Mistakes To Avoid If You Plan To Retire Early

There is no one straightforward way to reach the goal of early retirement. Although many people have attempted to streamline the process. And that includes me (see my 5 steps to early retirement) :). There are several other small things that you need to take care of before the grand picture emerges. One of them is expenses.

Of course early retirement is not just about the finances. There is a lot more to it and early retirement is certainly not for everyone (see should you retire early?). But if you have already made up your mind, read on.

Save a lot

This is quite obvious. You will need to save a lot and invest wisely if you want to retire early. But how much should one save? It depends on your income, but I personally say you should save 70% of your total family income. Of course it may not be possible for everyone, especially if your salary is low and/or you are the only earner in a large family.

The saving rate plays a huge role in how quickly you can retire. For example, lets say you earn Rs. 1,00,000 per month and your saving rate is 70%. Then your expenses must be is Rs. 30,000 per month or about Rs. 3.60 lakhs per year. Using the 4% rule you are supposed to have a corpus of Rs. 90 lakhs to retire at that time. Lets say you only have Rs. 0 saved up so far. Then if you invest the Rs. 70,000 savings in a good investment vehicle that earns 4% post inflation, then it will take 9 years for you to accumulate the amount required to retire.

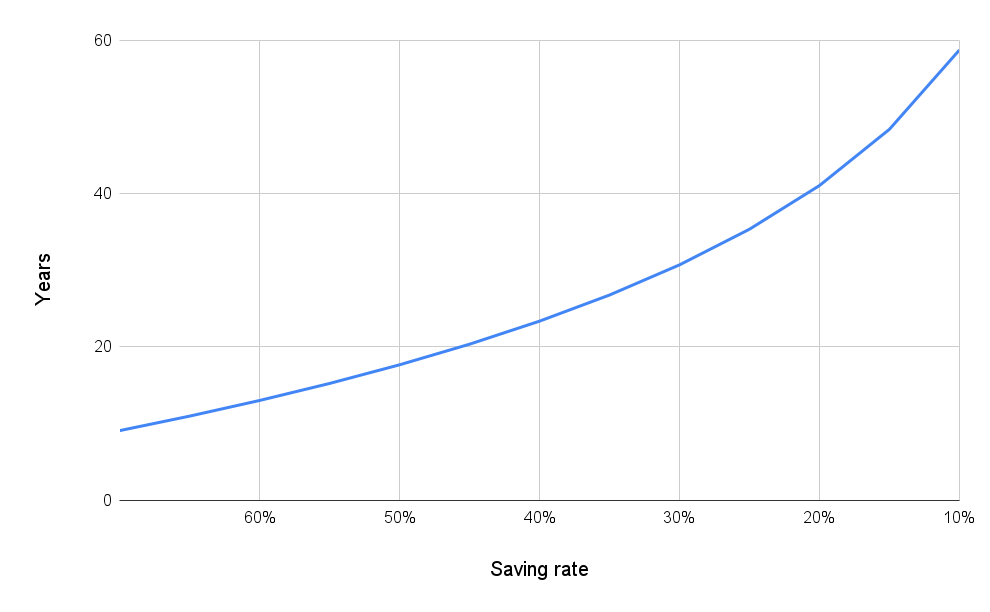

I made a chart of how long it will take for you to accumulate the retirement corpus using various saving rates below. As the saving rate reduces linearly, the number of years until retirement increases exponentially. Notice that with 10% saving rate, it will take almost 60 years to retire! The reason is easy to understand. One, compound interest. Two, when your saving rate is low, it means your expenses are high which also drives up the corpus required to retire.

Watch the expenses

The saving rate is a function of expenses. So, the lower the expenses, the higher the saving rate. Make sure your expenses are in check and they are not unnecessary. Especially when you are young and are single. Most likely you will not have a lot of expenses but this is also the time you might pick up the habit of unnecessary spending. Of course, expenses also depend a lot on family burdens, your life partner and so on, which may be out of your control. So yeah, luck plays an important role.

I track my expenses by writing down every little detail of where the expenses are going and reviewing if they are worth it. One thing I noted is that even with the meticulous tracking and review, some expenses do slip by. For example I spent a few hundreds, several times, on buying each part of my DIY 5.1 surround system. A few hundred here and there did not pinch at all. But the total cost creeps into the thousands and you will never know. If I were to think if it is worth spending so much in one go, I might think again.

Don't underestimate

Some people estimate their monthly expenses to be very low. I am not really sure if they are meticulously tracking or just guessing. I have heard from a couple of people having expenses in the range of Rs. 3000 to Rs. 5000 per month. I am not really sure how they arrived at that number. Even if you are living in a village, grow your own vegetables and have solar panels to take care of your power needs, the expenses cannot be so low.

Why? Remember, you will have to replace your solar panel batteries every few years. Your fridge, car, scooter, laptop, phone or whatever will eventually break and will need repairs or replacement. There will be petrol, hotel, train or flight expenses once in a while when you go on trips. So make sure you account for all possible expenses that can happen over a span of 10 years and then average out the expenses.

Conclusion

That is pretty much all I wanted to say in this post. The main point I wanted to drive home is the saving rate. It make an exponential difference in the retirement age. Watch your expenses accurately and try to increase the saving rate.