Experience With New Income Tax Portal

The new income tax portal launched last year, so it is not really “new” anymore, but I wanted to write about my experience with it. When it first launched, there were innumerable bugs. The portal was very slow. Login used to fail due to excessive load on the servers. Data I entered would not tally properly because of rounding errors in the software etc. But it has come a long way. The most recent tax submission process was much better compared to how much I struggled last year. Perhaps there are still bugs but I did not encounter any this time around, or at least I figured out the quirks in the system and worked around them.

One such quirk was that when I enter Schedule CG with all the short and long term gains for both debt and equity, I have to save the data without filling section F. Then I have to go to Schedule BFLA, and back to Schedule CG. Only then was I able to enter the “Information about accrual/receipt of capital gain” section. Without going to Schedule BFLA and back, it would always show some error. Don’t worry if you did not encounter this issue. Perhaps it was fixed or may be something only I am facing.

There were a couple more weird issues like that when validating my data at the end of the submission process, but they are manageable. One such validation issue that comes to mind is some error reporting that TDS “Claimed in own hands” cannot be more than my TDS deducted. But I certainly did not claim more than my deductions. Just opening the TDS schedule and saving it resolved it.

Annual Information Statement (AIS)

The AIS was both a boon and bane for me. I loved the fact that most of my income is reported and available in one place. So all I had to do was to copy paste the information from AIS into the tax schedules where applicable. This includes income from other sources such as bank interest, income from house property (in the case of my wife), dividends, TDS, income tax refund etc. However, the problem is that I have to cross check and make sure that the numbers are all correct. Generally this is not a big problem with small transactions such as interest income and rental income. In fact all of those numbers were correct.

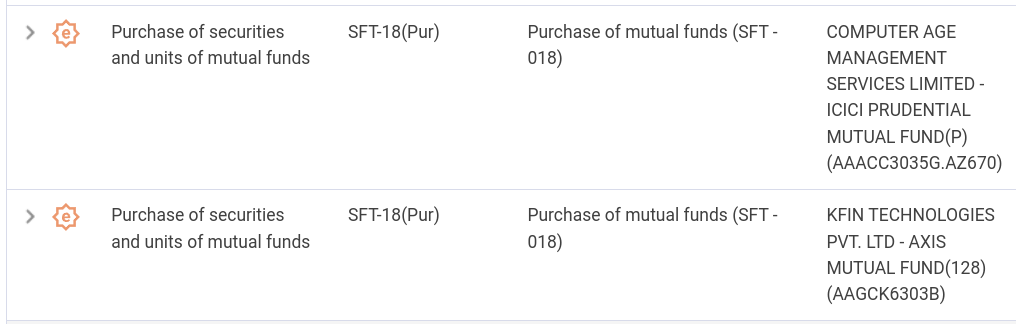

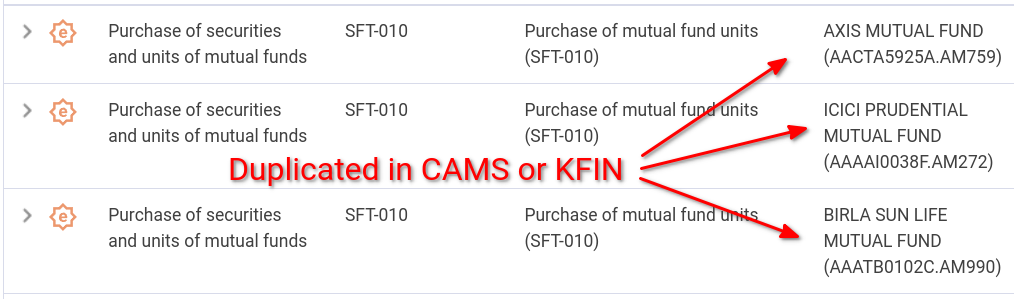

I faced the biggest problem when I had to verify a bunch of mutual fund transactions – both purchases and redemptions. You see, sometimes both the fund houses, CAMS and KFIN tech report the same transaction. So there would be a bunch of duplicates.

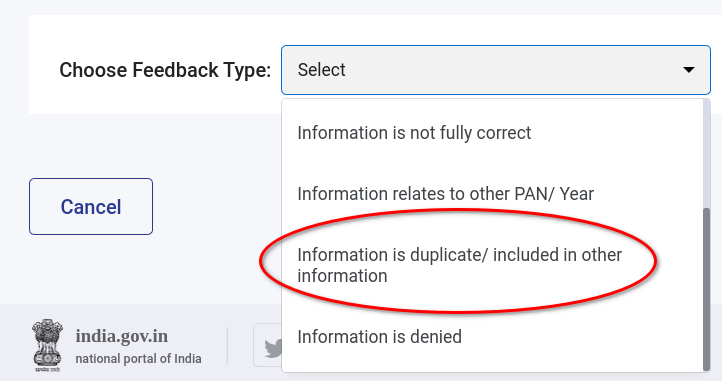

I have to check and make sure there are no duplicates. If there are duplicates, then I have to submit feedback reporting that it is a duplicate information.

