How I Funded Purchase Of A New Car

If you have been following my past few posts, you already know that I purchased a new car. You might also recall that the budget I set for the new car was Rs. 6 lakhs. In this post I want to answer some of the questions that might be popping in your mind including why I have a specific budget and how I funded it. I have just one portfolio which is my retirement corpus. I don’t maintain different portfolios for different goals, because I only have one goal which is to stay retired for ever :). The retirement corpus is supposed to fund all expenses in my retirement. It could be any monthly expenses like food, petrol, electricity, kids expenses etc. Or it could be some big annual expenses such as buying a car or painting the house etc. If you want more details, I suggest you follow the links above and read about my expenses first. I explained everything in detail.

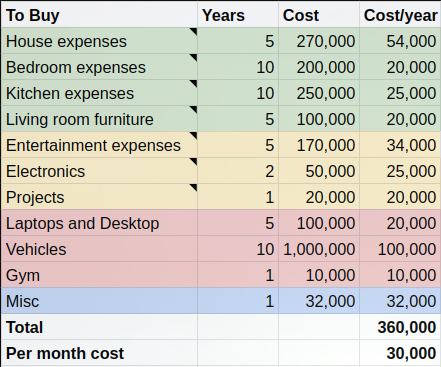

Now, coming to my corpus, it is built to be big enough to handle all my monthly and annual expenses using the 4% rule. Since I don’t know exactly how much expenses I will have every year, it is what is called as a budget. The budget for monthly expenses was Rs. 50K/month (Rs. 6 lakhs/year) and annual expenses was Rs. 3.6 lakhs/year. The total combined budget per year for the first year in retirement is thus Rs. 9.6 lakhs. Based on that and going by 4% rule I built a corpus. The exact number is not important but know that I have accounted for the big annual expenses that happen from time to time like buying a car.

I am reproducing my annual expenses budget again here if you don’t want to read that post.

You will notice that I allocated a budget of Rs. 10 lakhs for buying vehicles in a span of 10 years. What that basically means is that I can buy and sell any number of vehicles, but on average, in a 10 year period, the total cost should be no more than Rs. 10 lakhs. That is a budget I made before I retired and this is all part of financial planning to determine my post retirement expenses and thus the corpus you want to build before retiring. Why specifically Rs. 10 lakhs? Because that is approximately how much I spent in the past 10 years for vehicles including inflation and some buffer.

That explanation out of the way, we now know that I can spend up to 10 lakhs from the period of 2020 to 2029. Those of you who follow my blog regularly might know that I have two vehicles. One is a two wheeler to get around for nearby shopping and the other is a 4 wheeler (Alto earlier, now Ignis). While I’d like to keep every vehicle for a full 15 years from it’s manufactured date, the plan was to buy only used vehicles which are already 3-5 years old. Which means that I have to replace them every 10-12 years. I went with the lower number and decided to replace the vehicles every 10 years.

The Rs. 10 lakhs in 10 years should be sufficient for exchanging my current two wheeler and four wheeler for another new or used one. But that is not all. That budget is supposed to also cover any expenses related to the vehicles other than regular service and insurance. These expenses can show up in the form of battery replacement, tires replacement, car cleaning products like pressure washer, car wax, or tools like jump start cables, tire inflator etc, repairs such as suspensions, clutch plate, light bulbs, etc that are not covered by insurance.

It is normally recommended that car tires be replaced every 6 years or 25K-50K kms mileage. I will be conservative and take 5 years just in case. Realistically they go much longer if you take good care like not parking your car in the sun. For a car, the cost could be around Rs. 25K (for 5 tires) and for the scooter it would be around Rs. 5K for 2 tires. We need to replace the tires twice in the 10 year period. So the total cost comes out to be (Rs. 25K + 5K) x 2 = Rs. 60K.

Batteries need to be replaced every 3 years or at least that is the recommendation. They may actually last longer, but it is better to be safe than sorry. Battery cost for car and scooter put together comes out to be Rs. 5K. Over a 10 year period, they need to be replaced thrice. So total cost is Rs. 15K.

Rest of the expenses such as repairs or cost of tools are hard to determine. I generally take a 20% buffer for such expenses. So out of the Rs. 10 lakh budget, Rs. 2 lakhs is kept aside for these kind of expenses. Including battery and tires expenses I am left with about Rs. 7.25 lakhs to spend on replacing my vehicles. Here is the twist. I am thinking that I might go with an electric scooter once my two wheeler completes 15 years in about 4 years. Going by the current price, it might cost me Rs. 1.25 lakhs just for the vehicle. And I haven’t even accounted for battery replacement after about 5 years which might cost a lot for an electric scooter. Anyway, setting aside the Rs. 1.25 lakhs for the scooter, I am left with Rs. 6 lakhs for replacing my car.

So now you know why I have a strict budget of Rs. 6 lakhs for my car. My corpus cannot handle any more. Since the vehicle expenses are part of the budget and my corpus, I simply sold some of my debt mutual funds worth about Rs. 6 lakhs and purchased the car with full cash (NEFT online transfer) payment. Hope that answers some of your questions. If you want to know more, please feel free to leave a comment.

If you didn’t already know, I purchased Maruti Ignis Zeta MT (manual transmission). All my cars including the one I purchased in the US are manual transmission type. For some reason I don’t like the slow response of automatic transmission (AMT). There is always a lag from the time you accelerate to when the car responds. I am a person who enjoys driving a responsive vehicle. Hence the reason for purchasing the peppy and youthful Ignis. It is something else when you try to overtake a vehicle in manual transmission. Fortunately mrs. reynd also prefers manual transmission because she doesn’t want to lose her muscle memory. Once you drive an AMT, it becomes difficult to go back to MT.