Reached A Milestone

We have finally reached an important milestone! But not in a good way :(. While we are sort of minimalists, we still spend quite a bit. As a result, we recently reached a milestone of Rs. 50 lakhs spent on various expenses since we became financially independent in January 2018. Generally people should be proud of their achievements, but this is not one of them :). Still, it is not all too bad. According to my projections of expenses I should have reached the Rs. 50L lakhs milestone by end of 2022, yet we did not reach it until July 2024. So not too bad.

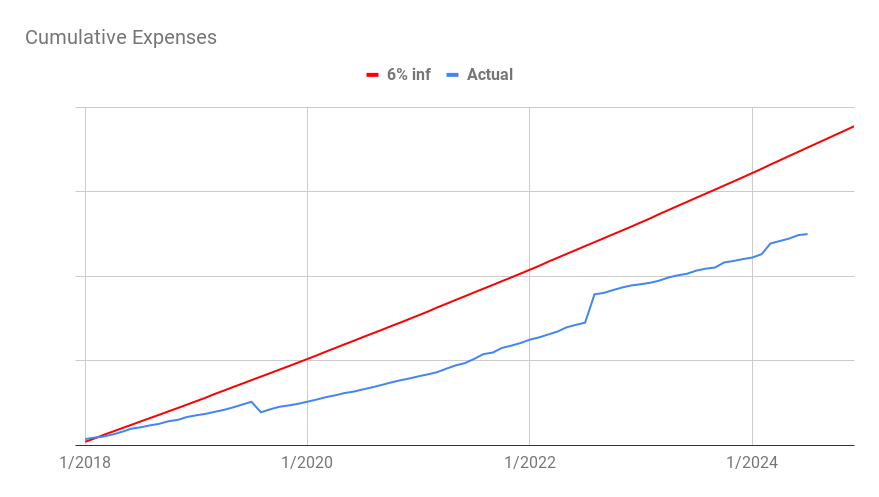

Let’s start by looking at the cumulative expenses compared to projection. Basically before I retired, I anticipated monthly expenses of Rs. 80K based on the past history. So I made a projection of how the cumulative expenses will grow as months progress. I increase the monthly expenses by 6% after every year. So the first year, i.e. 2018, the cumulative expenses will be Rs. 9.6L (Rs. 80,000 x 12). For the next year, i.e. 2019, the monthly expenses will be Rs. 85K an increase of 6% compared to previous year. Then the cumulative expenses by the end of 2019 will be Rs. 19.77L (Rs. 9.6L + Rs. 10.17L). I do this for several years and that becomes the projection line (see chart below).

In the above chart, the red line is the projection of cumulative expenses and the blue line is the actual cumulative expenses. The first drop in 2019 is because we sold our 2nd car which gave back us some money, so the cumulative expenses dropped. The jump up in 2022 is the result of again a car :). We exchanged our car for a new one. The small jump up in 2024 was due to expenses related to painting of our house.

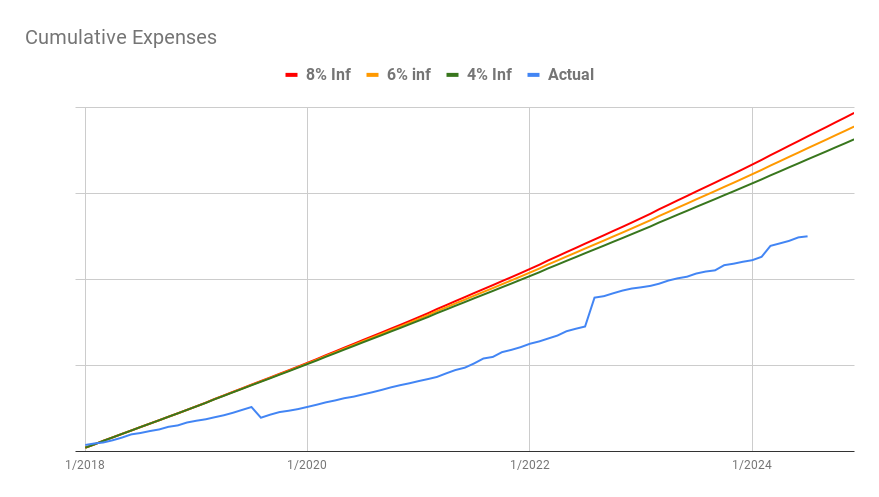

I also have another set of projections based on 4% inflation and 8% inflation as well (see chart below) in addition to the 6% inflation projection.

