Income Tax Reporting

While the name "income tax reporting" seems to suggest that you only need to report income, it is not really the case. It has been expanded to report investments that you already have, whether they gave you any income or not during the assessment year. After reading a comment on one of my blog posts I became aware of the fact that some people might be misinformed about what is supposed to be reported.

Since I am not a tax adviser, I cannot tell what everyone should report, but I will go over what I have been reporting over the years and may be it will help you too, so you don't miss out some important ones. I report my taxes using form ITR-2 since I have foreign investments and deal with mutual funds. I use the java tool to input my details. I am giving details here based on the assessment year 2019-2020. The schedules and tool might change in future.

Basic

The first tab that needs your information is called PART A - GENERAL. Here you will need to submit all the basic details like name, address, date of birth etc which is pretty basic. The next one is Schedule S which is used to report your income from salary. Since I don't have any more income, I skip this now. But used to fill until last year :).

House Property

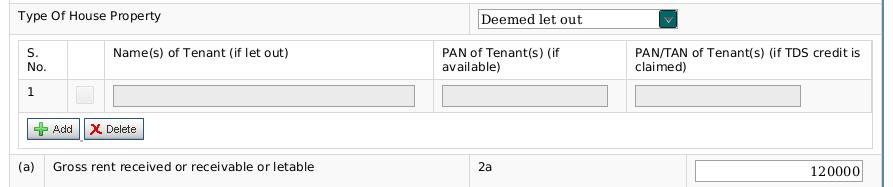

Schedule HP should be used to report rental income and also interest paid on your loan. Most probably have EMI on their home loan and probably are reporting that. But remember, if you have income from the house because you are not living in it and have rented it out then you have to report the rental income. If you have more than one house then you can claim to be living in one of the houses (your choice) assuming you do not claim HRA. Then for the rest of the houses you have to report rental income. Even if you did not rent out your house because you parents are living in it etc, you still have to assume you are getting nominal rent and report it. Most people don't report this. They think because their parents are living in it or because the house is lying vacant, it can be assumed as no rental income. Not true at all.

For a house that was not let out, you have to call it "deemed let out" and report notional rent. A notional rent is something one could have earned in case property had been let out. Even if the property is not let out, the notional rent or deemed rent receivable is taxable.

Capital Gains/Loss

The capital gains have to be reported in Schedule CG. If you have any capital gains or losses because you sold mutual funds, stocks, fixed income or immovable properties, this is where you report it. This is one of the more tedious task for me every year. I have to get the capital gains statement from CAMS and from other fund houses that don't report to CAMS (for example Franklin, Sundaram etc). Then make a spreadsheet with all the capital gains or losses in a matrix with equities and debt on one side and short and long term gains on the other side. Then I need to report them. Please make sure to compile all gains and losses from all fund houses and sources (if you do trading or real estate).

Income from Other Sources

Don't forget to report income from all other sources that do not fall under the other heads. This includes dividends, loan given to other people on which you are deriving interest, bank savings interest income, fixed deposit interest, income tax refund interest, lottery income, cash rewards from Google Pay, PhonePe or whatever other means, etc. Many people fail to report a lot of things under this heading. Don't make that mistake. Recollect and remember all source of income. Generally checking the credit column on your bank statements should tell you most of this. I know it is a tedious task of going through a years worth of statements, but you have to do it. At least it is not as bad as Schedule CG :)

Carry Forward Losses

If you have any losses during a year that you need to carry forward to future years use Schedule CFL. I have used it in the past when I had to sell some funds in loss and it was quite useful in offsetting my gains for a few years. Saved me a good bunch of taxes since I was in the highest tax bracket. Make good use of it when you can.

Deductions

Everyone knows how to use Schedule VI-A :). You have all kinds of Section 80 deductions in this. I don't think Indians need any advice on the topic of deductions and savings. One of the most useful one is Section 80C deductions. Make sure to include ELSS investments as well as children school fees in this deduction. If you have kids you most likely will use it up pretty quickly. Other than 80C you have health insurance premium (the one that you paid, not your company paid), medical expenditure, interest on loan taken for higher education, interest on house loan etc. For some more knowledge, check out my post on tax deductions.

Clubbing of Income

This is another area where people play tricks. Make sure to club income from spouse, kid or parents where applicable. If you own a house, but your parents rent it to someone and are getting the rent paid into their account, then that income is not their's but yours. Likewise, lets say you gifted some money to your spouse and they get interest on it for example from FDs then that income is yours not their's. Likewise if you invest something in your kid's name and there are capital gains or interest, that will be clubbed with your income. There are a lot more clubbing rules that most people conveniently side step. Don't do that. Report everything in Schedule SPI.

Exempt Income

For exempt income use Schedule EI. The usual suspect is agriculture income of course, but don't forget to avail dividend income exemption. Gifts received from certain relatives are tax exempt. You should report that as other "Others exempt income" in Schedule EI. Mark the "Nature of Income" as "Any Other" and type in something like "Gift from parents" etc. While gifts are exempt, it always helps to report everything in the interest of full disclosure.

Foreign Assets and Income

Remember to report all your foreign assets even if they are not generating income like stocks which you have not sold etc. Not reporting this information is a violation with huge penalties. Under the Black Money Act, undisclosed foreign income and asset will be taxed at a flat rate of 30%. Further, there may be significant monetary penalties (up to 300% of the tax) along with the risk of criminal prosecution. Additionally, failure to furnish any information or furnishing inaccurate information in the return with respect to foreign income and foreign assets could also trigger a penalty of Rs. 10 lakhs. So always report everything including bank account, stocks, real estate or any other asset. You can report everything in Schedule FA.

Assets and Liabilities

Finally you should report all your assets and liabilities if your total income exceeds Rs. 50 lakhs. I would say that even if your don't exceed Rs. 50 lakhs it might as well be a good idea to report everything. Here you can report the values of your immovable assets, jewelry, bank deposits, shares and cash in hand. I think in future this might become a required schedule and will not have the Rs. 50 lakh limit or the limit will be reduced.

Summary

There you have it. All the details that I usually report in my taxes. Some believe that reporting more than required is unnecessary and think it might actually invite the tax audit. I don't think that is the case. Always pay tax as applicable and don't try to avoid paying taxes by withholding information. Taxes is how the government can run the country even if it very inefficient and riddled with corruption.