How Soon Can You Retire?

Like I mentioned in the previous post, there are really just two variables that you can control, which determine how soon you can retire. They are your expenses and savings. Remember step 4 of How to Retire Early in 5 Steps? Plan a Simple Retired Life. The lesser the expenses today, the less it will be in future after adjusting for inflation. If you like a rich lifestyle today, then as the years go by, not only will inflation cause the expenses to go up, but you will want higher and better lifestyle which adds up. Your savings will not be able to handle the burden of your expenses. The less your expenses, and more your savings, the earlier you can retire. But how soon? That is the question that I want to answer in this post.

This is more of a DIY (Do It Yourself) exercise since I don't know what your savings and expenses are. So I created a calculator (see the bottom of this post) where you can plug in your numbers and what you believe your risk level is and it will calculate the age when you can retire. Follow these instructions to plug in the numbers into the calculator.

Monthly Savings

For monthly savings, figure out how much you are able to save each month on average (from your take home salary) after servicing any EMIs and monthly expenses. The higher this number, the faster you can retire.

SIP Increment

The rate at which you want to increase your investment every year. For example today, may be you can invest Rs. 50,000 per month. But you do also get a raise every year most times. So typically you should be able to save and invest more every year. Given what your career path has been and what you imagine it might be in the future, you can enter some number here. If you have been getting 10% increments in the past few years and you expect it to continue, enter 10%. Always aim to invest more than what you invested the previous year.

Monthly Expenses

Plug in your monthly expenses number here. Note that you should not include any expense that will not exist in your retirement. For example your EMIs should not be part of your expenses unless you plan to continue paying EMIs in your retirement (I don't suggest you do it).

Your age

Well you know what you need to enter.

Current value of your investments

If you already have some investments that are going to give good returns like equity then plug in that number here. You can enter 0 if you don't have any savings yet, or don't want to include that as part of your early retirement corpus.

Withdrawal rate (example 4% rule)

Use a withdrawal rate that you are comfortable with. Ideally, I would suggest that you keep it at 4% which is a conservative number. Note that this number determines how long your corpus will last. If you want your money to last for a long time, and you are not confident on your corpus giving good returns then use a lower number such as 3% or even 2%. Using a lower number means that your income may outlive you. On the other hand if you are confident that you can supplement your corpus with some other income in your retirement, then use a higher number like 5% or even 6%. Using a higher number means that you may outlive your money. If you are unsure, I would suggest that you leave it at the default 4%.

Investment return

Assume an investment return rate that you are comfortable with. This is the returns you expect from your investments until your retirement. In the past, equities have given very good returns (like 20%) over a long period of time, but don't assume they will continue to do so in the future. I would suggest 10% or 12% to be a good conservative estimate. If you want to be even more conservative then use 8%. On the other hand, if you are feeling adventurous then go for 14%. If you are nuts and live your life on the edge then go for 16% (God bless your brave soul).

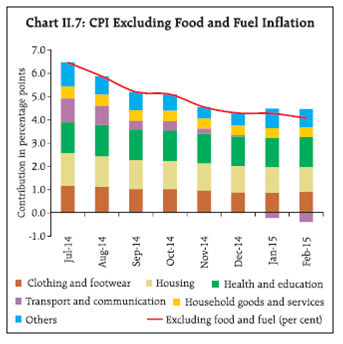

Inflation

In the past, inflation has been on the higher side in India. But thanks to the RBI's inflation mandate, it is trying its best to keep the retail inflation at 4% with a 2% tolerance. Hopefully the future governments and RBI will continue to target it, in which case the upper limit for inflation will be 6%. Do note however that this inflation is CPI (Consumer Price Index) based and is just the inflation of a basket of consumer goods and services purchased by households. Your real inflation may be higher or lower. For example, health and educational inflation is higher than food inflation, so if you have more expenses there, then obviously your inflation will be higher.

I would suggest that you use 6% as inflation, but if you want to be more conservative, go for 7% or even 8%. If on the other hand, you are in good health and can maintain it that way, have no educational expenses to bear and will live a minimalist life in your retirement then you can try 5% or 4%. Although I wouldn't suggest either of those extremes (4% and 8%).

You can retire when you are this old

Given your savings and expenses (you need to just input the first 2 numbers and your age, and leave the default values for the rest), the calculator will tell you when you can retire. Remember again that the calculator is only as good as the conviction you have in your numbers. Think very carefully when choosing the numbers for your savings and expenses.

How Soon Can I Retire Calculator

| Monthly Savings | |

| SIP increment rate | |

| Monthly Expenses at Retirement | |

| Your age | |

| Current value of your investments | |

| Withdrawal rate (example 4% rule) | |

| Investment return | |

| Inflation | |

| You can retire when you are this old | |