during work years. It is just crazy. See the below graph. You will notice that in the initial years of my investment journey from March 2011 up until about June 2012, I was investing systematically the same amount of savings into mutual funds, both debt and equity depending on the asset allocation I choose at the time which was 70% in equity mutual funds and 30% in debt mutual funds.

While that was a case for SIP, I also used to do lumpsum investments spread over a couple of months when I got bonus. That usually happens between December to February of each year. Then there have been cases where I had to sell my investments to meet some expenses because the expenses were over and above my salary. These expenses mostly happened around mid 2012 when our house construction was completed and we paid the final bills. In additions we purchased some furniture and appliances for the house. You will see this event in the graph where the line goes below zero on the horizontal axis in mid 2012.

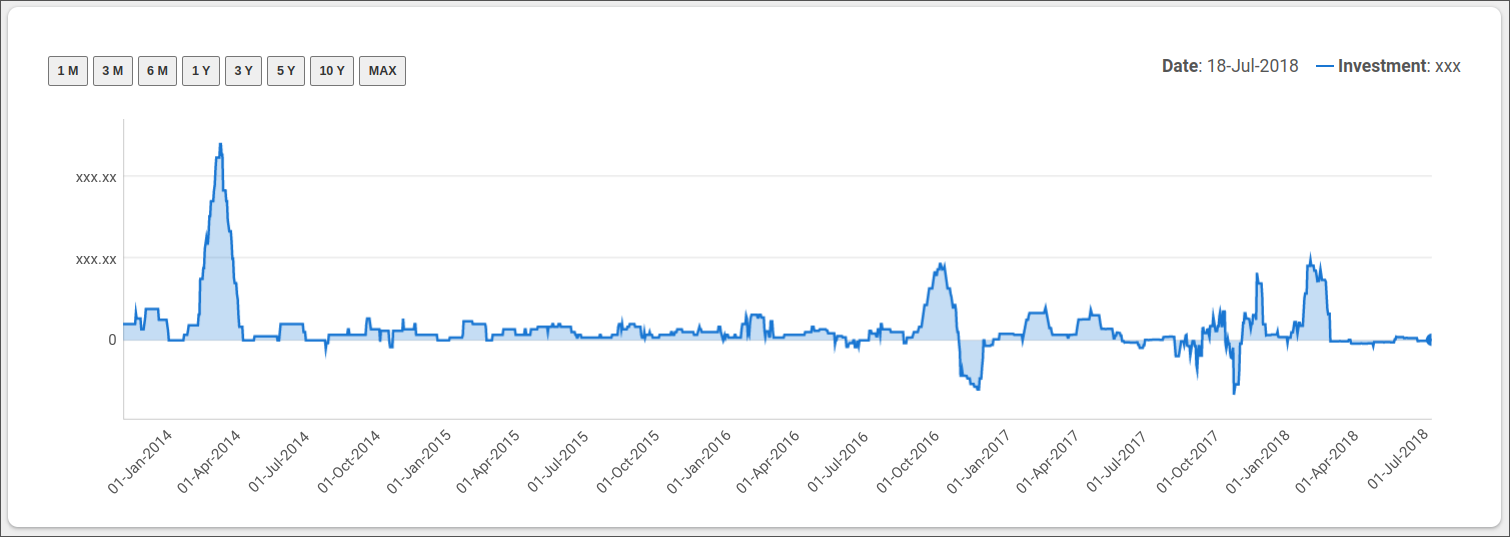

But wait, there is more. Starting from about late 2012, I tried to invest tactically. Investing more when the markets were down and waiting during bad periods. That is the reason why you will notice the hills of investments followed by flat plain where I pause investments and so on. But the biggest kicker came in early 2014. Take a look at the below graph where I sold a bunch of my foreign RSUs (which were part of my compensation) and invested in indian equities. Which is why there is that huge peak in early 2014.

