Follow-up to Virtual Meetup #7

Thank you to everyone who joined the virtual meetup #7. We had a very low turn-up but we certainly had a lot of questions. This post is a follow-up to that meeting so you know what we discussed. As it usually happens, the topics we covered varied quite a bit from investment related things to solar panels to taxes.

I like the 70:30 rule but I would like to avoid rebalancing myself. Thinking of moving a part of my allocation to aggressive hybrid fund. What do you think?

Sounds like an excellent plan. The aggressive hybrid mutual fund by design is required to hold at least 65% in equity, so that would be the easiest way to keep your asset allocation at around 70% without incurring any taxable transactions yourself.

Let’s say I don’t have any income, now if I have a Rs. 100 long-term equity capital gain, should I have to pay the 10% tax on it? Or is the Rs. 2.5 lakhs of tax free applicable here.

Yes the Rs. 2.5 lakhs of tax-free income is applicable in this case. So if the person has no other income other than the Rs. 100 long-term equity capital gain, then they will not have to pay any tax on it because it is still less than the Rs. 2.5 lakhs tax free income. You can verify this yourself using the income tax calculator provided by income tax department. Fill up all the details in the calculator and see when the tax actually applies.

In fact, with the tax relief under section 87A, you can actually earn Rs. 3.75 lakhs worth of long term equity capital gains, without needing to pay any taxes. Let us try to understand why this is the case. First, Rs. 2.5 lakhs is tax free income. So out of Rs. 3.75 we deduct Rs. 2.5 lakhs. Then we are left with Rs. 1.25 lakhs of long term equity capital gains. The tax on that is Rs. 12,500. You also get a tax relief of up to Rs. 12,500 if your total income is less than Rs. 5 lakhs under section 87A. Since your total income is less than Rs. 5 lakhs, you get the relief. Now the tax payable is zero.

[Updated: Thanks to Melwyn for pointing this out in comments] You can actually earn Rs. 3.5 lakhs worth of long term equity capital gains, without needing to pay any taxes. Let us try to understand why this is the case. First, Rs. 2.5 lakhs is tax free income. So out of Rs. 3.5 we deduct Rs. 2.5 lakhs. Then we are left with Rs. 1 lakh. Since there is no tax on the first Rs. 1 lakh worth of long term equity capital gains, there is no tax on that.

Of course the amount of tax free income changes with the type of income. For example, if your income was entirely from long term debt capital gains, then the maximum tax free income after tax relief under section 87A will be Rs. 3,12,500. Likewise if your income was entirely from short term equity capital gains, then the maximum tax free income after tax relief under section 87A will be Rs. 3,33,333. As an exercise, figure out why that is the case for the above 2 cases :).

If you only have short term debt capital gains or any other income that comes under taxable income, you have up to Rs. 5 lakhs tax free income. In fact if you can use sec 80(c) you can have Rs. 6.5 lakhs of tax free income. You can save even more with other deductions, but you get the idea right? So the best form of capital gains would ideally be short term debt capital gains for a retired person like me :).

Do you use any tax websites like cleartax or anything else?

I used cleartax a couple of times in the past before the tax filing utility was available. But once the income tax department launched the Java utility to file taxes, I started using that since 2014-2015 financial year. Basically I used to download a zip file which unzips to a java app. I run the app on my laptop and fill the details that way. I have always used ITR-2 because I always had some type of capital gains. Since financial year 2020-2021 I am using the new online tax filing method. It is easy in some ways and difficult in some other ways compared to the Java utility, but it is fine.

Do you avail the rebate that government offers for installing solar panels?

