Sensex and Nifty Up More Than 35%

I wrote a post less than three months ago that Sensex and Nifty have fallen more than 30%. It is only fair that I should write a post when the indices have gone up. This time, they have gone up by more than 35%! The unfortunate thing is that I have no idea why. But hopefully your investments are up and probably in the green zone. Of course neither indices (thankfully) have not reached their historic highs.

Interestingly, some people confuse why the market has not reached the peak when it is up the same percentage as when it went down. You have to understand that the base is different in each direction. For example, if Nifty is 10,000 and drops to 5,000 then it has fallen down by 50% = (10,000 - 5000)/10,000. The base was 10,000 in that case. Now, if the market goes up by the same 50% from here, will we reach 10,000 again? No. Why? Because the base is now 5,000. Nifty will be 5,000 + 5,000 * 50/100 = 7500.

So if it were to reach 10,000 again, the market will have to go up by 100% and not 50%. Going down is easy, but coming up is difficult, like many things in life. Sorry, I went rambling there. Had to explain this to someone a few days ago. Thought I should remind my readers about base effects.

Why is the market so buoyant?

Your guess is as good as mine. If you know why the markets are going up like crazy when all the economic indicators and job market is down, please do let me know. It is beyond my comprehension. And yet, here I am trying to explain something that I don't understand myself. But you can't stop me from throwing random guesses now can you?

If I were to guess, I am assuming it is probably because of the Federal and Central banks all around the world are injecting liquidity and stimulating economy. It is as if these countries don't want markets to ever come down. That is just really silly. It sort of made sense in 2008 when the economy was crashing and the governments were bailing out and injecting liquidity after the fact that a bubble burst and companies went bankrupt.

But this time, everyone is acting up in anticipation of an economic disruption. We haven't even seen the numbers for quarter ending June, but everyone is predicting huge losses and hence the backstopping. For an event that hasn't happened. Central banks have been slashing interest rates, selling bonds to increase liquidity, governments are announcing a lot of stimulus packages. While all this is fine, the market participants seem to be blissfully unaware that these are all temporary measures.

What does the future hold?

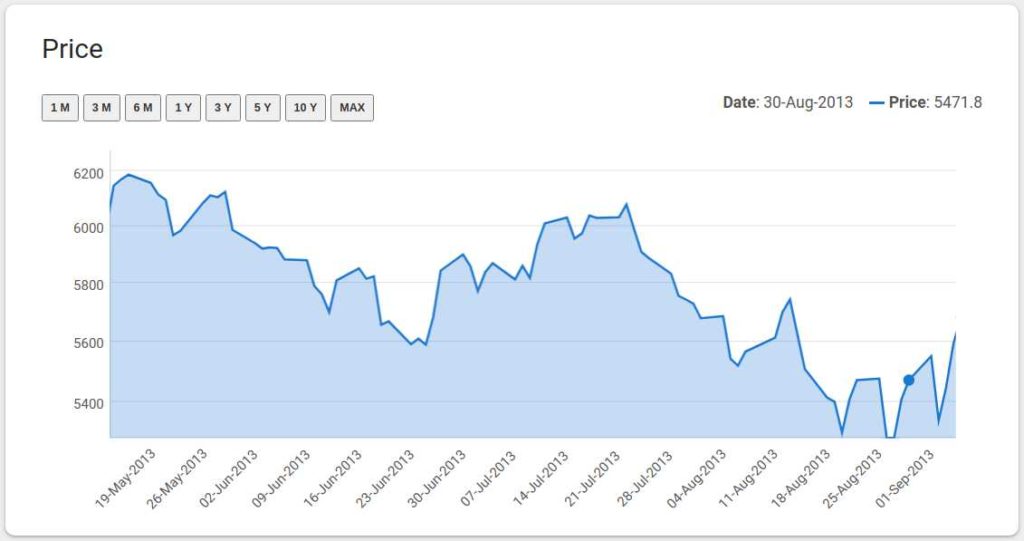

Like before, I have no idea. But I will do some predictions as usual. Remember what happened when FED introduced quantitative easing? The markets went up. Foreign investors flush with cash started investing in Indian equity markets. But as soon as FED announced tapering, the markets did not take it well and the markets went down. Remember May-Aug 2013? You don't and I don't blame you for that. Read the impact of FED's exit on India if you are interested in the details. One of the reasons was that the foreign investors took away their investments from India.

So, I am wondering if this market euphoria will fade away once the reality sets in. The economic numbers will be down, there will be increased unemployment and growth will be slow in some traditional industries. Of course people will innovate and new ones will emerge that benefit from the social distancing aspects and boost the economy. But that will take time. I don't know. Just repeating my thoughts out loud. Or may be the crash may never happen and the markets will continue to zoom forward and hit new highs without ever dropping significantly.

What should you do?

Well, nothing much. That has always been my advice and it always will be :). The only thing we can do is continue with our investments as planned. The markets will do what they will do. But the most important thing to do is check you asset allocation and rebalance. If you rebalanced when the market went down in March, you must be sitting on some good gains in equity. May be the balance is off and you need to rebalance?