At the time I felt that my investments were too overweight in one stock (my RSUs), so I did a full rebalance. Other than that most of the investments were just the usual, investing my salary in a semi SIP way. You will also notice how the investments went to zero towards the end of the graph as I retired in 2018. From there on, there is no other income, just expenses :) which I used to meet by selling some of my investments every month. That is all about investing for the salaried.

If your income is uneven, say for example you are a freelancer or have business income, then you have the choice of either investing in lumpsum or SIP. In this case I don’t have a strong suggestion. If your income is very lumpy with lots of money coming in one go with a long empty period, then I suggest spreading the investment over several months. But of course once you receive the money, you have to invest in a FD or other fixed income instrument and then slowly transfer money from the safe investment to a higher risk-reward investment like equity. A lumpsum investment can also work, if you can carefully time the market.

If you are a retired person like me, then it might make sense to be using lumpsump investment because now you may not be having regular income or any income for that matter. For example, in my case, I don’t have any income at all. I am selling my investments to take care of my expenses. If I ever see a good opportunity to change my asset allocation, I would sell some fixed income investments and invest in equity. That is a lumpsum investment. Of course I could pretty much do a SIP by selling my fixed income every month and investing in equity, although it is little more work.

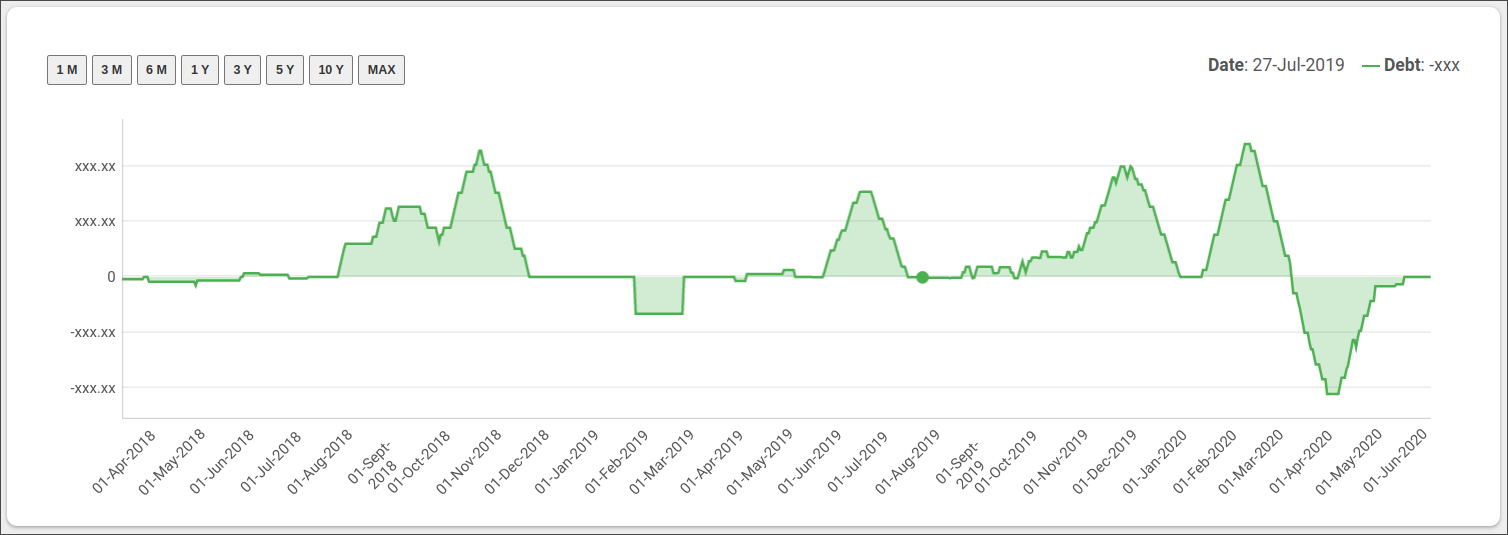

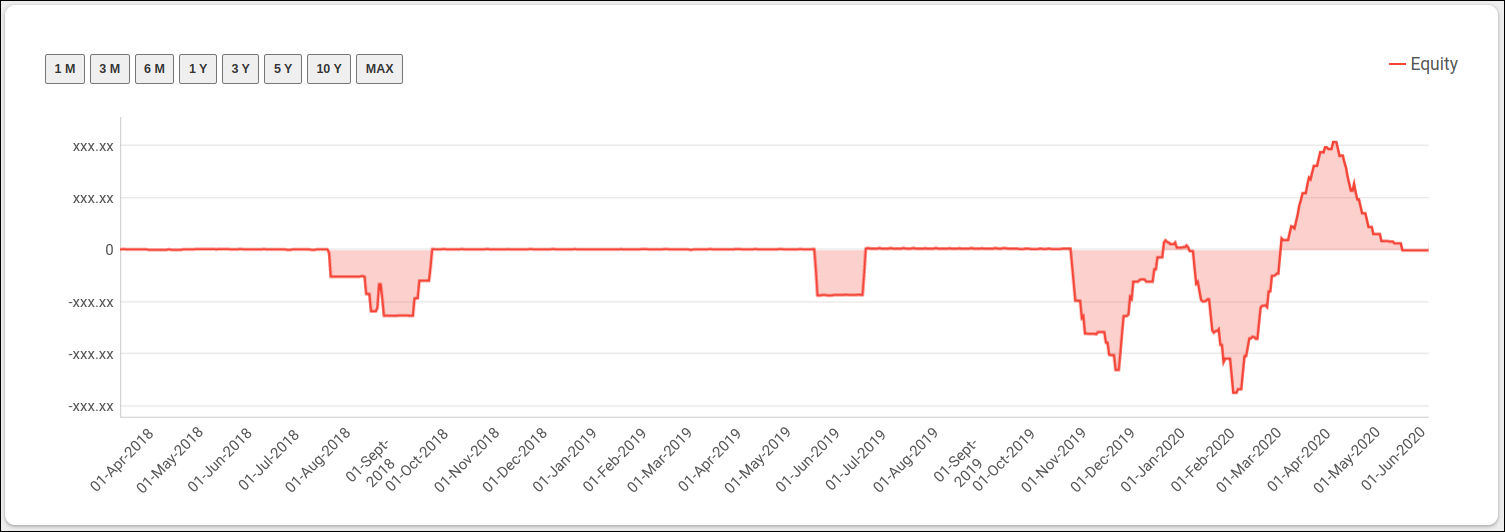