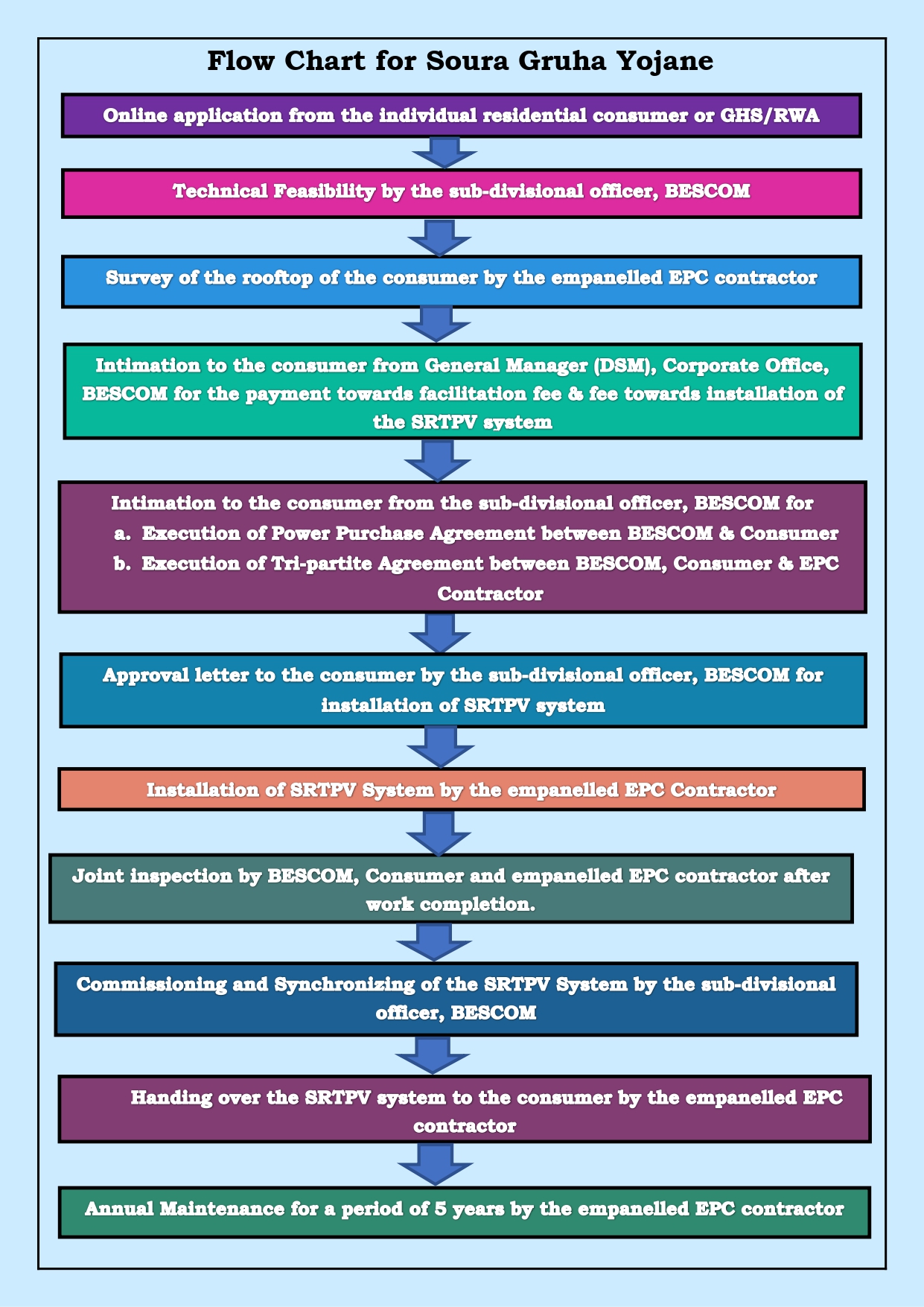

No, I did not use any subsidy offered by the government while installing roof top solar panels. There are a few reasons. For one I wanted to install the panels myself and learn by experimenting. To obtain subsidy from government, you will need to have a BESCOM (Bangalore Electricity Supply Company) approved contractor to setup the solar panels for you. Secondly, it might take a long time for the whole process to complete (see flow chart below). Thirdly, involving government personnel comes with the unsaid rule of bribery. Finally, I don’t know if anyone would setup just 320W panel on a contract basis. That is way too small of a size for their business.

If I did not have the above restrictions, I could have gone for the 30% or so subsidy from the government, but I am really not looking for any discounts from them :). I would like the public welfare schemes be used for people who are really in need. If you are talking about the Rs. 50 rebate on installing solar panel water heater, then that is a different story. It is only applicable for solar water heater and not solar panels.

