Investing For Multiple Goals And Portfolios Management

• reynd

One of the readers of my blog asked me how I manage multiple portfolios for various goals. They also wanted to know what platform I use to manage portfolios for family. So I thought I will expand a bit on that topic. To start off, I don't have multiple goals. I just had and still have retirement corpus as the only goal. The portfolios I manage for my parents, wife and kid have only one goal as well. However, mine is a unique case and almost everyone have multiple goals. As I mentioned before, every goal needs to have a different portfolio.

I do all my investments through the MF Utilities online portal. However, in the past I have used FundsIndia and Unovest too. I don't remember much about either of those two platforms, but I think both offered portfolio management for multiple goals. Since I am using MF utilities currently, most of the discussion is about it in this post.

How to create a goal in MF Utilities

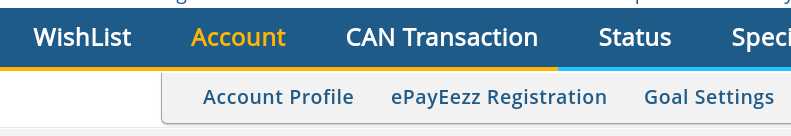

It is always preferable to have different portfolios for different goals. That way you can invest with different asset allocation based on the type of goal and duration. Read my post on goal based investing to get a better idea. After you have logged in to MF Utilities, start by clicking on Account in the top blue bar. From the drop down select Goal Settings.

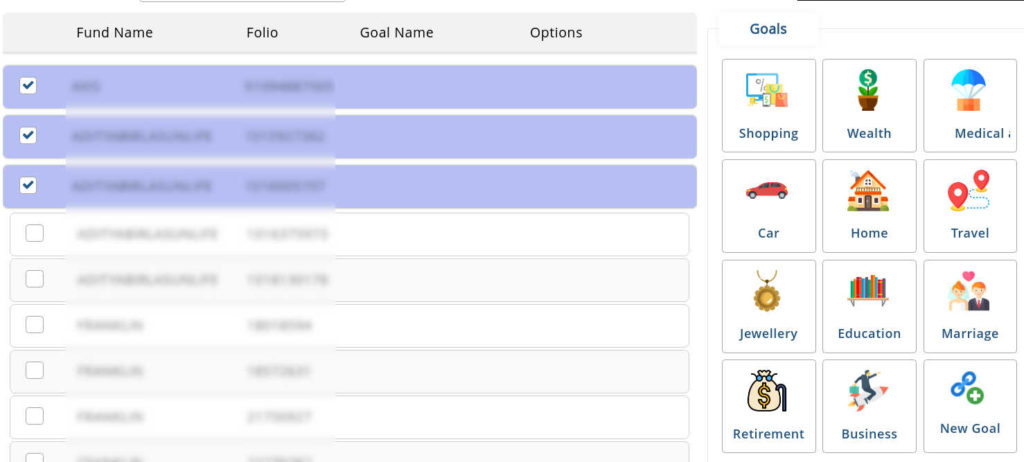

Once the page loads, select your CAN in the drop down. Then you will see a list of folios. Select the folios that you want to assign to a goal by selecting the checkbox on the left.