In retirement, the investment graph will be quite boring with a flat line below the horizontal line because I was removing money from investments to meet expenses. But that does not mean there was no activity. In fact I was still doing my tactical asset allocation based on market conditions which can only be understood with both equity and debt graphs together as shown below.

Note how I sold and bought different asset classes at different times depending on what I thought about the market. For example, I sold a bunch of equity mutual funds during the period of July to October of 2018 and invested in debt mutual funds. I am doing a tactical allocation there because I did not believe there is more upside to equity at that time. I did the inverse during the lows of COVID around April 2020. That is lumpsum investment for you. I sometimes even do SIP sort of investment during a sideway market cycle. In that case I just sell a small amount of debt mutual fund and invest in equity mutual fund every month.

For all the claims that SIP is better than lumpsum, it is not always true. Sometimes lumpsum can give you better results and at other times SIP gives better returns. The advantage of SIP is that it teaches you financial discipline and you save up for your future without thinking too much. While lumpsum investment needs some thinking. However, as I mentioned before, in the long run, they both tend to give similar returns. So don’t sweat it. More importantly you have to work with your income and invest based on the regularity of it. Finally when I say SIP, I do not mean that you setup a SIP that deducts money every month automatically, although that is probably a good idea. I mean any systematic investment, even if you manually do the investment every month. That too falls under SIP according to me.