Trimming Expenses

In my last post I mentioned that I was confident of my approach to early retirement. In addition I wrote about a couple who have been retired for 30 years by just following the 4% rule. One of the learning from that post is that there could be a huge drop in market that may hit my investments badly. In that case my investments may not keep up with my expenses. For example if there is a prolonged market slump. And I need a plan. The plan starts with cutting down my expenses temporarily so that my investments can catch up.

Expenses

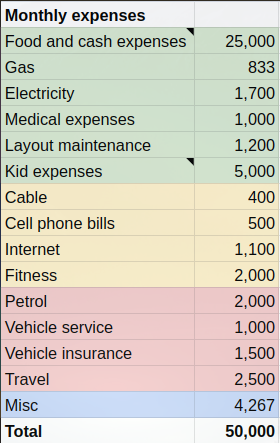

Lets start with my expenses first. You already know I planned for Rs. 50K per month on expenses that occur repeatedly a few times a year. Those could be groceries, vehicle servicing, phone bills, travel expenses etc. On top of that, there are expenses that occur less frequently like house painting, upgrading TV etc. Those fall under the annual expenses for which I budgeted Rs. 30K per month. In total my monthly expenses on average over a long period of time should approach Rs. 80K per month. Of course with inflation that will keep increasing over time.

Trimming monthly expenses

You might have noticed the color coding in my expenses. Take a look at the monthly expenses below.

The red color ones are mostly discretionary spending. So if my investments ever have trouble keeping up with my expenses they will be the first to disappear. I would sell my vehicles and cut down on petrol, service and insurance expenses. Will use public transport as necessary and reduce travel. Next I can cut down on the yellow expenses reducing the expensive mobile and internet plans. All said and done, I can bring down my monthly expenses to Rs. 35K per month.

Trimming annual expenses

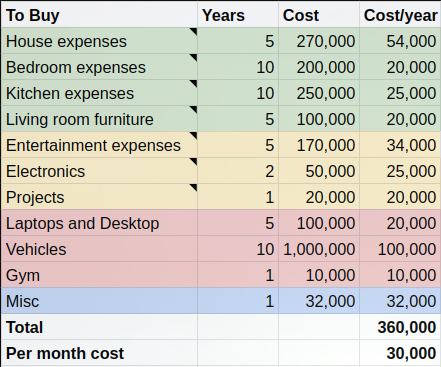

Consider the following annual expenses.

Almost all expenses fall under the discretionary category. I can certainly skip buying TV, laptop etc for a long time instead of upgrading as per schedule (column 2). There will be some equipment that will break from time to time and hence I may need to spend some Rs. 5K per month on them.

Corpus required

So my expenses would come down from Rs. 80K per month (50K + 30K) to Rs. 40K (35K + 5K). Which means my corpus can be half as much as I initially planned. What this tells me is that if there is a market slump that wipes out half my portfolio, I should still be able to manage. The situation will not be ideal, but I can at least survive. Eventually when the market recovers, I can go back to my expenses. That is my simple plan for now.