Invest Across Market-caps for Better Returns

If you want better returns for your investments, choose to invest across market caps. Generally, choosing 2-3 good multi-cap funds is sufficient for most investors. However, if you want to be a bit more aggressive with your investments, add some small-cap and mid-cap funds. But how much? That is the question I will try to answer in today's post.

Disclaimer: Information provided in this blog is to help educate you. I am not suggesting that is the right way to do it. Any names mentioned within the post are used only as examples, and should not be considered as recommendations or advice. Use the information to improve your knowledge, and make decisions based purely on your understanding.

Are Small-cap and Mid-cap funds for you?

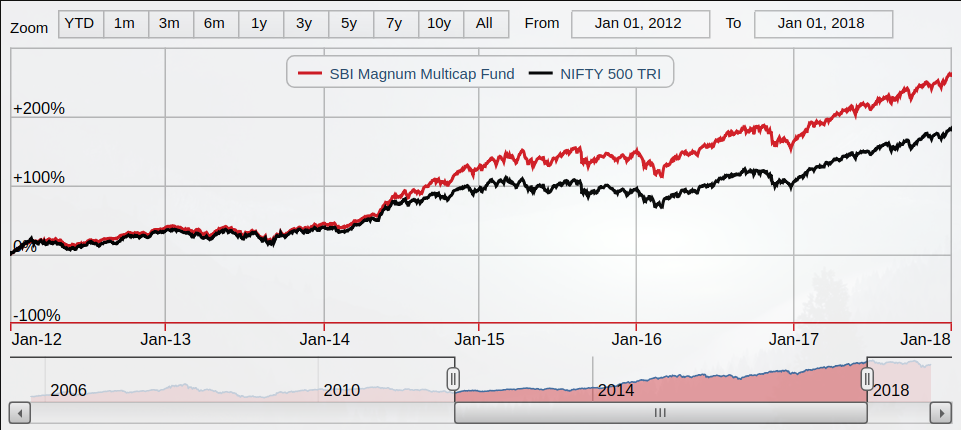

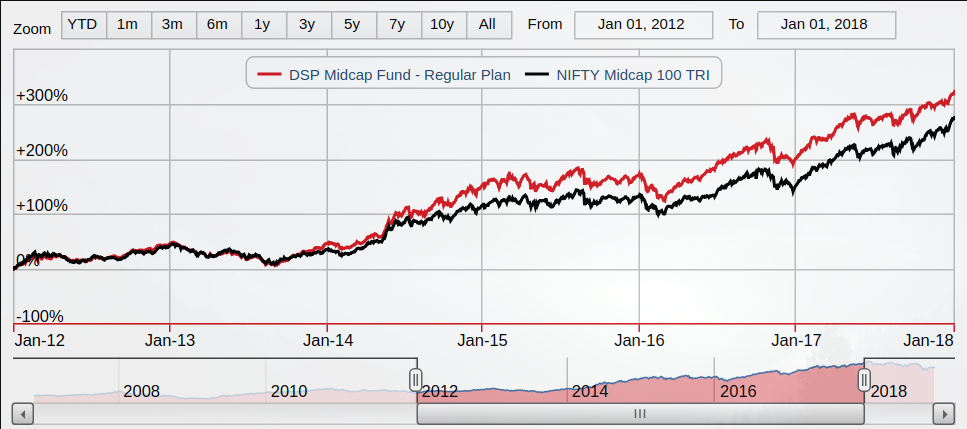

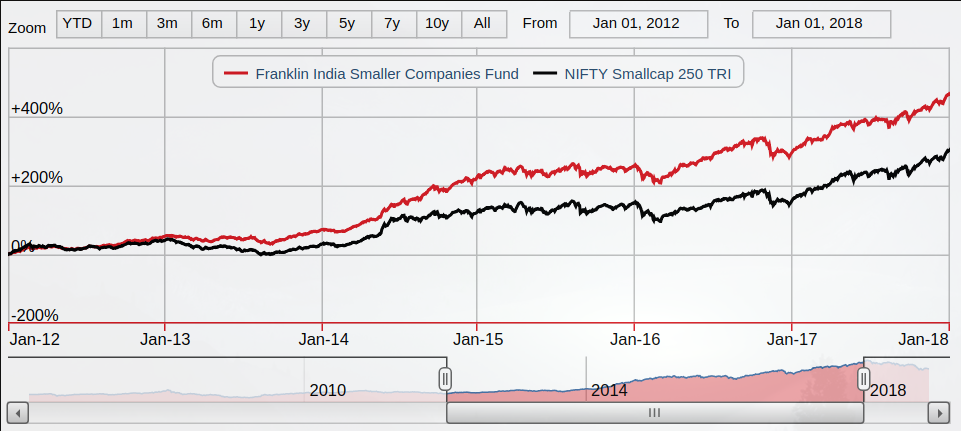

Before we discuss small-cap and mid-cap allocations, lets understand the risk-reward situation of such funds. What do you notice from the following 3 graphs?

Hopefully, you have answered that the returns have increased as we move from the top graph to the bottom. The first fund returned a bit more than 250% from Jan 1, 2012 to Jan 1, 2018. It is a multi-cap fund. The next fund, which is a mid-cap, gave a return of more than 300% during the same period. The small-cap fund returned almost 500%! But of course, the fall in the value could also be as bad. Generally small-cap and mid-cap funds tend to do well in growing economy and fall drastically during bear phases. If you can stomach the risks, small caps and mid caps may be a good idea. As can be seen from the chart below, after a bear phase, small cap performance may not look any better than large cap. Hence, if you can get out before a bear phase and invest only during bull phases it will be much more fruitful. If timing markets is not your cup of tea, then you are better off with multi-caps.

How Much to Allocate?

I prefer to have an allocation of about 15% in small cap, 35% in mid cap, and the rest in multi cap funds when I can't tell which way the market is moving. To be frank, I never owned a small cap fund, because I wanted to play it safe. But in hind sight, I could have been better served if I did. I started investing in mid-cap in 2011 when I first started investing. I used to do 70:30 split between large cap and mid cap since I didn't know any better.

When markets are coming out of a bear phase and during bull phases I suggest you be more aggressive. I don't have a specific number because it depends on how deep in bear or bull phase the market is. But don't ever go over board and invest all into small caps. Do a more reasonable 40:30:30 split into small, mid, multi cap funds in the best situations. I increased my allocation to 50:50 (large-cap:mid-cap) during 2013 and scaled back to 70:30 (large-cap:mid-cap) allocation by August 2016.

