How Am I Handling the Market

Given the current market situation, a few of my friends wanted to know how my portfolio is doing and what have I been doing during the crisis. So this post should hopefully answer these questions. I want to preface by saying that don't be fooled by randomness. I may have performed better or worse than you expect and it does not mean I made any smart moves nor that I made mistakes. Only note that luck favors the prepared.

For a couple of years now, I have been complaining about the market being overvalued (in my opinion) and you know that I have been moving a lot of my equity investments into safer debt funds since 2018. Here is what I said in one of my earlier posts

I have been (and still am) stupid, expecting the market to cool down since early 2018. But nothing of that sort has happened. Sensex is having quite a bull run even as the economic indicators are showing a slow down. The economy and market are at odds and it is quite strange. The mid-cap and small-cap space seem to be valued better, but not great. So lets see. Where is that promised recession?

Where is the Stock Market Heading? -- Dec 11, 2019

As a result my asset allocation has never been 70:30 (equity:debt) like I usually recommend to everyone. I explained why I don't follow the 70:30 rule in My Asset Allocation. Here is a summary of what I said in that post

I did not really follow the rule [70:30], not because it did not work for me, but for the simple reason that I wanted to learn market cycles and take risk while doing my investments. I would not suggest anyone play with investments like I did (unless you know what your are doing) and risk losing money. Instead follow the boring simple rule of 70:30 and it works. This is more of a case study of my investing style.

My Asset Allocation

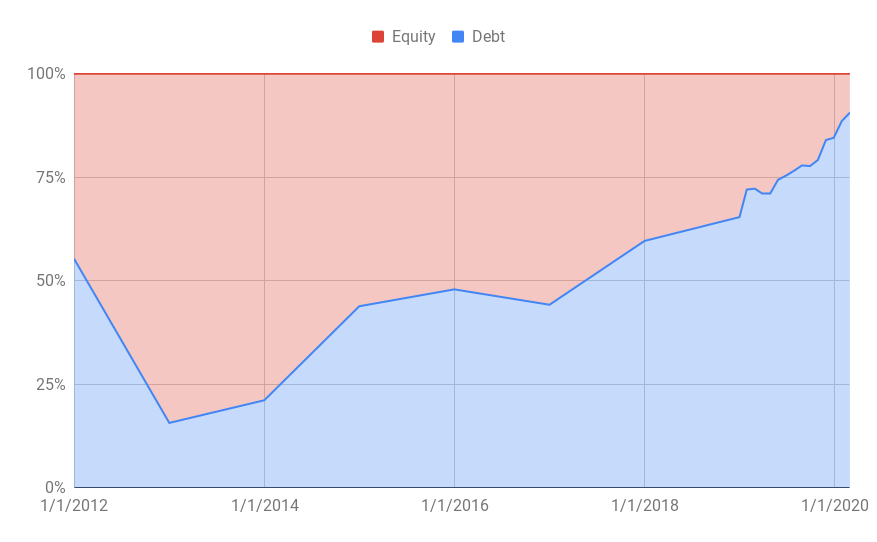

I change the asset allocation based on what the algorithms (an app that I built for myself to track market sentiment) indicate to me. So based on the data, I moved assets between equity and debt as I see fit. The allocation looks like this from the time I started investing.

As you can see, towards the start of 2020 my debt allocation has become 85% from a low of 15% in 2012. Do note that this is just my retirement corpus. I have a bunch of US stock that I only want to use for vacations. If I include that too, then my debt allocation is more like 62%. In the rest of the post I will be only talking about my retirement corpus.

Owing to the lower allocation to equity, the fall was not too bad for me. I don't track my portfolio on a daily basis, so I only have monthly records. From a recorded peak in Jan 2020, my portfolio has dropped about 5% as on date (March 25, 2020). It is most likely a lucky event. I am sure I will not be able to repeat such good performance the next time such a crisis hits me. Also note that this is the first time I am going through a bad cycle. Since I started investing from 2011, I never experienced the 2008 crash.

Currently, I am slowly moving some of the debt allocation into equity. Since I have a huge allocation to debt funds, it will be quite a while before there is a noticeable change in asset allocation. The markets may be volatile for some more time and I can't predict the bottom. Hence, changing asset allocation slowly is paramount, instead of switching from debt to equity in one go. Unfortunately debt funds are also having a bad time due to liquidity concerns. While RBI is doing what it can by infusing liquidity into the system, the debt funds are unable to handle the huge outflows. So my debt funds are also bleeding as well.

You might ask why I don't give recommendations on asset allocation on my blog. There are a few reasons. First, I know what I am doing and if I make mistakes, I will lose my money which is fine. If I announce what I am doing and someone else follows me and loses money, they will come with pitchforks and all. Next, people rarely take my advice. A few people I know got excited by the zooming markets of 2018. They felt that markets can do no wrong and decided to enter into equity investments, not via mutual funds but by actually buying stocks nonetheless! I told them at the time that I feel that the market is not right and probably it is not a good idea to invest. But they did not listen. As the market kept going up all of 2018 and 2019, their investment grew by leaps and bounds. I just looked silly in front of them for a long time :)

Now that the markets finally dropped, anyone can say with hindsight bias that "I told you so". But of course, we all know that this crash was a random event and nothing related to my prediction capabilities. In an alternate scenario, the market would have kept on going up and I would have lost the opportunity to make money because I had such low equity exposure. The only thing I know is to be fearful when others are greedy.

And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful

Warren Buffett in 2004 Annual Shareholder Letter

Another "I told you so" moment includes my advice to readers of my blog to invest in pharma stocks during the COVID-19 crisis. And just today I read an article titled 5 stocks hit 52 week high even as the stock market is going down. Take a guess which sector some of those stocks belong to? But does that make me a good predictor? No, it just makes me a lucky fool!

... perhaps you can time the market or invest in stocks which might go up (pharma stocks?).

COVID-19 vs Market