How And Who Should Pay Advance Tax

I just payed my second installment of advanced tax, so I thought I will write down the procedure. It will be like a reference for me in the future and might help some one as well. It is actually a pretty simple process that does not really warrant a post, but here we go anyway.

Who should pay advance tax?

If the computed payable tax for a year exceeds Rs. 10,000, then you are liable to pay advance tax. For most salaried individuals the payable tax probably will not exceed this amount because your employer pays tax (TDS) on your behalf for salary income. But if you have income from other sources, then you are responsible for calculating and paying advance tax. Income from other sources could be capital gains due to mutual fund or stock transaction, income from rent, interest from FDs etc.

Senior citizens who are 60 years or above and do not have income from business or profession are not liable to pay advance tax. This is very useful if you have senior citizens. They can just pay the self assessment tax while filing their income tax.

I did not have to pay advance tax last year. Although I sold mutual funds and had capital gains, the tax was less than Rs. 10,000 for the financial year. However, this year, Franklin made all the payments in one of the segregated funds which I own. Unfortunately, the cost of capital was zero which means all of the payout is fully taxable. Along with my other mutual fund transactions, the tax payable will exceed Rs. 10,000. So I am liable to pay advance tax.

How to calculate advance tax?

This is a little complicated if your income is uneven. Basically, you will have to estimate your total income for the financial year. This includes salary, rental income, capital gains etc. Salary and income from rent is easy to estimate. But estimating capital gains is not straight forward. For example, I don't have salary or rental income, but I need to estimate my capital gains. So I need to have some idea of how much money I will need for the full financial year based on my expenses. Then I need to figure out how much of my mutual funds I will need to sell to cover the expenses. Depending on how much I plan to sell, I need to estimate how much of it will be capital gains.

Using the income tax calculator, you can figure out how much tax you are liable to pay by the end of the financial year. If your employer deducts TDS, you can deduct that much from the calculated tax. You can take all other deductions that are applicable to you such as section 80(c) etc. Then, if the tax is more than Rs. 10,000 you will need to pay advance tax.

When and how much should you pay?

You are expected to pay advance tax in four installments according to the following schedule

- On or before 15th June: Up To 15% of the advance tax liability

- On or before 15th September: Up To 45% of the advance tax liability

- On or before 15th December: Up To 75% of the advance tax liability

- On or before 15th March: 100% of the advance tax liability

Lets take an example where you are liable to pay a computed tax of Rs. 1,00,000. In that case, you will need to pay advance tax according to this schedule.

- On or before 15th June: Pay Rs. 15,000

- On or before 15th September: Pay Rs. 30,000 (Rs. 45,000 - 15,000)

- On or before 15th December: Pay Rs. 30,000 (Rs. 75,000 - 30,000 - 15,000)

- On or before 15th March: Rs. 25,000 (Rs. 1,00,000 - Rs. 30,000 - Rs. 30,000 - Rs. 15,000)

How to pay advance tax?

There are multiple ways you can pay advance tax, but the simplest I found was via online. Here is the process that I followed --

- Open income tax e-filing website

- Click on the e-pay tax link

- A dialog opens letting you know that it will redirect to NSDL website. Click on the Continue to NSDL website button

- You end up on the NSDL page

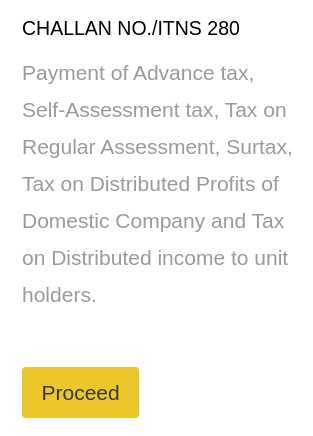

- Click on the Proceed button of CHALLAN NO./ITNS 280. Challan 280 is used to pay advance tax

- Select (0021) Income Tax (Other than Companies) under Tax Applicable section in the form.

- Choose (100) Advance Tax as the Type of Payment

- Fill in the rest of the details as applicable to you and click Proceed button

- After asking for confirmation, the website will redirect you to your bank

- Make sure all the details are correct and pay the applicable tax according to the installment

- After a successful payment, you will get a challan counterfoil with all the payment details. This counterfoil is proof of payment of advance tax. Keep it safe. You will need it to fill in the tax payment details when filing your income tax when the financial year ends.