The Market Scare

There is a lot of talk about how markets are crumbling all over the world. I have no idea what they are talking about. We barely corrected 10% from the peak if you take Sensex into account. That is a normal drop one would expect from the markets in any given year. I don’t understand what the excitement is all about. A 10% drop is peanuts in my opinion. But more importantly why would one look at the drop from the recent peak? Isn’t investing in equity all about the long term view? What happened then? These very same people don’t seem to be too concerned when the markets were moving up by 20-30% in a short duration. All this confuses me quite a bit.

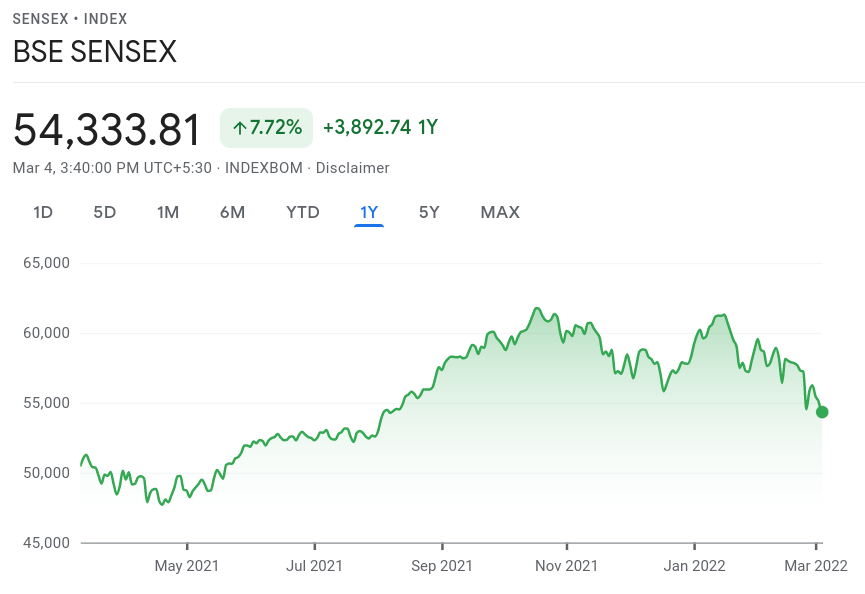

Is this 10% drop really of concern? It is not like you invested all you money on the day when market peaked and you are now looking at your portfolio today when the markets are down. Even if that is the case, it has only been 6 months since the peak. What if you had a longer time frame of looking at things? Let’s look at how Sensex performed in the last one year, just 6 more months than the peak.

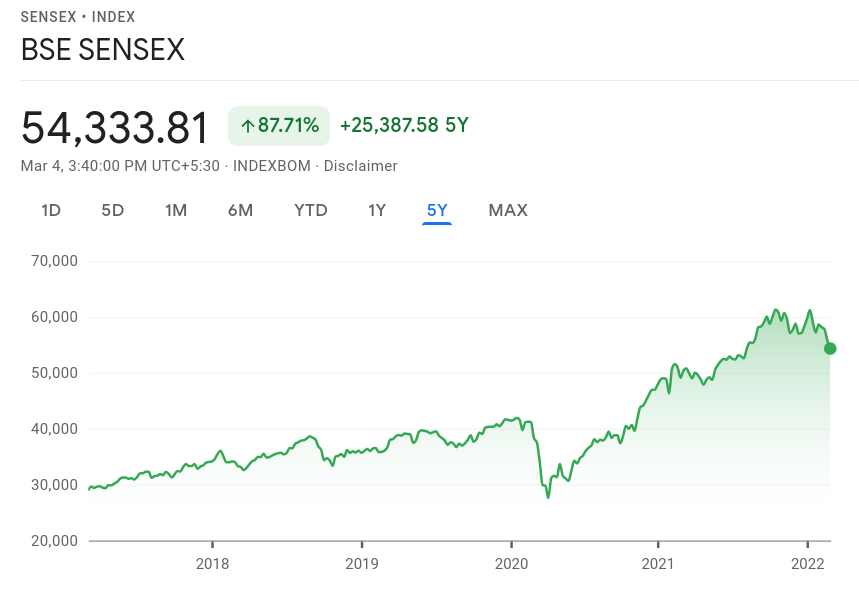

If you look at the one year return, you are looking at 7.72% return. Isn’t that a lot, given that interest rates are so low? What aer you complaining about? If you look at a 5 year return, that is a whopping 87% return on investment in 5 years! Isn’t that crazy? Unless you have invested in the past 6 months and looking at your portfolio, I am sure your investments are all showing positive returns. And if you have invested in the last 6 months, you probably lost a few thousand rupees because you just started investing. I am sure you are not investing crores of rupees per month in the last 6 months.

The news last week was full of talk about the war and stock market. The war part I cannot understand. Different people have different opinions about who is right, but the loss of life is real and a very painful aspect of war no matter who is right. The stock market is doing exactly what one would expect it to do when there is a war. In fact war or no war, everyone should be expecting at least a 10% dip every year. So nothing out of the ordinary happened so far as far as I am concerned. I am wondering why there hasn’t been a bigger drop? That is what worries me.

Now, leaving all that alone, we normally don’t invest in Sensex right? So lets take an example of a real mutual fund and how it might have performed and if the worry about market fall is anything of concern for us. I took one of the worst performing equity mutual fund (based on 5 year return) with more than 7 years of history and if you had invested in it one year ago, then you will be looking at a 8% positive return on investment.

But who in the right mind would invest in a equity mutual fund for less than a year and check the returns? Anything beyond 3 years, you will be sitting on even more positive returns. And we are talking about one of the worst performing fund here. But normally you wouldn’t be investing lump-sum. So investing via SIP over 3 years will most certainly have given you positive returns. Anyway the point is that don’t worry about the market conditions as of now. It is still too high for what its worth.

Having said that, this is a great opportunity to rebalance your portfolio! That is the only actionable thing you can do. Anyway, by the time you read this post, the markets might have gone up and you’d be left wondering what I was talking about :).