Year In Review - 2019 Returns

It is that time of the year again when I do a review of my investments, expenses, net worth and also plan for the upcoming year. This year is special because I also have to do my 10 year planning as this is the start of a new decade. Anyway, enough banter, on to the good stuff. As usual, this will be a series and this is the first of them which covers my returns in 2019.

Portfolio vs Index

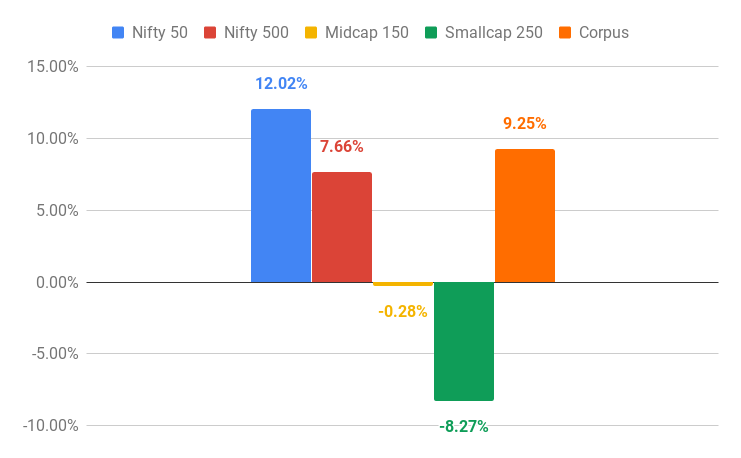

I got returns of 9.25% last year. When compared to some well known indices, my portfolio performed better than most, but not all. Nifty 50 with 12.02% returns has handsomely beaten my portfolio by a huge margin. I would have done well to have invested all my money in Nifty 50 last year. Of course hindsight is always 20/20!

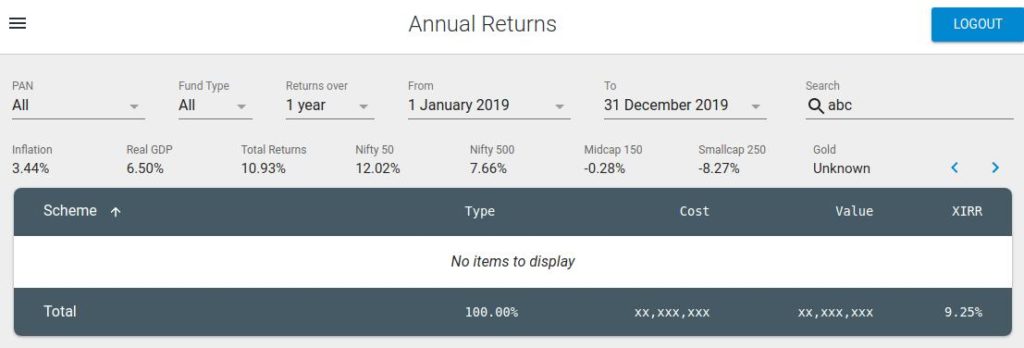

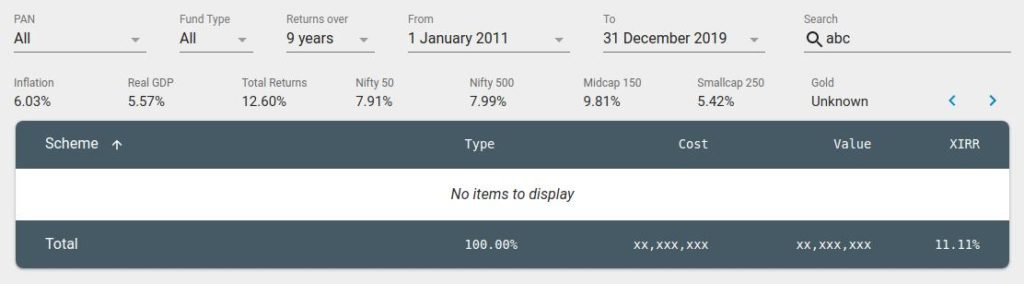

For even more numbers like GDP, total returns etc, I use my handy little web app. Now I don't need to use a spreadsheet to compare my numbers with them.

Over the last 9 years (I started investing in 2011), my portfolio grew by 11.11% annually. Most people will be disappointed with that kind of return, but I am quite fine with it. People expect much higher returns like 15% or even 20% from their investments. But remember that during those 9 years, none of the indices were able to give even 10%. So keep your expectations low. Of course the reason I have better returns is because of SIP and nothing special about my mutual fund picking or timing the market :) . Anyone can do the same or better.

Portfolio vs Volatility

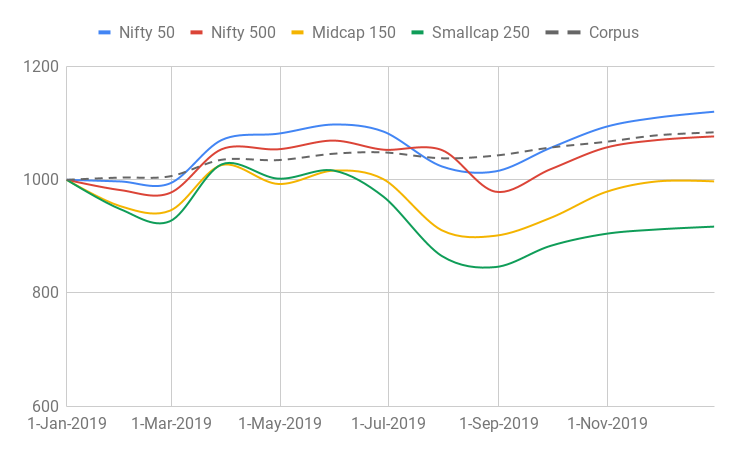

Of course returns do not mean a thing if they are not compared to volatility. As you might have expected, the indices had a rough ride. My portfolio did fine which helps me sleep well at night :). As in 2018, I was reducing my equity exposure and did not participate much in the market until the fag end of the year. I was still feeling the market is in the high part of the cycle. I am doing this because I need to preserve my capital -- remember, I am retired. If you are not nearing retirement or retired yet then continue your SIP in the preferred asset allocation. Don't time the market unless you know what you are doing.

