The Peer-to-Peer Lending Experiment

It is 3 years to this day, when I first decided to get my feet wet with a new type of investment -- peer-to-peer lending. While peer-to-peer lending is nothing new in countries such as the US at that time, it was relatively new in India. After reading about the lending platform called LenDenClub, I decided to give it a try to see if I could get some good returns.

How it Started

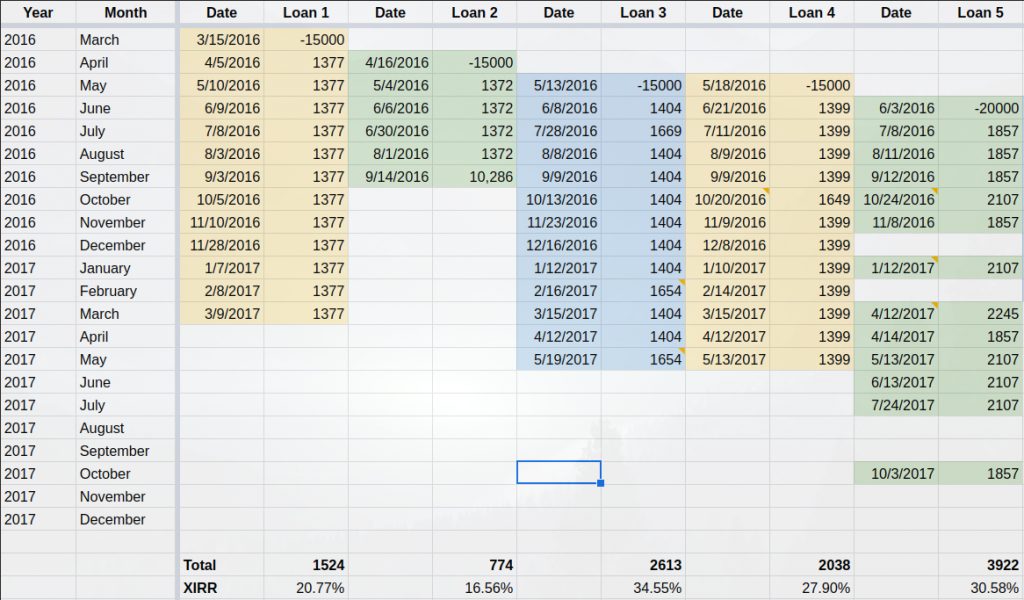

Peer-to-peer lending is a high risk and high return asset class which is certainly not for everyone. Don't go down this path unless you understand the risk. So, as I was saying, I started investing in P2P lending in 2016 with a small sum of money. It was a time when I had a lot of free time at work. I was working on a project that needed very little effort on my part. I thought it would be a good use of my time to run an experiment. Anyway, enough talking, lets get into the details. The idea is that at the start of every month, I would try to find an eligible borrower on LenDenClub and lend the person some money. Initially I started with Rs. 15,000 per month and slowly increased it to Rs. 50,000 as the experiment progressed and I was feeling confident. I tracked my investments and returns in a spreadsheet. Here is a snapshot of it.

The Results

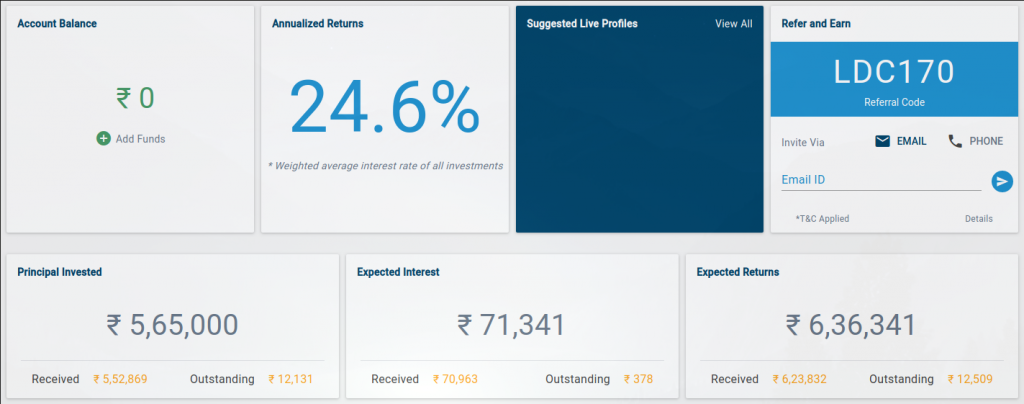

At the time, the platform was not mature enough, and the EMI deposits from the borrowers would go straight to my bank. So I had to check the deposits and track them on the spreadsheet. Later, as the platform matured, all the details started to be available online. As you can see, the returns on these investments were pretty good. I got anywhere from 12% all the way up to 50% on some loans! I stopped the experiment after running it for a year and half. Overall, I made a cool 25% return (annualized) on my investments and I am pretty happy with the way the experiment turned out.

