Withdrawal Plan In Retirement

After my post on lumpsum vs SIP investment, a reader asked – “Wanted to understand the other side - how to redeem from our funds after we retire? Say we have calculated the number and we have enough. But, the challenge is how to get to a withdrawal mode from accumulation mode. You have showcased how you do it in some articles but can you do it with some numbers for a fictitious person? Ex: Age 40. Amount 6Cr spread across multiple equity and debt funds and US Stocks. Now, how to withdraw to last till their age of 85 for an expense of 1L per month (corpus is 50 times)?”. I thought it is an interesting question that needs answering. I will go with the numbers given by the reader and work out an example in this post.

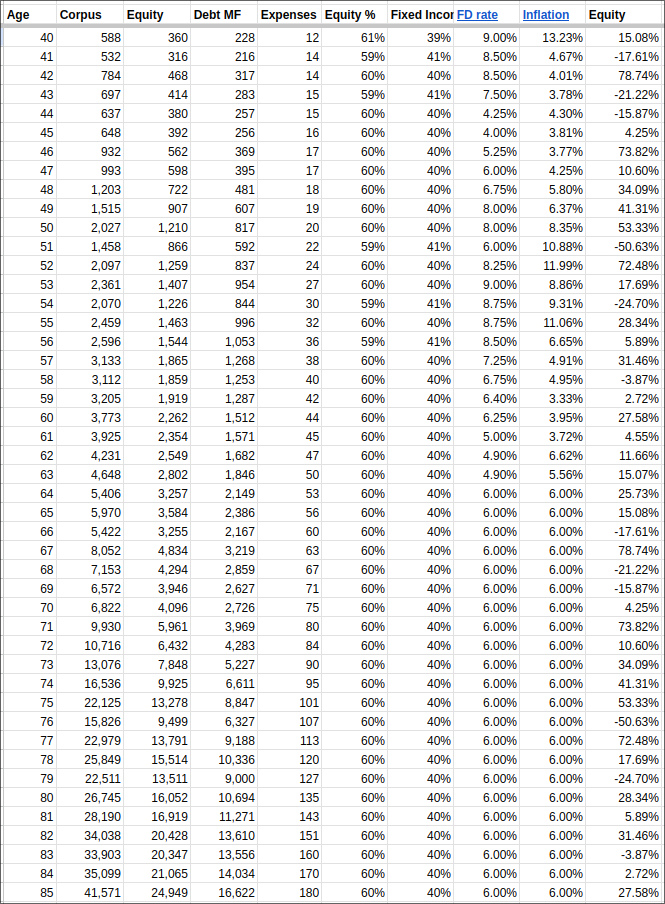

The reader did not mention any asset allocation, so I will go with some assumptions. Lets say the person has 30% in Indian equity mutual funds, 30% in foreign equity and 40% in Indian debt mutual funds. So the asset allocation is 60% in equity and 40% in debt. The reason I went with 60% in equity and not my usual recommendation of 70% is because having US stocks (as opposed to mutual funds) is quite risky already. So using 70% allocation will be even more risky. Lets suppose you want to maintain the same asset allocation throughout the retired life. The person is aged 40 at the time of retirement and expects the 6 crore investment to last until they are 85. That is a 45 year span.

I will be using past Nifty 50 data for returns from equity investments. That includes both the US stocks and any investments in Indian equities. We have Nifty data only from 1998 (25 years from 2022). Since we don’t have data for 45 years in retirement, I will repeat the Nifty returns from 1998 onwards again to have a total data for 50 years. Remember that past returns are not indicative of future returns. For debt MF returns I am assuming the equivalent of FD returns. I used 1 year FD returns from RBI. For inflation numbers I used data from macrotrends. Lets get started.

Year 2023

Now lets see year by year how your portfolio will change and how you can sell your investments to meet your expenses after retirement. Today you have 6 crores distributed as follows in your portfolio.

