Mid Year Portfolio Review

I don't normally do mid year portfolio review but this time I made a exception. There were a couple of reasons for this. First I made a mistake in the way I calculated my XIRR because of which my return numbers were skewed. Second, the markets have gone crazy and I thought I should share my portfolio when the going is good :).

Portfolio returns

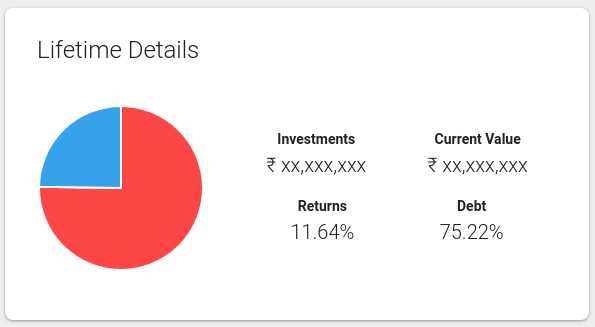

You know why I don't have a 70:30 mix of equity and debt although I always recommend it. While the 2020 crash gave me a small opportunity to invest in equity, it was not enough time. My portfolio is currently sitting with 75% in debt. I feel I lost a great opportunity to invest more back when I had the chance. However, when you are living through the turbulent times it is hard to imagine a quick recovery :). Anyway it is always easy to rationalize ones mistakes, so I'll stop here.

As I mentioned in my previous post, my lifetime returns are really 11.64%. For the year so far the returns are 18%. My daughter's portfolio which is 100% in equity gave a return of 50% in just the past 6 months. So yeah, market has been crazy and I don't understand why and for how long it will continue.

Debt Portfolio composition

My debt portfolio composition is as follows

- Ultra short term funds

- Allocation: 49%

- Number of funds: 3

- Short term funds

- Allocation: 30%

- Number of funds: 2

- Gilt funds

- Allocation: 5%

- Number of funds: 2

- Conservative hybrid

- Allocation: 16%

- Number of funds: 3

My investments are spread across 4 debt categories. Ideally I want only 3 categories -- ultra-short, short, and gilt funds. I invested in conservative hybrids a long time ago when I first started investing. Did not know any better back then. I was in the process of getting rid of that category. Unfortunately the Franklin debacle happened and I had to pause selling that category to reduce taxable transactions. Another thing I was planning to trim down is the number of funds in each category. I want to have only 2 funds in each category. So in the end I should have 3 categories and 6 debt funds in total.

You will note that a huge part (50%) of my debt portfolio is in ultra short term funds. Given the current interest rate situation, I felt ultra short term and short term funds are the best way to invest. Of the 3 funds in ultra short term funds, one of them is Franklin Ultra Short Term fund which is under-winding up. So eventually I will have 2 funds in this category. I have a small allocation to gilt funds but I want to increase that to 20% after consolidating the conservative hybrid fund.

Equity Portfolio composition

My equity portfolio is composed of

- Flexi-cap/value oriented funds

- Allocation: 51%

- Number of funds: 2

- Mid-cap funds

- Allocation: 31%

- Number of funds: 2

- Small-cap funds

- Allocation: 18%

- Number of funds: 3

Equity make up is pretty much how I wanted it to be. I was aiming for 20% small-cap, 30% mid-cap and 50% flexi-cap. Only small-cap category has 3 funds. One of the funds has stopped accepting investments, so I had to add another one.

In early 2020 my portfolio had only 12% in equity. After the crash in April, I slowly increased my allocation. Now the equity is up to 25%. Ideally I would have liked to have even more allocation, but time did not permit :). The crash was for a really short duration and the market recovered way too quickly.

Conclusion

Hope that gives you an idea of my portfolio make up. I was not planning to do this kind of mid year review. But if you like it and want me to do more of them I'll be happy to do it. Do let me know in the comments below or via the contact me page.