You are not getting as much power from sun the past few weeks because of the cloud cover?

Yes. I used to get around 50 units per month in the months with lot of sunlight, but now a days I am getting something like 20-30 units a month.

You change the angle of the solar panel to utilize maximum sunlight?

Yes I do. I don’t change the angle through out the day, but just once a month because the direction of the sun where I live goes more towards the south during winters and straight up during summers. I contemplated changing angle of the panel to make it perpendicular throughout the day, using a motor that turns the panel. But from what I read, the energy that is consumed by the motor pretty much cancels out the increased energy output, so I gave up the idea.

Do you manually turn off the grid power in the morning to utilize the solar power?

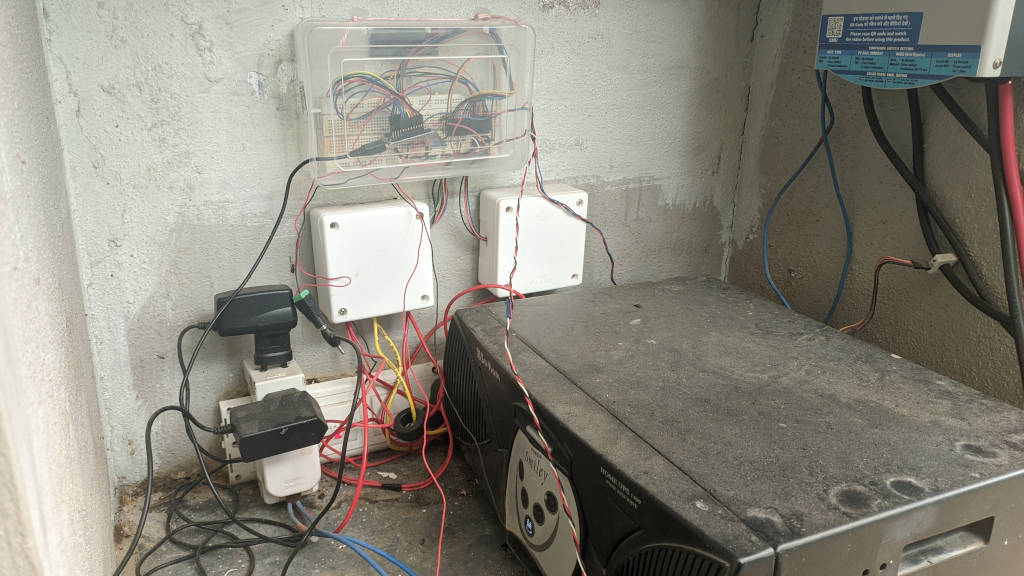

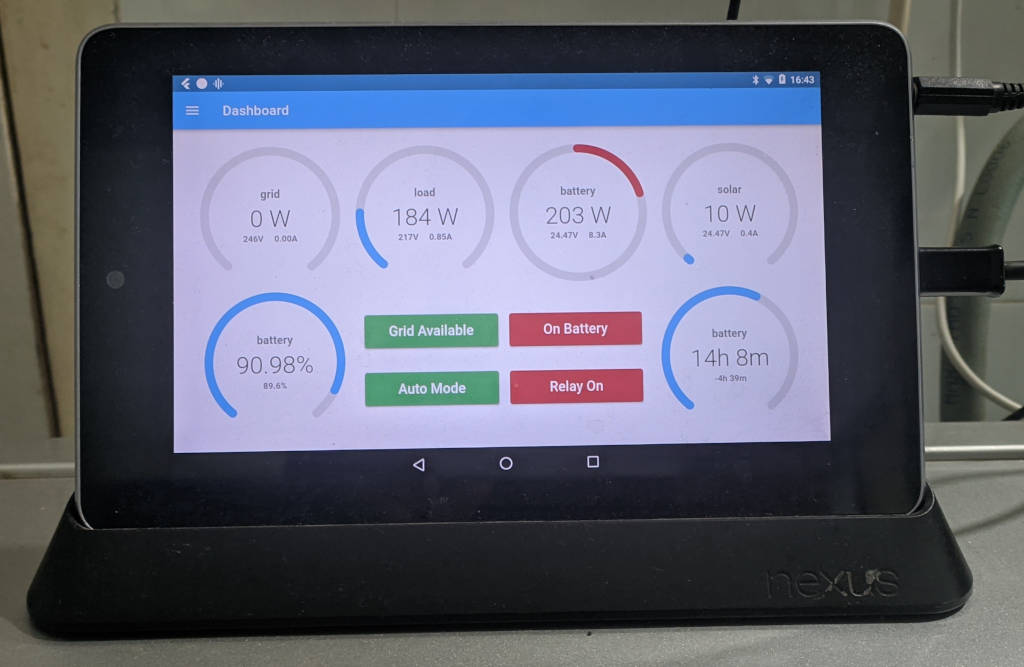

No. I have some hardware and software setup that checks the energy left in the batteries, how much power is coming from the sun, how much power is used by the household load etc to determine when to disconnect the grid. Basically I let the load run on batteries + solar power until the battery is depleted to about 80%. Then I connect the grid to charge it up to 90% and do the whole dance again. I wrote a pretty comprehensive post on that if you are interested.

I heard that charging cycles will reduce the life of battery?

That is correct. But I don’t charge and discharge the battery too many times. Moreover, the number of cycles that reduce the battery life depends on how much you discharge, called the depth of discharge (DoD). For example if you deplete the battery from 100% to 80% and then charge back to 100%, then you have more battery cycles. However if you discharge from 100% to 20% and then charge to 100%, the number of available cycles will be lower. See the figure below. At 20% DoD, which means discharging from 100% to 80% which is what I do, the number of available cycles are 3300 according to the chart below. If the DoD is 100% then the available cycles are only 500.

You can’t run 15 amp load right?

Yes. As of now, the way everything is setup, I cannot run 15 amp load. In future if I buy a bigger inverter that is capable of handling 15 amps load and I add 2 more batteries, then I can give that a try.

How long does you battery last?

