Year In Review – 2022 Net Worth

The last post in the year in review series for the year is on my net worth. I am doing the net worth calculations using the very basic formula for net-worth which is basically assets - liabilities. Some don’t agree with that formula, but I will continue to use it since that is what I have used in the past. If I change the formula now, then there will be discontinuity in the numbers. Moreover, since I don’t publish any numbers, it does not matter what my net worth really is. It is only to show how it has grown or fallen over the years. My retirement is in no way dependent on my net worth. It is only dependent on my corpus of investments (debt MFs and equity MFs).

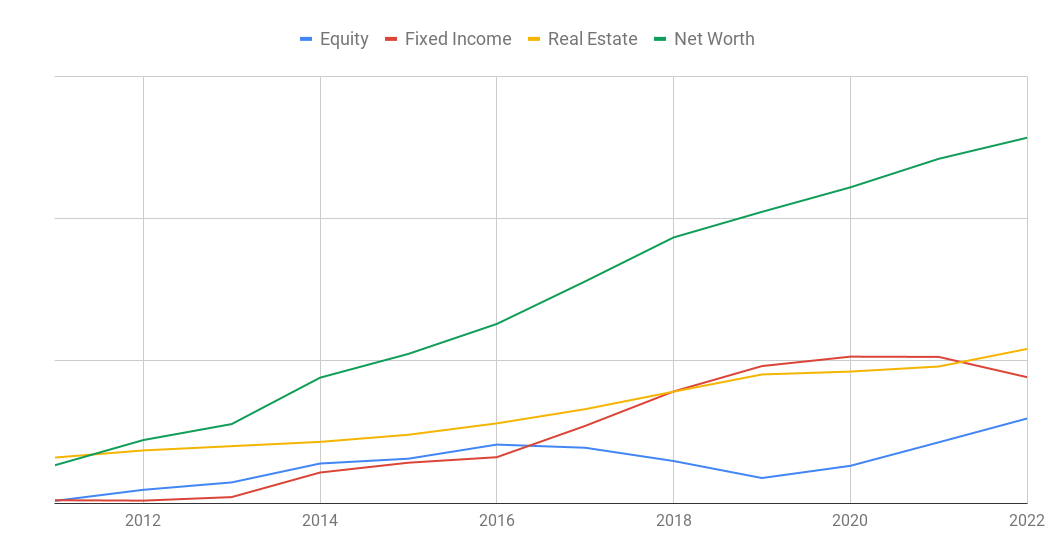

As you will see from the graph below, my net worth (green line) has grown uniformly over the years. You wil also notice that the real estate value which was almost flat during 2019-2021 has now gone up a bit. During COVID period, real estate did not do much. Now that we are out, the speculation has started again. Anyway it does not matter what the value of my real estate is because we live in it and can’t sell. It is just a way to see how my total assets are growing.

Fixed income value has come down for a few reasons

- I was selling some of it to pay for my monthly and annual expenses and there were some big expenses last year

- The interest rate was quite low for most part of last year, and as a result all my short term debt funds were giving low returns

- The increase in interest rates by RBI affected all my long term debt fund negatively

- I moved some investments from debt mutual funds to equity mutual funds

You will notice that the equity component has been slowly increasing since 2019. As I mentioned above, I moved some investments from debt mutual funds to equity mutual funds when I felt equity is not as overvalued at some point in 2022. That is not the case anymore. Other than that, there is nothing much that I can derive from the graphs.

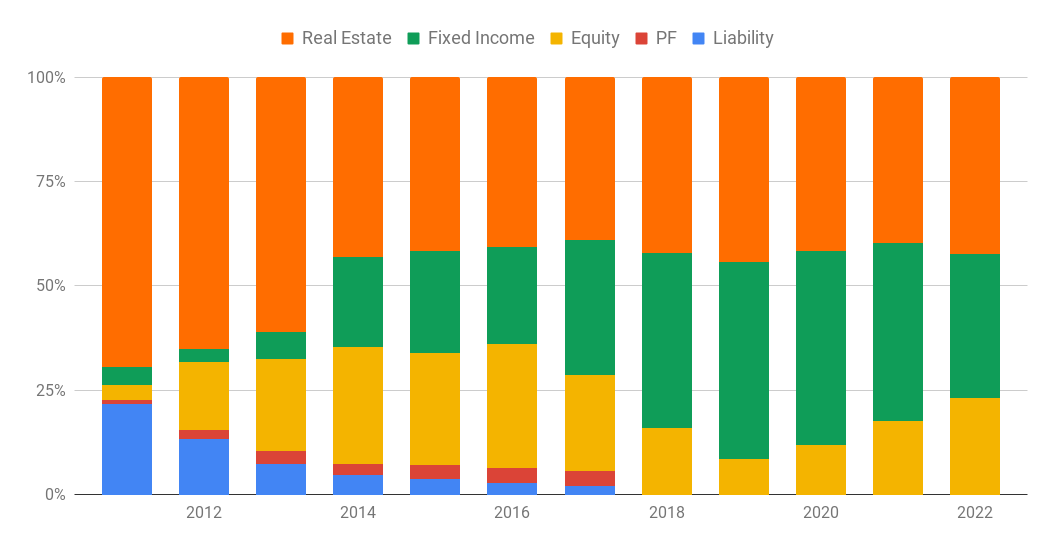

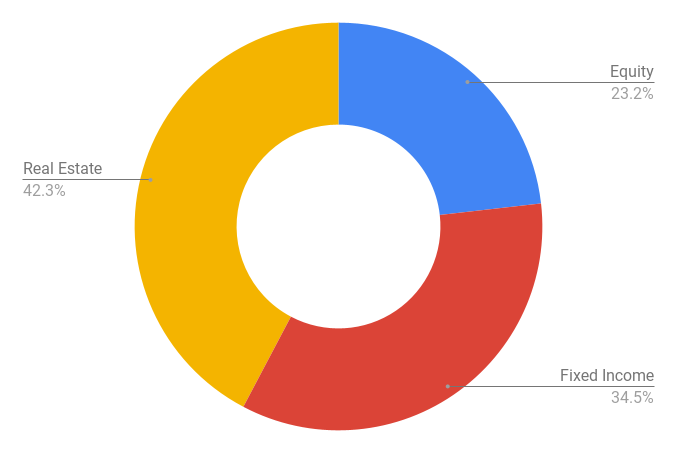

Next, lets take a look at the asset allocation (see chart below). There has been a slight increase in the equity asset allocation from last year but it is not nearly as much as I wanted it to be. I was too slow in moving money from fixed assets to equity.

But what bothers me the most is that the real estate part is still almost 42% of my net worth. Of course, the real estate number is just a hypothetical number. The real value is known only when you sell it. What you read online about the value of real estate per square feet is not real. It magically goes up when you are looking to buy and magically comes down when you want to sell the same exact property :).

I know, I know, real estate is not part of my retirement corpus, because it is not an investment because we are living in it. But if we were to die today, this is what my daughter will inherit and I don’t like the heavy tilt towards real estate. That is not the legacy I like :).