This step is really important before you file your taxes. Do check and make sure all the information provided in AIS is accurate. If you need to make corrections, do send feedback for each of the line items that is wrong.

Grievance process

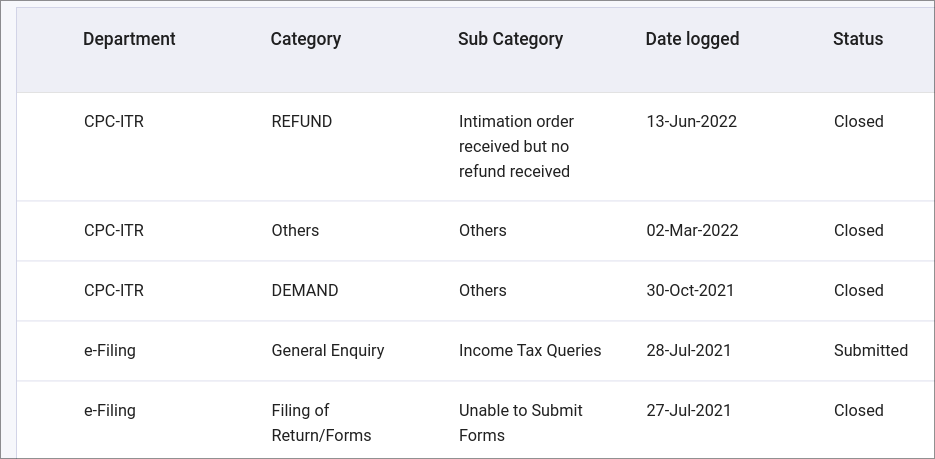

Similarly, I had mixed experience with the grievance process. Sometimes the process was quick, and at other times it took some time. But what I appreciate is that the process is very streamlined and easy to use. I’ve raised 5 issues in the last one year and all of them eventually got resolved.

The oldest grievance was about issues with the new tax website and I was unable to file my taxes because the numbers were not tallying up. The next one on 28 July, 2021 was regarding my previous year tax returns which was “under processing” since Jan 23, 2021. It was finally resolved in Sep 2021.

The 30 Oct, 2021 grievance was interesting. The thing was I filed tax returns with some duplicate information because of which I overpaid my taxes. I found my mistake and filed a revised tax form in a few days. Unfortunately for me the income tax department already started processing my first submission and they decided to slap a tax demand for some small amount. But in the revised tax filing, I was supposed to get a refund. So I had to open that grievance asking them if I should pay the tax demand and file another revised tax form or if they will consider my second submission eventually. They closed the grievance letting me know that I should just wait for the second tax filing to be processed.

What they did not mention is, if I should pay the tax demand for which the deadline was fast approaching. I decided to wait for the second one to be processed and not to pay the tax demand. Worst case I will have to pay the tax with interest and since it was a small amount, it did not matter. But even after 6 months the revised tax was not even picked up for processing. Which is when I opened another grievance in Mar, 2022. Eventually it was processed in May, 2022 with refund due. So at least I did not have to pay any additional taxes.

However, another problem cropped up. I did not receive my refund in my bank even after one month after US 143(1) was send. I checked NSDL website and it shows “No records found. Your assessing officer has not sent this refund to refund Banker. Please contact your Assessing Officer”. So I opened yet another grievance and this time for my refund. I received the refund in 4 days and the grievance was marked as resolved in a couple more days. Nice!

Conclusion

In general the income tax department is quite responsive to grievances which is great news. Sometimes the issue gets resolved in a timely manner, but at other times it takes a long time and we don’t have any insight into the timeline. So it was a mixed bag.

Likewise, it is great to have all the information showing up in one place in AIS, but then the problem is data quality which I have to manually check and correct. The other good thing is that some data in the tax form is prefilled (from previous tax submission and from form 26AS), so makes things easier. Less typing and more verification.

On the whole I am satisfied with the new portal and process. There are still some niggling issues like not having a simple way to upload all of my foreign holdings. I have to manually enter each and every ESOP stock vesting transaction. Hopefully it will improve further and takes the hassle out of tax filing process. How was your experience?