Expenses Revisited: 2022 Edition

Hopefully you understood how I funded the purchase of a new car. The summary of it is that I already anticipated all kinds of expenses I might encounter in retirement and then some (called as miscellaneous). Based on those expenses I figured out a corpus big enough to handle not just our living expenses (called as monthly expenses), but the major expenses such as buying a car or laptop or new furniture etc called as annual expenses. I will get to that number in a minute. So using my investments, I was able to fund my car. Basically, I sold a few units of my debt mutual funds and paid for the car in full. In this post I would like to revisit our cumulative expenses and corpus as on date after the major car purchase expense.

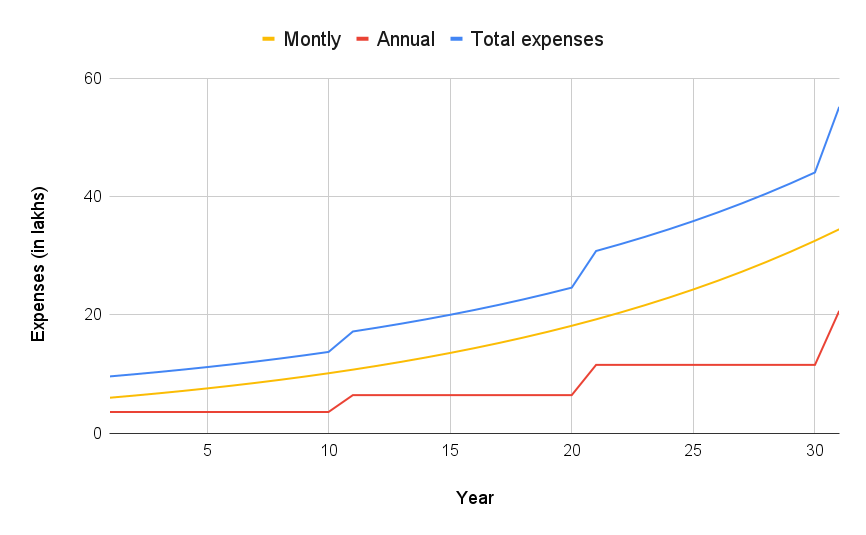

Going back to our discussion about my corpus, it is built to be big enough to handle all my monthly and annual expenses using the 4% rule. Since I don’t know exactly how much expenses I will have every year, it is what is called as a budget. The budget for monthly was Rs. 50K/month (Rs. 6 lakhs/year) and annual expenses was Rs. 3.6 lakhs/year. The total combined budget per year for the first year in retirement is thus Rs. 9.6 lakhs. As you know, inflation causes the expenses to go up year on year. According to my financial planning I assumed a 6% inflation. So my budget should inflate every year to account for increase in expenses due to inflation. Here is where it gets interesting. I increase my monthly budget by 6% every year, but I inflate my annual budget only once every 10 years. This is how it looks like for the first few years in my retirement.

| Year | Monthly budget (annualized) |

Yearly budget | Total budget |

|---|---|---|---|

| 1 | 6.00 lakhs | 3.6 lakhs | 9.60 |

| 2 | 6.36 lakhs | 3.6 lakhs | 9.96 |

| 3 | 6.74 lakhs | 3.6 lakhs | 10.34 |

| .. | .. | .. | .. |

| 9 | 9.56 lakhs | 3.6 lakhs | 10.75 |

| 10 | 10.14 lakhs | 3.6 lakhs | 11.17 |

| 11 | 10.75 lakhs | 6.45 lakhs | 17.19 |

So the budget keeps expanding but not at the rate of 6% for the initial 10 years because the annual expenses are kept constant. But on the 11th year, I inflate my annual expenses also by 6% inflation taken over the 10 years and you will notice a big jump in the total budget. I do this interesting dance because monthly expenses budget is set once every year while the annual budget is set only once every 10 years. If you are getting confused as to why the monthly budget and annual budget work so differently, you might want to read my posts on monthly expenses explained and annual expenses explained posts. If you chart out the budget over a long period of time, it will look like this:

Those graphs above are what I call as projections. My actual expenses may be more or less than my projected expenses. If you recall, I have been saying that I have always stayed below my projected expenses for the past 4 years since I retired. Some of my blog readers thought that I was able to sustain because I was spending less than my projections and hence not really following the 4% rule. Well, the purchase of my car brought my expenses inline with my projection and that should hopefully clarify the doubts some of you might have.

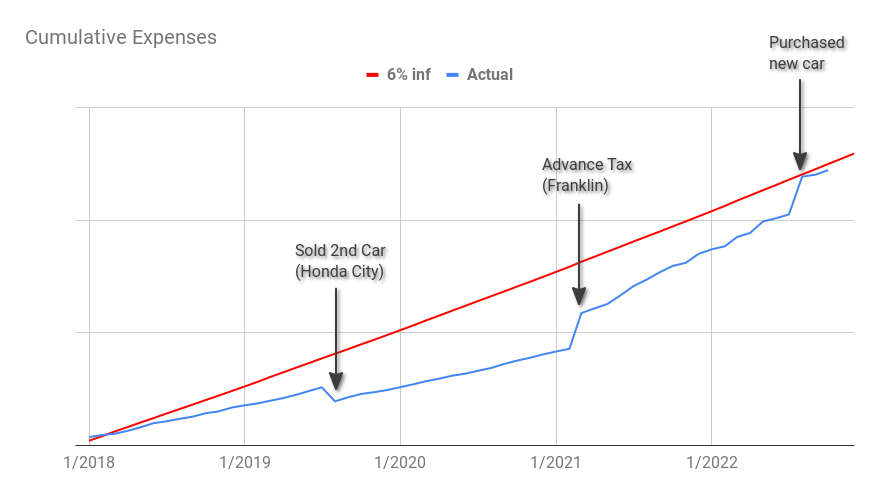

In the chart above, the red line is the projection of cumulative expenses (including both monthly and annual expenses) since the time I became financially independent in Dec 2017. I used 6% inflation to plot the projection. The blue line represents my real expenses. As you will notice, the blue line is usually smooth because the monthly expenses do not vary much month over month. But on occasion, you will notice a big jump or drop in expenses which are the bulky annual expenses. I annotated the chart with the big events that happened since I retired.

You will notice that the expenses have gone down around mid 2019, because I got some money when I sold my 2nd car. Then in March 2021, I had to pay a big chunk of advance tax because of Franklin debacle which is why you see a sharp rise in expenses. Finally in August 2022, I exchanged my old car with new one and the resulting expenses show up as another hill.

Hopefully you now realize that my expenses are exactly where I projected they would be. It is just that they won’t be a smooth ride hugging the projection because some expenses come only once in a while. Now as time passes, again my real expenses will continue to be below the projected one until that one time when there is a big expense like buying a new TV or laptop or house repairs or something. Also note that sometimes the big expenses may cause the real line to shoot above the projection, but as time goes by they will eventually meet again. It is like stock market volatility, but much less frequent :).

Naturally, as you can imagine, since I paid from my investments, my corpus came down by as much. There is no point showing my corpus since the dip is so small in comparison with the stock market volatility that you won’t even see the event. Let me know in the comments below if you have more questions.