When you realize that the markets are too high, it is time to get out of the volatile funds. Start selling and get out of small and mid caps before the bear phase sets in. Of course, it is impossible to time the market, but remember what Warren Buffett said -- "be fearful when others are greedy". During peak bull phases, you tend to hear greats news all around, something along the lines of Sensex reaching crazy new peaks in the coming 6 months etc. I started selling my mid caps from August 2017 until Jan 2018 during which time I felt there is too much good news. By that time I was almost completely out of mid-caps but for a small bit, which I eventually sold in August 2018. Now my allocation is 0% to mid-cap and 100% in multi-cap.

How to Choose a Fund

Hopefully you have read my previous post on how to select mutual funds, which is the same process you will follow to identify 2-3 small and mid-cap funds that you will want to own. One additional filter you might want to add is to check the fund size or assets under management. If the fund size is too big, then the fund may not perform as well. This is especially true for small cap funds.

According to new SEBI's guidelines, small-cap universe starts from the 251st company, with a market cap of up to 9,700-9,800 crores. So even if a fund invests in 20 stocks with 100 crores in each stock, the fund size can be no more than 2000 crores. Of course the fund can instead invest in more than 20 stocks (since there are around 500 companies), but the more companies the fund invests in, the closer the return will be to the small cap index. To make better returns, funds tend to prefer concentrated bets on fewer companies. So it seems like smaller fund size is preferable. But remember, a smaller fund size can have liquidity issues especially during a bear phase. A small cap fund with AUM of Rs 1,000 to 5,000 crore is preferable.

Likewise, for mid-cap funds, prefer an AUM between Rs. 5,000 and Rs. 15,000 crores. But don't make it an important criteria. There are some excellent funds which have a much larger AUM. Keep this filter for the last and once you have shortlisted your funds, use this metric to further make informed decisions.

Summary

There you have it. My preference to mid and small caps. While I missed the small cap opportunity in the past, I will certainly explore it when the time comes next time. Until then, I am sitting on my hands. If you want to invest in small and mid cap, do so by all means, but know what you are getting into.