The Markets Of 2023

The year 2023 is behind us, and this year was definitely less eventful than the past 3 years. Since COVID hit, things have changed quite a bit. It all started with the virus of course that wreaked havoc all over the world at the same time. There were a lot of side effects. Many lost loved ones, we were restricted to home isolation and lock downs were introduced. For the first time ever, we had everything closed including schools. Only the emergency services were running. The new work from home culture started. Then came pumping money in the fear and anticipation of reduced spending. The free flow of money caused inflation because people now had more money but nowhere to spend. Remember, everything was closed, so you could spend on nothing but food and health. Then came interest rate hikes to control the inflation. What a crazy ride.

With so many changes to the dynamics, one should expect the market to act crazy. Many experts in fact did predict a market crash among several other things. But the markets did not pay heed and went their own merry way. Many predictions did not pan out as expected.

Take for example the work from home culture. Many expected that to be the norm and we as well as the markets were supposed to take that into account. But what really happened is completely different. While there may be a few companies still supporting hybrid work, there is no wide spread work from home expectations. I remember the time way back in 2021 and early 2022 when the roads in Bangalore used to be free of traffic. Can you believe that? But now, there is more traffic than ever. Schools opened, and there is no word of virtual classes anywhere. Most people I know are going back to work and doing some hybrid approach but the needle is moving more towards work from office.

Because hybrid work was expected, many assumed commercial real estate value would come down. If there are fewer people going to work, there is less real estate to be leased by companies. However, if the current news is to be trusted, work from home is now dead. More office space has been bought in the recent past. Should we have invested in REITs before this happened? Perhaps. But who can predict the future in such uncertainty?

Interest rates have not changed, for the most part, in 2023. While the inflation remained slightly on the higher side of RBI’s range, it is not as bad as earlier thought. Everything about 2023 was more or less in the normal range like it was pre-COVID. Yet, many sounded alarm bells of an impending recession or at least a steep fall in market which did not materialize. I am not saying it will not happen in the future, but that is something we were able to avoid in 2023.

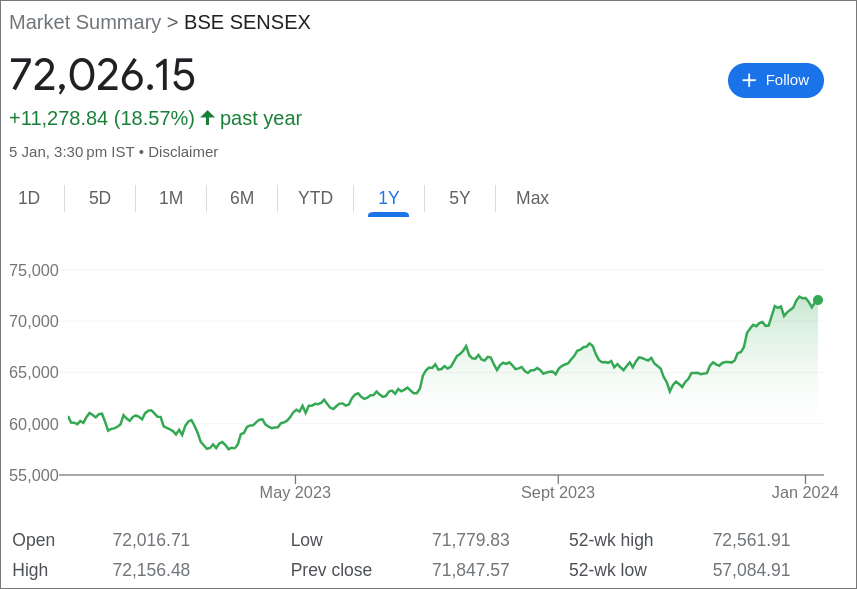

The markets had a completely different story to tell. Sensex gave almost 20% returns last year. Nifty gave 20% while midcap 150 and smallcap 250 indices gave more than 40%! Who wouldn’t love such excellent returns? What more, even FD returns have been much higher. But can we expect the same in 2024? Definitely not. I mean, I don’t know what to expect for this year. As far as I can tell, the large caps are still reasonably priced while small seem quite expensive based on my indicators. Midcaps are slightly on the expensive side. Is there a possibility of recession or market fall this year? Who knows. Experts sounded the alarm last year and nothing happened. May be it will happen this year. But we can’t sit on the sidelines waiting for the market to correct. Just follow your asset allocation is always my advice.