LenDenClub shows that my returns are 24.6%. I wanted to make sure it was correct and ran the numbers myself and I got 25.7%; even better :).

The Exit

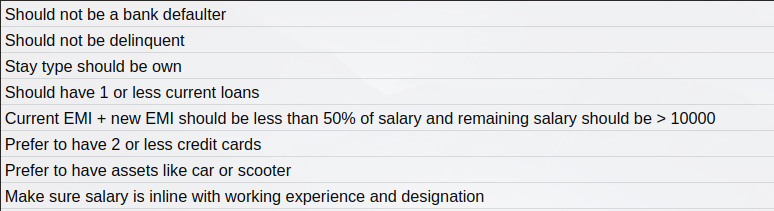

While the returns were great, I still decided to end the experiment due to few reasons. First, you have to understand that finding the right people to offer a loan is no easy task. You have to review the borrower's profile, understand the risk of default, their capability to repay, and most importantly willingness to repay. It takes a lot of time and guess work. For this reason, I came up with the following checklist after reviewing several profiles.

I made this checklist some two years ago, so I am not really sure if it still applies today, and for that reason I would not advice anyone to use the checklist as is. Even with the checklist, I did not enjoy the time I spent on figuring out the profiles. That be the first reason. Moreover, in spite of putting so much effort, you can still end up with defaulters. I had three borrowers whose repayments were rather erratic and they missed several repayment due dates. In the end, two of them eventually repaid the loan in full and there was one defaulter. This was out of 22 borrowers. That is a 5% default rate. Not bad. But a good 41% of the borrowers would make late payments one time or the other. So the constant back and forth with LenDenClub about the delays in EMI etc was another waste of my time. That be the second reason.

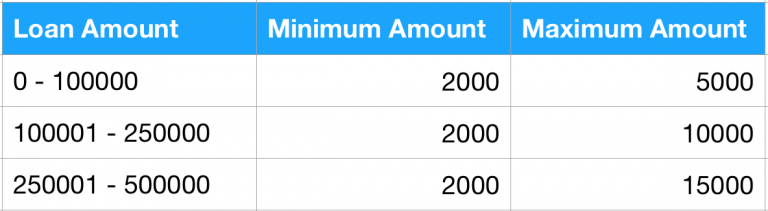

As the platform matured and there were more and more lenders, it became much harder for me to find a good borrower. At times, I felt that there are too many lenders and too few borrowers. It means that I need to jump on to the platform as soon as a new borrower comes for a loan, assess the risk and decide whether to lend or not before other lenders checkout the profiles and start lending. I hate making on the spot decisions and I hate things that demand my attention randomly (that is why I have most notifications turned off on phone, Facebook etc). I don't like someone controlling my attention. I will attend to it on my own free will at a time that I like. But that does not work with too many lenders chasing too few borrowers. There be the third reason for you. Another issue with the platform was that they changed the rules on the platform to not allow a single lender to pay more than a small sum (to reduce the risk of default for the lender). Previously there was no such rule, so if I wanted to, I could lend Rs. 50,000 at a time to one borrower. But with the new rule (see below image), I had to find several borrowers to invest Rs. 50,000 every month. And you know how I hate reviewing profiles to find more borrowers (see my first reason for the exit if you forgot). That is my fourth reason. Also, as I was nearing my retirement, I didn't want to continue taking such risks or invest my time on it, which is my last reason.

That was my peer-to-peer lending experiment running its course. My last investment was on May 8, 2017 and the final repayment of that loan came on May 11, 2018, just months before my retirement.

I finally finished running all my experiments (see my previous experiments on Gilt and Index funds) before I retired :)

Summary

While I did not enjoy the journey, I did enjoy the destination. A whopping 25% return on investment is excellent for the amount of effort I had to put in. The problem was that it was not my style. I may run the experiment again in future. Not sure. Right now, I have way too many things up my sleeves that take up most of my time. As a side note, I invested my wife's money, using her account who has very little income by the way of rent. The investment gains added to her income was still under the minimum tax slab and so there was no tax issue. Otherwise the tax might have been another reason for me to end the experiment ;)