Market Euphoria And Relevant Trends

• reynd

The number of new fund offers (NFO) in the recent past is giving me the jitters. Have you seen how many NFOs were offered? And investors are just lapping them up clean. And let us not even talk about the IPOs. I am not here to make predictions, but the market seems to be reaching euphoric phase. And you know what that means to the stock market once the excitement subsides.

Stock market has been reaching new highs every other day since the crash of March 2020. And the general public is excited to join in on the fun. But my worry is that the quote -- what the wise man does in the beginning the fool does in the end, may be coming true. Here are some trends I've been noticing lately.

NFOs search trend at the highest

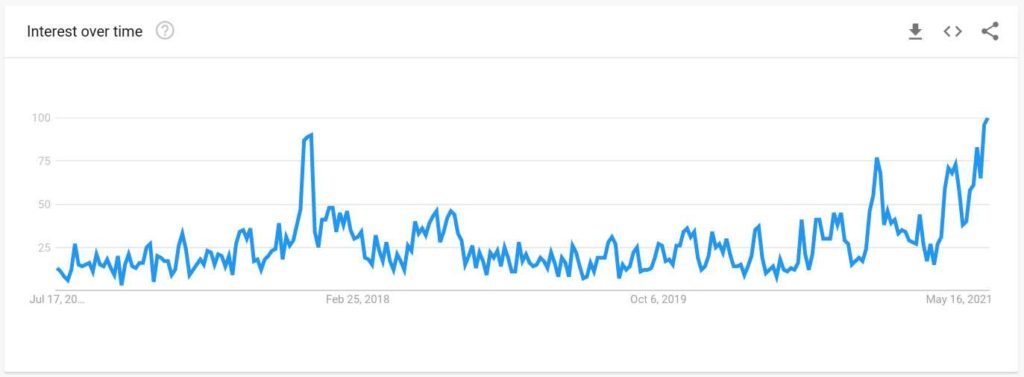

I don't know where I can get the list of NFOs offered by date, but if I had that list I am sure there will be a rising trend. Even without that data, I have received so many emails about NFOs in the recent past, I know it is going up. Anyway, are people searching for NFOs? May be that is a proxy to the interest. This is the search trend for NFOs from Google trends.

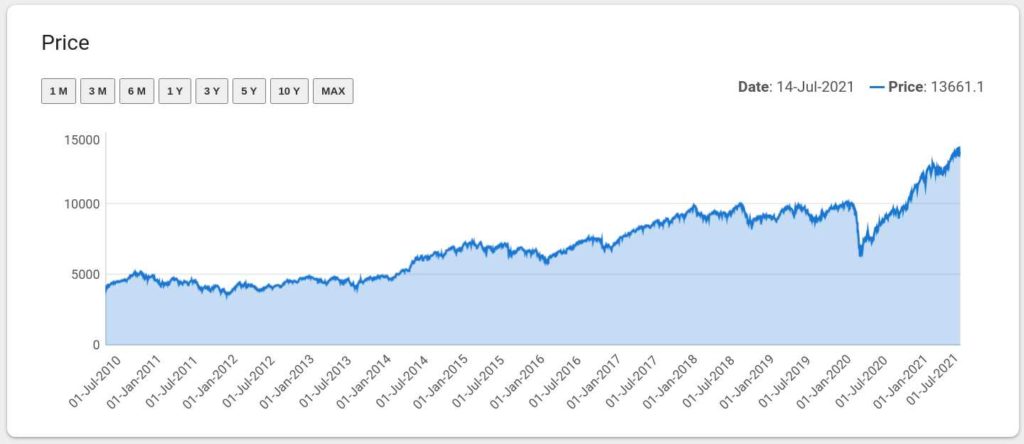

As you will notice, there was a lot of interest sometime towards the end of 2017 when the market was peaking at that time (see Nifty 500 graph below). After the peak in 2017, the market moved mostly sideways until the crash in 2020. So is this peak in trend an indication of sideways market?

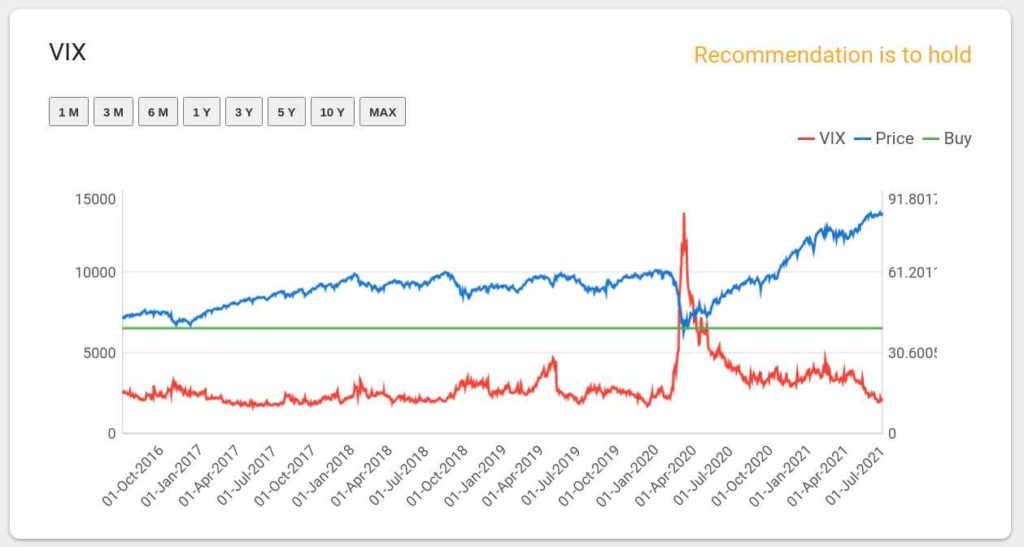

VIX is at the lowest

The volatility index on the other hand is quite low. It means the stock is moving uniformly in one direction. Again a sign of euphoria that nothing can go wrong. And most of the time nothing goes wrong for a long time until it does! VIX is trending down in the past few weeks.

Other signals

I see a lot of interest to invest in stocks from people who are not even in the financial know how. It looks like we are in stage three of Peter Lynch’s Cocktail Party Stock Market Indicator. If you don't know the four stages, read the excellent book One Up On Wall Street or look up the internet for "Cocktail Party Stock Market Indicator".

While I am not even considered a novice in financial market, people are asking me if it is good time to invest in stocks. Some want to know if bitcoin has a future, others are excited about some Ponzi scheme. So that seems to fall into stage three. Once my friends and barber give me tips on where to invest, I know my time to exit the market has come. Seems like we are still a little ways away from it.

Action plan

Unless you are timing the market -- which you shouldn't unless you know what you are doing, the action plan is always the same irrespective of market conditions and economic situation.

If you are closer to your goal (say 2 years or less), and reached your corpus, move your investments away from equity into something safer like liquid funds, ultra-short term funds or fixed deposits.

If you are in the accumulating phase, and the goals are far away, continue investing according to your asset allocation.

In all other cases just rebalance your asset allocation to your predefined ratio.

Conclusion

As usual, I don't know where the market is heading. There are only three ways it can go -- higher, lower or no where. Just the probabilities change. As of now it feels like markets can go even higher and crash or go sideways. Just a guess. Don't quote me on that. While the indicators seem to point towards an expensive market, the corporate profits are going up even in the face of pandemic. So it is quite confusing. On the other hand people who don't even know how to evaluate a business are investing in stocks. And there is a rising trend in the number of NFOs and IPOs.