Year In Review - 2018 Expenses

Continuing the "year in review" series, this time lets go over my expenses last year. Did they go according to plan? Did I over estimate or under estimate? I wrote a couple of posts explaining my monthly and yearly expenses. You can check those out for more details. But for this post, I will just go over them briefly and how they panned out over the course of last year.

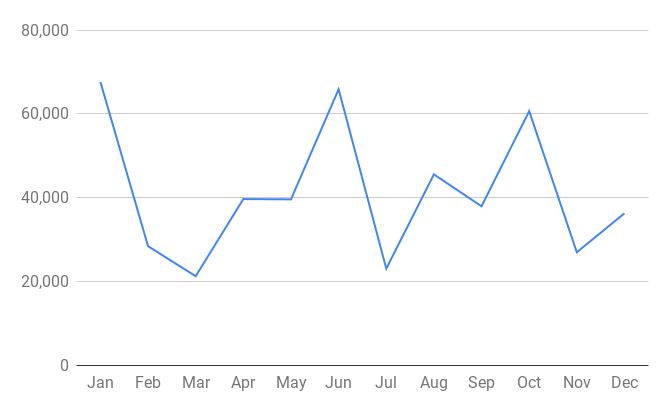

To start with, I have two types of expenses -- the monthly expenses and the annual expenses. Any expense that occurs every month or more frequently than a year are clubbed into the monthly expenses. These would be food, mobile, internet, electricity, water bills, society maintenance, petrol, car servicing etc. I budgeted the monthly expenses at Rs. 50,000 per month. As you can see below, the numbers are all over the place, with a high of Rs. 68,000 and a low of Rs. 22,000. However, I averaged about Rs. 41,100 per month which is under my budget. So that gets a thumbs up!

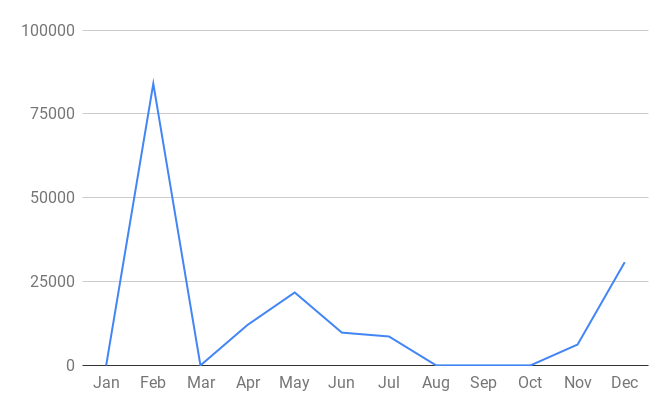

My other type of expense is annual expense, which are big expenses that happen annually or less frequently. These include things like buying or repairing stuff like vehicles, electronics (TV, mobile, laptop etc), gym equipment, home improvements (washing machine, couch, bed etc), my projects etc. I budgeted for Rs. 3,60,000 per year on these kinds of expenses. I ended the year with a total of Rs. 1,75,000 spent which averages to about Rs. 15,000 per month. Again a thumbs up!

As you probably know, I purchased my home gym equipment in February 2018, so that was a big expense. The months from April to November saw expenses for

- home improvements (washing machine broke, water purifier needed filters and motor replacements, automatic door closer was leaking hydraulic fluid and needed replacement)

- cell phone

- gym accessories

- property tax

- other miscellaneous things

One of the many perks of not having to go to work is that I have more time to do DIY projects at home. So when the automatic door closer started leaking hydraulic fluid I took the opportunity to replace it myself. Finally bought myself a drill machine (expense) and the automatic door closer (expense). Following the directions and replacing was not too hard. Just need to get the measurements right and drill the holes in the right place ;). What took more time was the adjustments to the hydraulic fluid to make the door close fast but not too fast that is bangs on the door frame. And there are 2 adjustments (swing speed and latch speed) and adjusting one requires a change in the other. So it took some time to figure out the 2 speeds. Anyway, I digress. Back to my expenses story.

The month of December saw another big spike in expenses because I purchased a bunch of stuff to start working on my electronics project. We also decided to make the indoors a bit more green, so lots of indoor plants raised the bill.

That is the story of expenses in 2018. All in all, it went well. We were under budget on both expenses, but as I explained in my previous post, the portfolio performed poorly, so not a lot to celebrate. This year (2019) will be the first year when all my expenses will be funded solely by my portfolio. So it will be interesting. Lets see how it goes. To take inflation into account, I have increased my monthly expenses budget to Rs. 53,000 (assuming a 6% inflation) for this year. I didn't increase my annual budget though. I want to increase it only once every 5 or 10 years (haven't decided yet). The take away for 2018 is that I can live on a Rs. 56,000 monthly expense (Rs. 41,000 monthly + Rs. 15,000 annual expense per month).