India Equity MFs = Rs. 180 lakhs

US Equity = Rs. 180 lakhs

Debt MFs = Rs. 240 lakhs

Of course you will have multiple MFs in each category, but just assume as one since you can choose to sell the same amount from each mutual fund when you need to sell. Ideally you would sell some investment every month and use it for monthly expenses, but to keep things simple, lets assume you sell the amount you need for the full year of expenses. So on Jan 1, 2023 you sell Rs. 12 lakhs. But from which investment? It should almost always be from debt mutual fund. After selling the investment, your new portfolio looks like this

India Equity MFs = Rs. 180 lakhs

US Equity = Rs. 180 lakhs

Debt MFs = Rs. 240 lakhs - Rs. 12 lakhs expenses = Rs. 228 lakhs

Expenses = Rs. 12L

The asset allocation has now changed to the following

India Equity MFs = Rs. 180 lakhs / Rs. 588 = 30.6%

US Equity = Rs. 180 lakhs / Rs. 588 = 30.6%

Debt MFs = Rs. 228 lakhs / Rs. 588 = 38.8%

Since the asset allocation is not too far from the expected allocation of 30%, 30% and 40%, we will not do any rebalancing at the time. For all of 2023, one would be using the Rs. 12 lakhs that was sold from debt MFs to cover monthly expenses of Rs. 1 lakh.

Year 2024

Now the year is 2024. Lets say the inflation (based on past data) is 13% for the year. Which means your expenses for year 2024 will be Rs. 12 lakhs x 1.13 = Rs. 13 lakhs. While your equity investments grew by -17.6%, you debt mutual funds grew by 8.5%. So your investments may look like this:

India Equity MFs = Rs. 180 lakhs x 0.824 = Rs. 148 lakhs

US Equity = Rs. 180 lakhs x 0.824 = Rs. 148 lakhs

Debt MFs = Rs. 228 lakhs x 1.085 = Rs. 247 lakhs

Next, sell Rs. 13 lakhs for the full year of expenses and your portfolio will be

India Equity MFs = Rs. 148 lakhs

US Equity = Rs. 148 lakhs

Debt MFs = Rs. 247 lakhs - Rs. 13 lakhs expenses = Rs. 234 lakhs

Expenses = Rs. 13L

The asset allocation has now changed to the following

India Equity MFs = Rs. 148 lakhs / Rs. 530 = 27.9%

US Equity = Rs. 148 lakhs / Rs. 530 = 27.9%

Debt MFs = Rs. 234 lakhs / Rs. 530 = 44.2%

Suppose you think the asset allocation has moved too far from expectation of 30%, 30% and 40%, so we go for a rebalance at this point. We want a 40% debt portfolio, so 40% of Rs. 530L = Rs. 212L. Now all you’ve got to do is sell Rs. 234 - Rs. 212L = Rs. 22L from debt mutual funds and invest in equity MFs equally. Suppose you have to pay a tax of Rs. 2L on the transaction, then this is what has happened

India Equity MFs = Rs. 148L + Rs. 10L = Rs. 158L (30%)

US Equity = Rs. 148L + Rs. 10L = Rs. 158L (30%)

Debt MFs = Rs. 234L - Rs. 22L = Rs. 212L (40%)

Taxes = Rs. 2L

Expenses = Rs. 13L

You can continue doing that for the next 45 years. Instead of doing things manually, I created a spreadsheet and dumped the numbers in the below figure. I assumed you need not pay any taxes or alternatively, you can manage taxes within the expenses. Another assumption is that you are rebalancing every year. So the numbers below may be slightly different from the ones calculated above. If you want to play around with the numbers, you can make a copy of the spreadsheet and go nuts.

You started your retirement at 40 years with a corpus of Rs. 6 crores (Rs. 600 lakhs). As years pass you will notice how your corpus is going up and down. By the time you are 85 years old, your corpus will grow to Rs. 41 crores. So you can still go on for several years. I hope this helps.