Asset Allocation After Retirement

What asset allocation should you go for after retirement? That is not a common question I hear from readers of my blog because most of them are still in the accumulation phase and don’t have to worry too much about retirement yet. But it is something that I struggle with myself from time to time since I am already retired. If you are close to retirement or are already retired, maybe this post will help. In case you don’t already know what an asset allocation means, please read my post on it.

To start with, I use a dynamic asset allocation. Which means I try to time the market and change my asset allocation based on market conditions. I would not recommend anyone do this. Generally, market timing should give you slightly better returns at lower volatility. At least that is in theory. But even if we assume no market timing and go with a simple asset allocation, it should still work. Let’s go over some asset allocations and see how it works in retirement.

Disclaimers

A couple of points to note before we start. I am assuming only two asset classes – equity and fixed income. The asset allocation thought experiment is only applicable for the corpus specifically set aside for retirement. For any other goals, follow the appropriate asset allocation strategy.

I am using Nifty 50 index as the basis for investments into equity. Basically, I am assuming that your investments in equity will be via some index mutual fund. Moreover, I am only using Nifty 50 data from 2001 to 2021 and extrapolated them for the following years. Future equity returns may not follow the past returns.

Assumptions

Let’s say the monthly expenses are Rs. 80K which is Rs. 9.6 lakhs per year. And you retired in 2021. At the time of retirement you have a corpus of Rs. 2.4 crores going by the 4% rule (corpus = annual expenses times 25). Let’s begin our experiment.

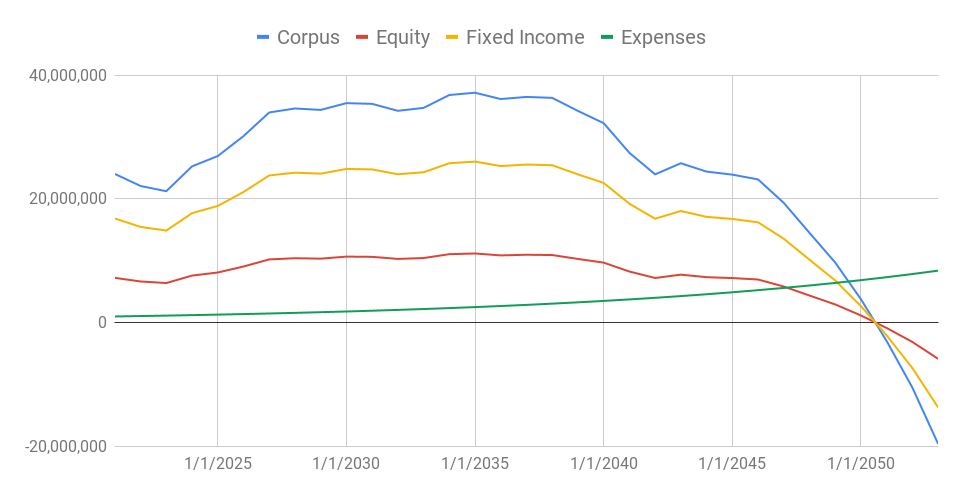

Equity: 30%

The Rs. 2.4 crores is divided into equity and fixed deposits in the ratio of 30% and 70%. So you have Rs. 72 lakhs in equity and Rs. 168 lakhs in fixed deposits. With FD returns of 5% and inflation at 7% the corpus will look like the figure below over the years.

It seems like you will end up using all your corpus by around 2050. This can be a pretty bad outcome depending on how old you are in 2021. I would be less than 70 by 2050. I might live longer than 70, so that is quite risky. Either you need to have a larger corpus than Rs. 2.4 crores or inflation has to be lower than 7%.