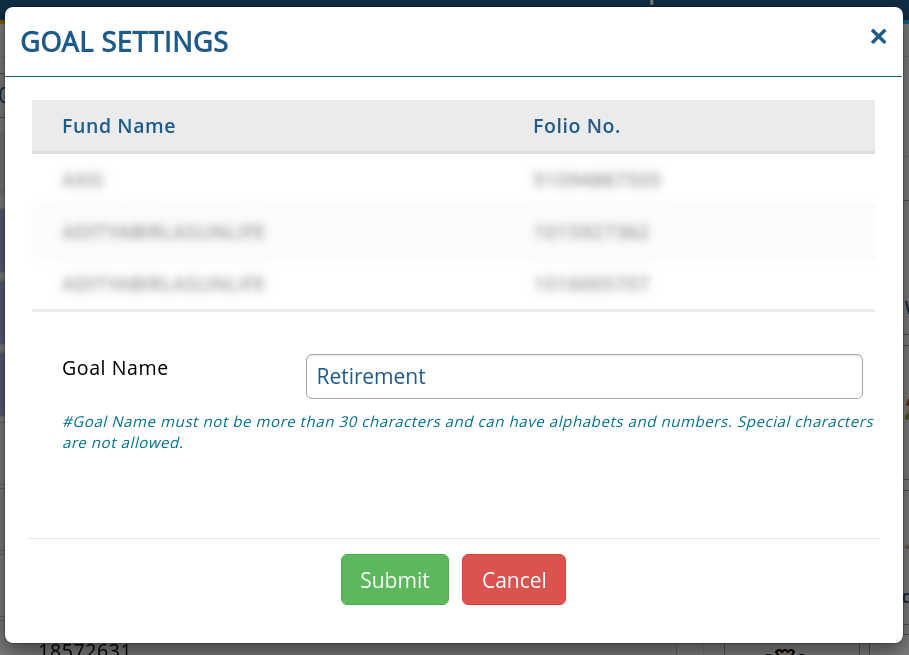

Finally click on a goal from the right side of the page. You can even create a new goal if none of the goals apply to you. After you click submit, the folios will be assigned a goal. Similarly you can assign the rest of your folios to specific goals.

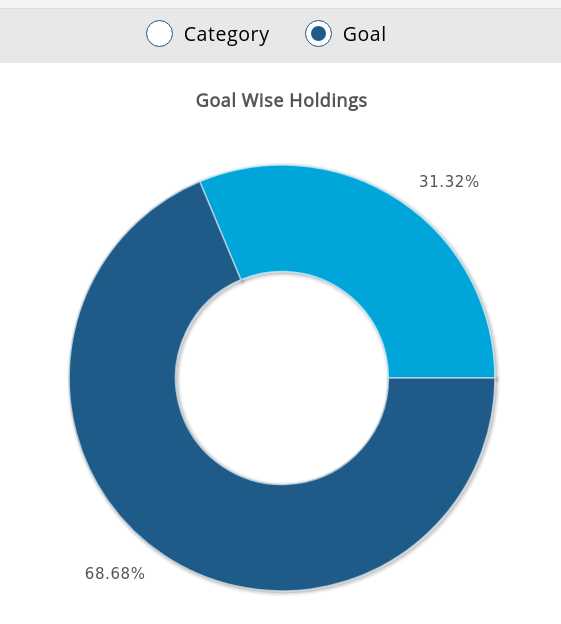

After your goals are created, you can check the dashboard to see how each of your goal is performing.

What if you want to start a new goal?

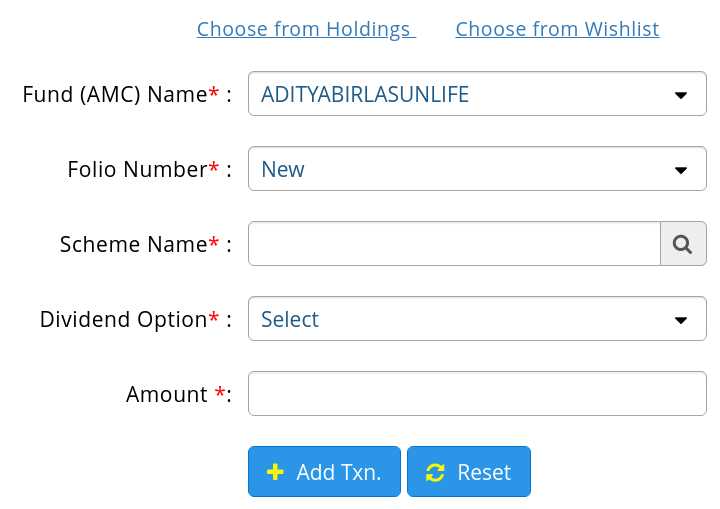

The above method works if you already have some investments in different folios for all the goals. If you are planning to start a new goal, start by investing in any fund, but remember to use a New Folio Number in the purchase transaction. Don't use any existing folio numbers. Then, once the units are allocated and the new folio shows up in your dashboard, you can reassign that folio to a new goal.

Portfolio management for family

Each of my family members have an account in MF utilities. As far as I know, MF Utilities does not have a way to manage multiple accounts in one place. So every time I need transact, I have to log in to the specific family member account and initiate it. I don't to a lot of transactions so that is perfectly fine for me. Once a month I record the value of each member's corpus into a spreadsheet and track if the investments are going according to plan or not.

Conclusion

As you can see, my portfolio management process is quite simple. I use MF Utilities and Google Spreadsheets for pretty much everything. MF Utilities offers the the bare minimum in terms of analysis and features. But that is what I like about it. Once you get over the initial learning threshold, it is quite simple to use and does not confuse you with lots of features. If you would like me to write more about MF utilities and how to create an account or make purchases/redemption etc, do let me know in the comments section below and I will write a post or two.