Record Your Expenses

In my previous posts, you have seen my monthly and annual budgets. Now it is time I explained how I actually track and record my expenses, so I know how I am performing compared to the budgeted numbers.

Most of our expenses are paid through debit cards. But in some cases, the vendor does not accept a card, in which case we use cash. We use two debit cards to make payments. Both cards are setup to send an email to me when any amount is debited from the bank. We make online payments or money transfers via NetBanking or Google Pay. We use only one wallet, which is in BigBasket. When we don't want to go out to buy stuff or if something we want is not available in the local shops, we use BigBasket. To make it easy, so anyone can buy groceries online (including my mom), without having to worry about paying via NetBanking or using debit card, I opened a wallet in BigBasket.

Given this information, tracking is a simple affair. As usual, I just use a spreadsheet to track all my expenses. First, any time I get an email from my bank about an expense made on debit card, I add the expense to the spreadsheet within the day so I remember what the expense is for. This covers all the online and offline transactions made via debit cards. For cash purchases, we don't usually track them unless they are paid for non-food related things. For example, my daughter's skating fees is paid in cash, so that has to be tracked separately. Otherwise all cash expense is considered as food expense. At the start of every month I take stock of how much cash we have and then at the end of the month, deduct the cash left. The difference is what is considered as food and cash expenses. The same is the case with BigBasket wallet. The difference between the end of month and start of the month is considered as the food and cash expenses. Next, all annual expenses are tracked separately from the monthly ones. Enough talking, now for some numbers then.

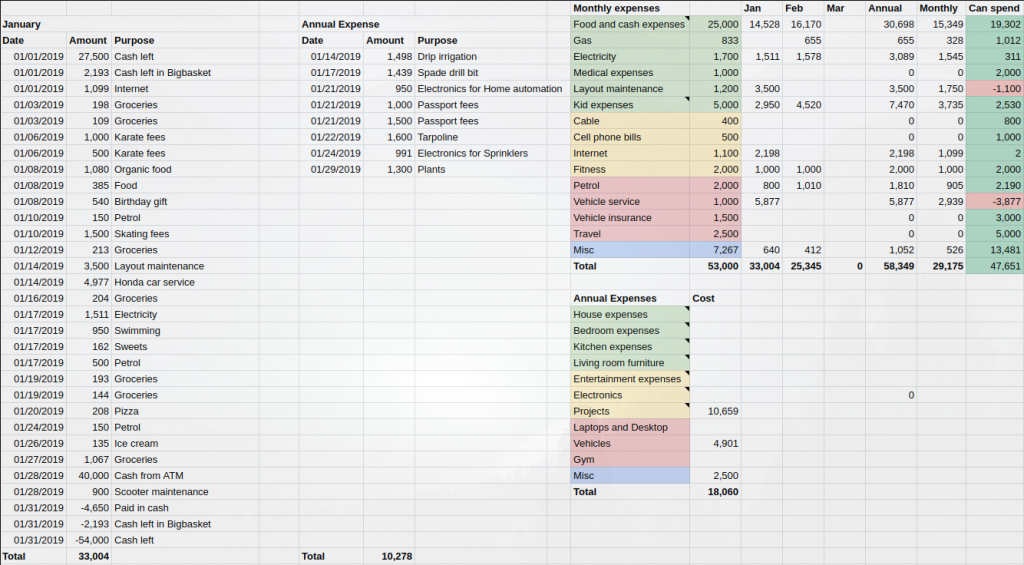

The above image is a snapshot of my monthly and annual expenses for January 2019. On the left are the list of expenses (monthly and yearly in separate columns) as they happened by date. On the right (with colored background) are the accumulated expenses for each expense type. That is how I go about tracking my expenses. In some months, there may be no expenses under some expense types, for example vehicle insurance. So the monthly expenses will be less in some months and a lot more in others. While my monthly budget is Rs. 53,000, I spent about Rs. 30,000 in January and about Rs. 25,000 so far in February.

If you want to understand where you are spending, you too should consider tracking expenses, perhaps not in such detail, but at least at a high level. I did not have time to keep track of my expenses so accurately before I retired, but now I do :)