Year In Review – 2020 Daughter's Portfolio

• reynd

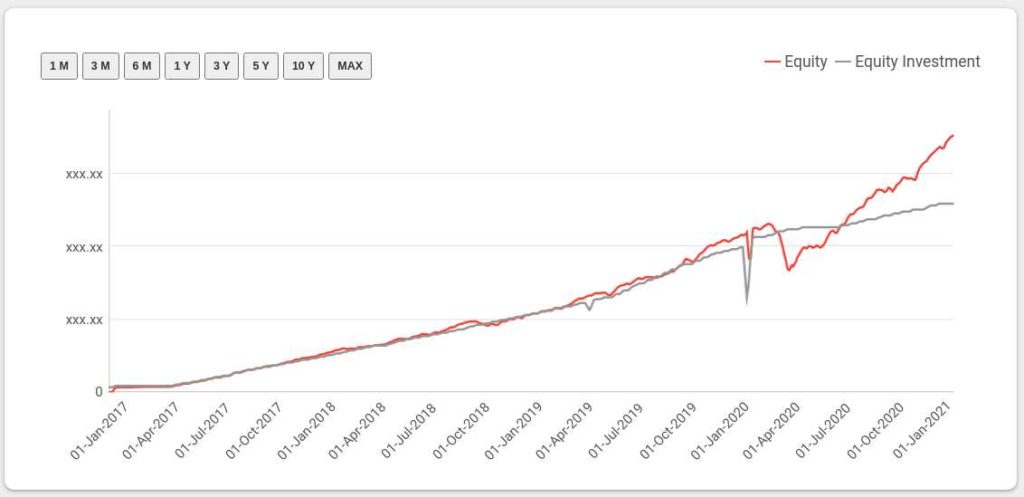

You know that I am managing a small corpus for my daughter. Since there is no goal involved and it is an experiment, I decided to go all in with equity investments. The plan is to hand over the portfolio to my daughter when she become a major. This will be a nice experiment to check if my quest for low volatility portfolio coupled with market timing is any better than just blindly investing in equities. All I am really interested is in the returns as compared with my portfolio.

Returns

To recap, the returns of my daughter's portfolio was 1.23% when I last wrote about it. That was soon after the COVID-19 market crash. I started monthly SIP for her in Jan 2017. So it has been just 4 years so far and the returns of a pure equity portfolio is 17.38% which is alright I guess. Nifty 50, 500 and midcap 150 all gave around 14-15% annualized during that time. My retirement portfolio gave 11.85%.

In 2020 the returns from my daughter's portfolio was 32.63% where as my retirement portfolio gave 15.15%. There is no secret sauce in my daughter's portfolio. It is made up of just two mutual funds. One is an ELSS fund and the other a flexi-cap fund (erstwhile multicap fund). Of course none of this means a thing until the portfolio has seen at least 10 years of market. So lets hold off on the judgement. The reason I don't use Sukanya Samriddhi Yojana is because the returns on that are pretty low compared to what I can get from equity investments. Especially because the goal is so far away that the volatility should not matter.

Investments

Although the plan was to invest every month, I skipped 2 months (May and June) in 2020. It was all thanks to the Franklin debacle. When a large portion of my money was locked up with Franklin, I decided to freeze all transactions and planned to live off of emergency and other liquid funds. The main reason is taxes. At the time I felt that the Franklin voting might go through and there will be a huge tax implication. I did not want to increase tax burden by selling my other debt funds. Anyway, none of that did happen and so I resumed my transactions.

The dip and spike around Jan 2020 is because I moved investments from one non-performing mutual fund to another. So there you have it. I will track this portfolio for a few more years and see how it performs before changing the asset allocation.