Cash Flow In Retirement

I realized that I don't have a post on how I fund my expenses after retirement. So here is something to help you understand my cash flow. Most of the numbers shared here depend on my monthly expenses. So please keep the Rs. 50,000 per month expenses in your head while reading the post.

Cash

Here I am talking about hard cash, not credit cards, money in current account etc. I keep around one month's worth of cash in the house at all times. Although we rarely use cash anymore (thanks to UPI), there are occasions when we need cash, for example paying the maid. Also when my dad goes out for groceries, he pays using cash because he still owns an old feature phone. Does not want to upgrade to a smart phone :).

Whenever the cash reserves drop below Rs. 40,000, we visit the ATM and draw Rs. 20,000 at a time to top it back up to Rs. 60,000. Normally the ATM needs a visit once a month or less.

Credit card

The bulk of our monthly expenses are through credit card. These include online groceries, LPG gas, petrol, internet, vehicle insurance, travel expenses etc. In addition any other expenses not related to monthly expenses are also paid using credit cards. For example buying a phone, or electronics for my projects, solar panels, battery for laptop etc.

The advantage is two-fold. One, I get cashback which is almost negligible, but still sufficient to pay my amazon prime membership and a bit more :). Two, and more importantly, I just have to pay it one time in bulk sometime in the month. I have a credit of Rs. 1,00,000 which is twice my monthly expenses, so it is sufficient for monthly expenses. And I can pay much later than when my expenses hit the card and that too without any interest. Who gives free credit these days :)?

Cash in bank

While most of the bigger payments happen via credit card, some small expenses happen via UPI. Most local vendors accept UPI payment these days. So expenses for fruits and vegetables, meat, haircut, karate fees etc happen via GPay. Since UPI payments take money straight out of my bank I need to keep some cash in there. I keep around 4 months to 8 months worth of cash in the bank.

There are expenses other that UPI payments that happen directly from the bank. These include paying credit card bills, homeowner association dues, mutual fund investments etc. Whenever I am close to Rs. 2,00,000 in the bank (which is 4 months worth of expenses), I top it up to Rs. 4,00,000 (8 months worth of expenses). I know that is a lot of money not earning much in the way of interest, but better safe than sorry :).

Ultra-short term debt mutual funds

Like I mentioned in the previous section, I have to refill my bank account when the balance is low. To that end, I sell my investments in ultra-short term debt mutual funds. At a time I sell about Rs. 2,00,00 worth of units and bring up the bank balance. Sometimes when there is a good investment opportunity too, I sell some units and buy equity.

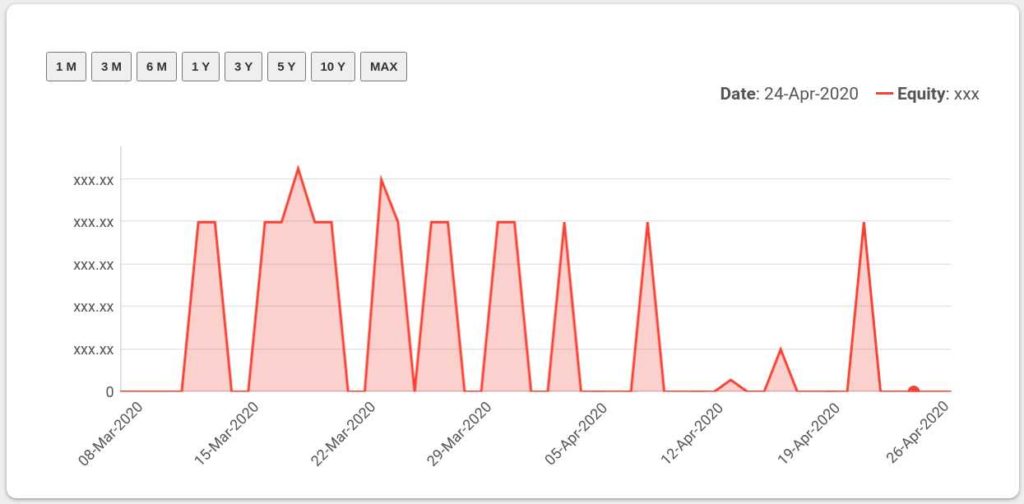

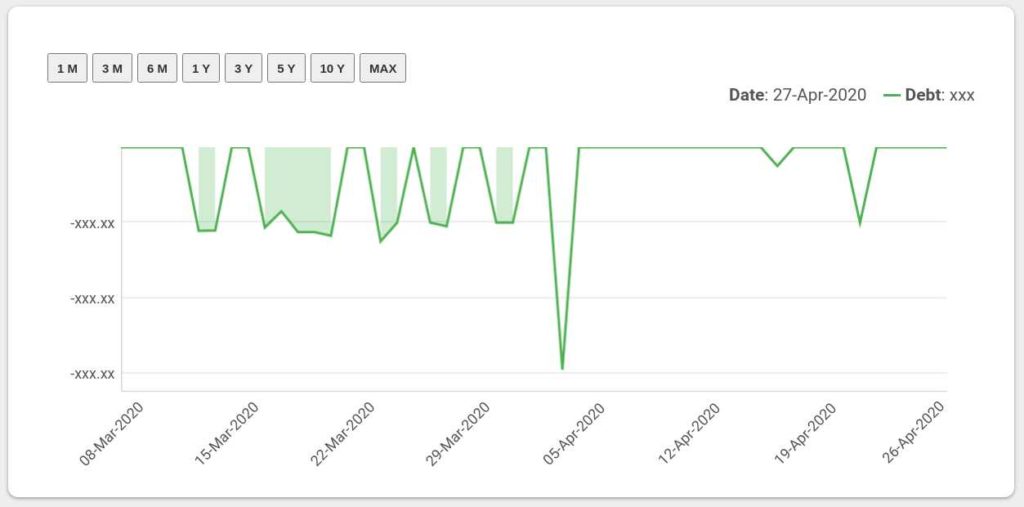

That is precisely what I did during the April 2020 market crash. I kept on selling from ultra-short term debt funds and moved them to equity. In the chart below, you will notice how I simultaneously sell debt mutual funds and buy equity mutual funds.

Since I have enough in the bank account, the buy transaction happens on the same day and money is debited from the bank. Ultra-short term debt mutual funds usually credit the amount the next day. So my bank is replenished again back to where it should be in one day. If I have another investment opportunity the next day too, then I repeat the same process.

You have to be careful if you are executing such a simultaneous transaction on a Friday because then the money will not be credited until Monday the next week. Same with holidays. During that time, your bank might go below 4 months worth of expenses. So plan accordingly.

Other transactions

These are the only transactions that take place most of the time. Almost all other times, I do nothing at all. As you might already know I don't do rebalancing. Instead I have a plan for tactical allocation. So I keep changing my asset allocation when the time calls for it. The asset allocation changes not only happen between debt and equity categories, but within the categories as well (short, medium, gilt, small-cap, mid-cap and multi-cap).

These opportunities present themselves very rarely. About 7 times in the last 5 years. Each time I was actively selling and buying for about 4 weeks on average. Then silent until the next opportunity.

Conclusion

I hope I was able to answer all your questions regarding my cash flow after retirement. It is quite simple really. It is probably a poor man's version of the bucket system people tell me about from time to time. If you still have more questions please feel to leave a comment below or write to me. If you are interested in my portfolio makeup, head on over to my most recent portfolio review.