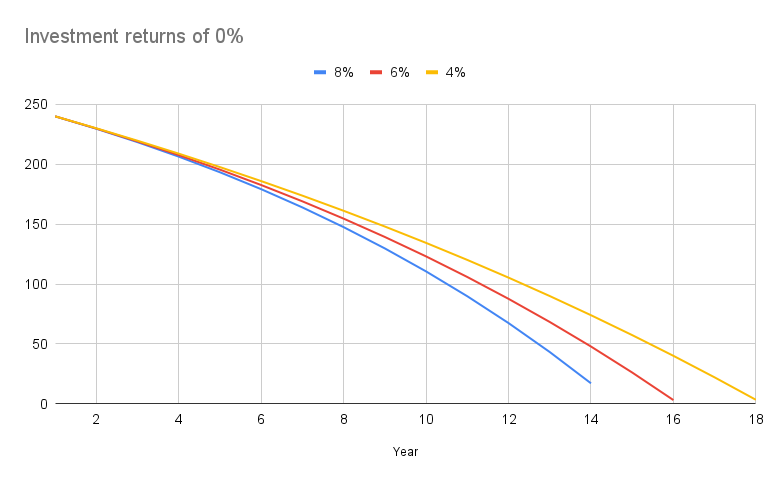

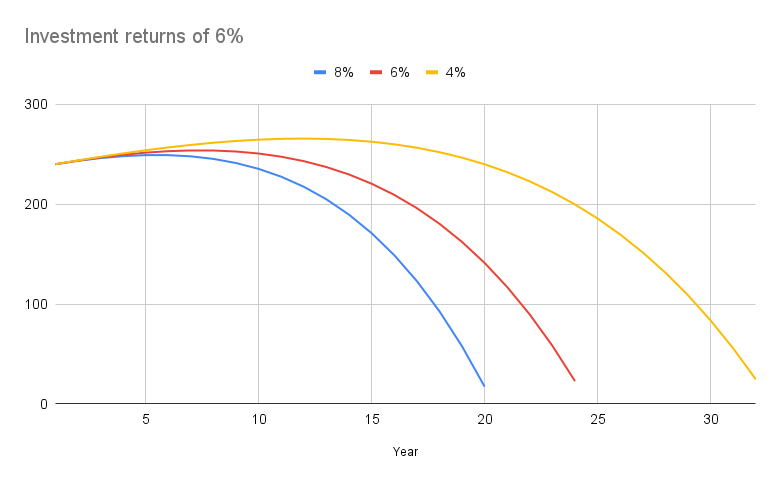

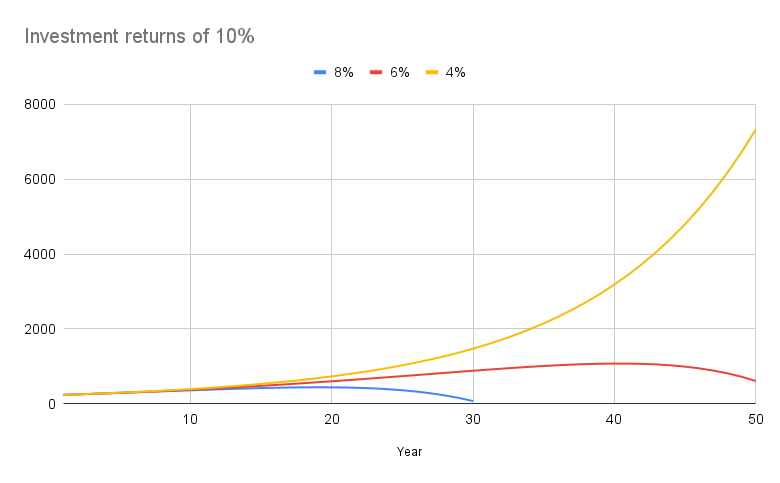

What I can’t get myself to believe is just in 6.5 years, we have spent Rs. 50 lakhs. Soon it will become Rs. 1 crore too. I used to think Rs. 1 crore is a lot of money and just imagine that you can easily chew through it in 12 years! That puts things into perspective. If I went with a 4% safe withdrawal rate, I would have Rs. 2.4 crores when I first retired. If I did not invest it and just kept it as cash, I would finish that amount in 15-18 years. In all the charts below, the projection lines are for a corpus that starts at Rs. 2.4 crores (Rs. 240 lakhs) and reduces with various inflation rates (8%, 6% and 4% inflation).

Thankfully, no one does that. Even if that money was invested in a safe FD type investment vehicle with returns of 6% and assuming taxes were part of your expenses, then the amount would last 20-30 years.

If you are a little bit more ambitious and invest in something that gives you 10% returns then the corpus should last at least 30-50 years if not more. That should be a lifetime I hope, assuming that one did not retire too early. So try to reduce your inflation and increase your returns. Not looking forward to the next milestone of Rs. 1 Cr cumulative expenses :).