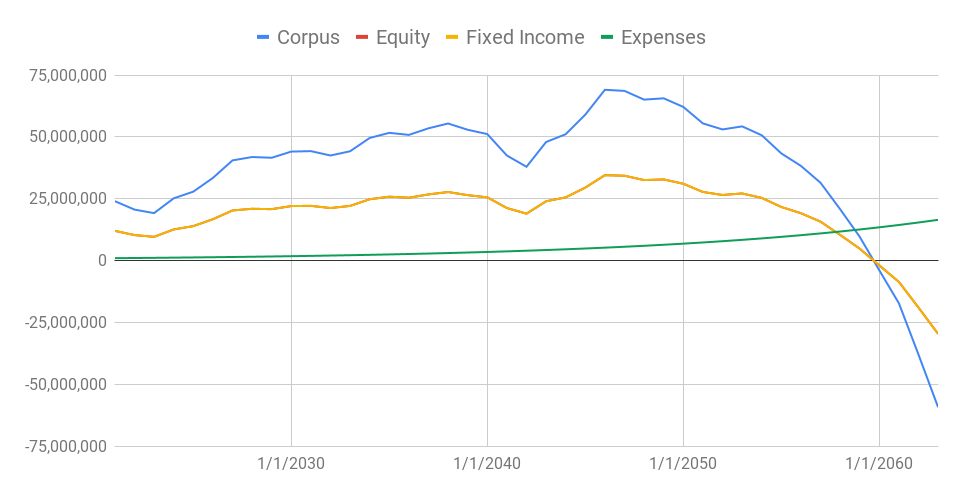

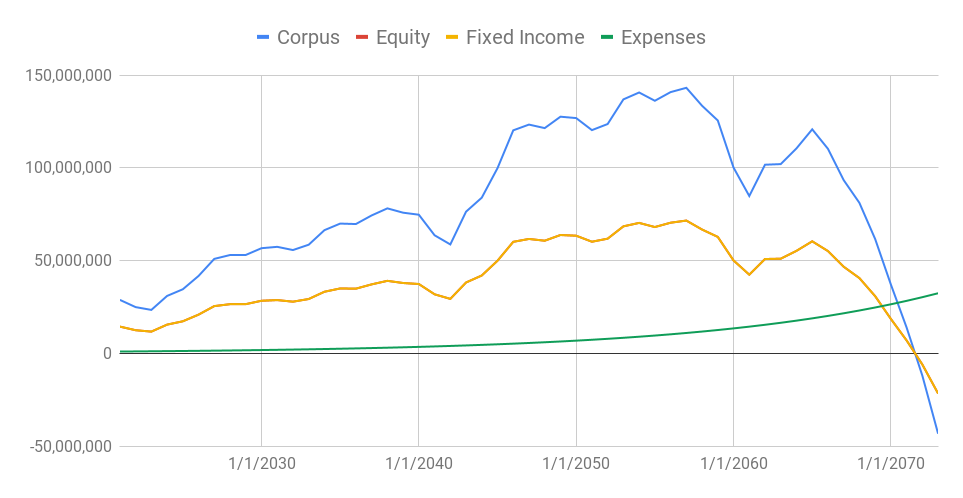

Equity: 50%

With 50% of the initial investment in equity and fixed deposits we have the following situation.

This is looking better. Now the corpus will last until 2060 which is 40 years from now. But still barely enough for a person of my age. Can’t take the risk of out living my savings.

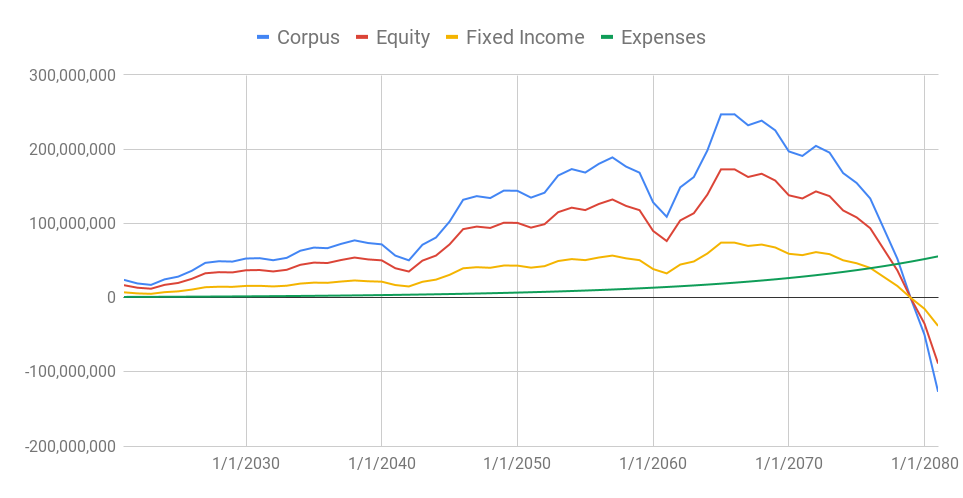

Equity: 70%

Going with 70% equity and 30% fixed income which I usually recommend for early retirees, the graph looks much better.

The corpus will last until 2080 which should be plenty for me. But remember that this comes with a lot of volatility. Imagine your corpus losing almost 50% of its value around 2062. Will you be able to stomach that?

Other options

What if you don’t want to invest so much into equity because of the volatility? There are options. You can either increase your initial corpus or reduce inflation. I don’t think going below 6% inflation is reasonable. Instead have a bigger initial corpus. I recommend 20% more that what the 4% rule tells you. Alternatively reduce your expenses.

Conclusion

Choice is yours depending on your risk appetite. As usual I always keep voting for 70% equity if you retire early. Especially because you can go back to work if the markets scare you. For older folks a 50% or even a 30% equity allocation might work.