Portfolio vs Projections

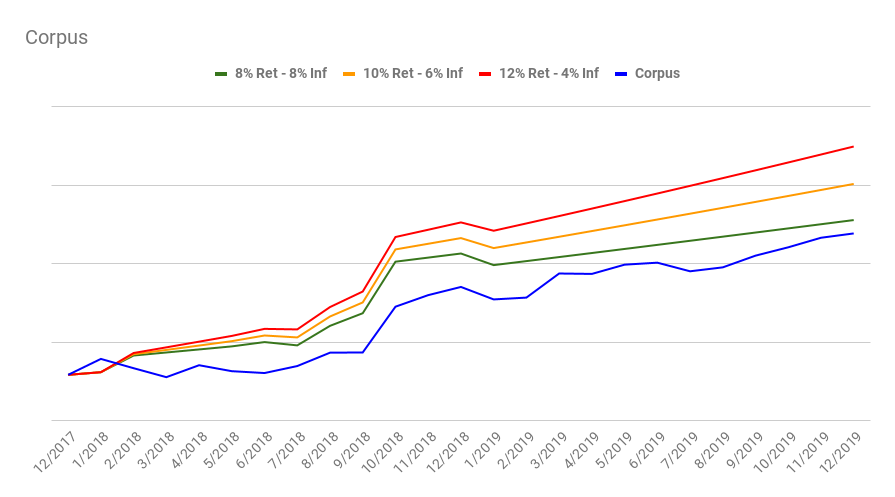

Now to compare my returns with projections. As you know, I made some long term projections for how my corpus should grow assuming some return and inflation rates since Jan 1, 2018.

As you can see, the actual amount is still very much below the projections. The projections are based on 8% return - 8% inflation, 10% return - 6% inflation and an insane 12% return - 4% inflation. My corpus currently is unable to beat even the 8% return with 8% inflation when projected from January 2018. Of course, if you just look at the projections from start of 2019 till the end, it will look much better almost around the 10% return - 6% inflation line. But I never look at that. Long term projections is a must.

Conclusion

So in summary, I made a middling 9.25% returns for the year with low volatility as compared to the indices. My corpus is below projections, which means I don't know if the corpus will be able to fund me till the end as I planned ;). But of course I am not worried at all. Two years is such a short term when it comes to investing, so I am betting the corpus line will catch up with the projections in a few more years.

Bonus Section

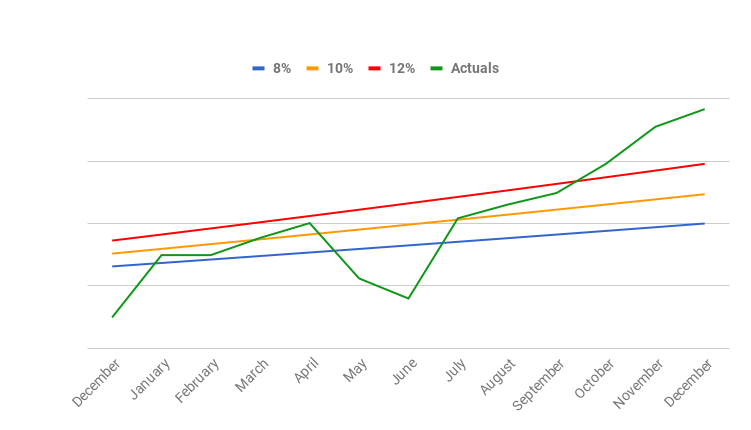

If you have been following my year in reviews from last year you know that I have a few stocks in the US that I got as part of my employment with a MNC. I left them there because I wanted to use that for any international vacations. That corpus has given me some wild returns!

The stock started lower than my expectation at the start of the year, but as the year progressed it ended up higher than my highest projection thanks to both the stock growth and USD-INR inflation. Seems like it is time to take that international vacation ;)

Update [22 January 2020]

I will give a bit more details about asset allocation in my Net Worth section of year in review series. I currently have some equity split into equity mutual funds in India and some foreign stocks. Around 97% of my equity mutual funds are invested in two multi-cap funds. The rest 3% is invested in one mid-cap and one small-cap fund. My mutual fund returns (excluding foreign stocks) since 2011 is 14.93%.

All of my fixed income is in debt mutual funds. I don't have FDs or PFs or NPS. I have my debts funds spread across many funds. I don't like it, and I am trying to consolidate them without incurring tax. So it is going quite slowly. As on date I am invested in 9 debt funds. Of that, 75% is invested in ultra short term debt funds, 3% in gilt and the rest in various other debt funds. Since 2011 the debt funds gave a return of 8.44%.

I will not divulge into the names of the mutual funds because I never do mutual fund recommendations on this blog. I don't want people blindly following my strategy or mutual funds because everybody's risk and situation is different. Do your own homework and figure out the right funds for you, or take the help of a financial planner.