Depends on the load. Our load on average during the day is about 240 W. Since my two batteries are in series, the voltage is 24 V (12V + 12V). For those of you who know that Power = Voltage x Current, the current draw on average = 240 W / 24 V = 10 A. Since I have a 150 AH battery, it should last at least 150 AH / 10 A = 15 hours.

But remember you cannot discharge the battery completely. It can go down to 20% before the UPS automatically disconnects to protect the battery from deep discharge. So realistically I would get 80% of 150 AH / 10 A = 12 hours. Then again remember that I have a C10 battery, which means it will give me 10 hours if 15 A is drawn from it continuously. Since I am drawing less than 15 amps, it actually lasts longer than 12 hours. I know, it is quite confusing, but many of the battery characteristics are non-linear :).

I think we are at a stage now to start physical meet-ups?

I think so, but seems like the virtual meet-ups are more convenient because then people from all over can meet. No need to worry about traffic or weather. However, I wouldn’t mind a physical meet-up if we have enough folks ready.

Do you want to predict the market? And are you tempted to get more into equity?

No and no :). I wish I was more into equity when it was not selling like hot cakes. But now it is a bit too late I feel. On the other hand I could be waiting for ever too.

What happened to your semi-urban lifestyle plan?

It did not materialize. I mean we are ready to move to a village and live like farmers, but there were a couple of reasons due to which we cannot do it at this time. One, my parents age is such that we feel it is better we stay near a city where we have access to good hospitals. Moving to a remote location can cause some anxiety for my parents. Moreover, visiting me here in Bangalore is easier for them when they travel to home town. We are close to airport and that is a convenience they will miss if they have to travel several hours to reach us in a village.

Second, my kid has a few friends in the neighborhood whom she will miss. We don’t know if she will find friends her age in a new setting. But more importantly, we have access to several other home schooled/unschooled parents and kids in Bangalore. So finding activities and playmates is easier here.

Conclusion

That’s pretty much the gist (if you can call it that) of out meet-up. There were few more small topics we covered, but I think this post is already plenty long. Hopefully more of you would join next time to make it even more interesting!