My Early Investment Journey

While I am sitting comfortably today, writing about my journey to early retirement, the initial days of my investment years were not without their share of issues. Let me explain in a bit more detail. When I first started out, I had planned to do a SIP of a certain amount every month and planned on increasing it every year. The increase in SIP I planned at that time was to match up with the inflation rate. The thought process was that if I was just average at work then my salary increments will match up with the inflation for the previous year. At the time of planning my early retirement in 2011, the inflation stood at around 8%, and consequently my projections were to increase SIP by 8% every year.

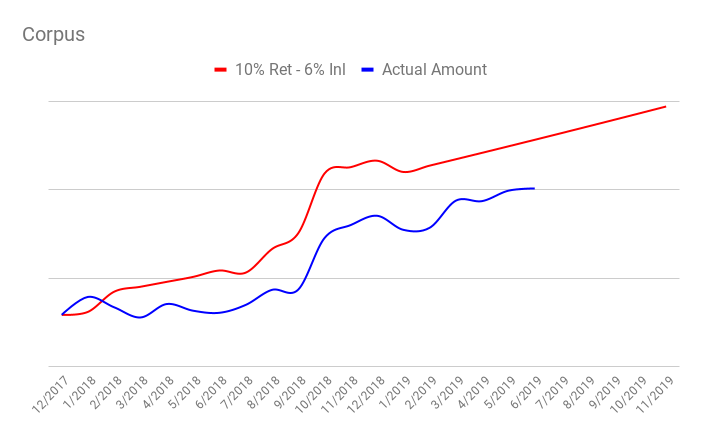

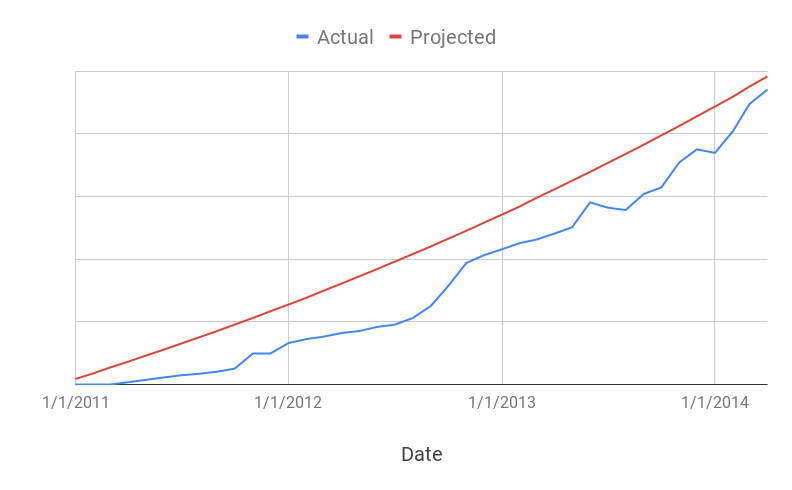

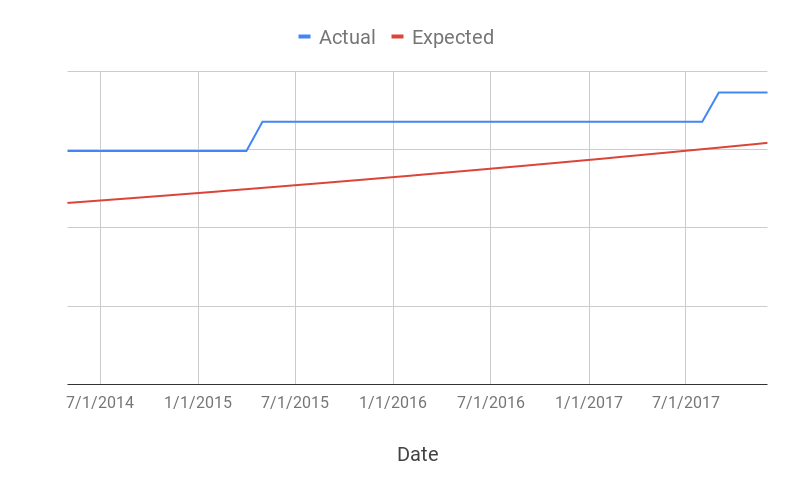

I had a corpus in mind if I had to retire at a certain date. I also assumed that I will invest conservatively in equity and assumed a return of 10% for my investment. Based on this information I was able to calculate the SIP number for all the investment years. The initial investment per month came out to be a higher number than I could save at the time. So my corpus growth was slower than my projections.

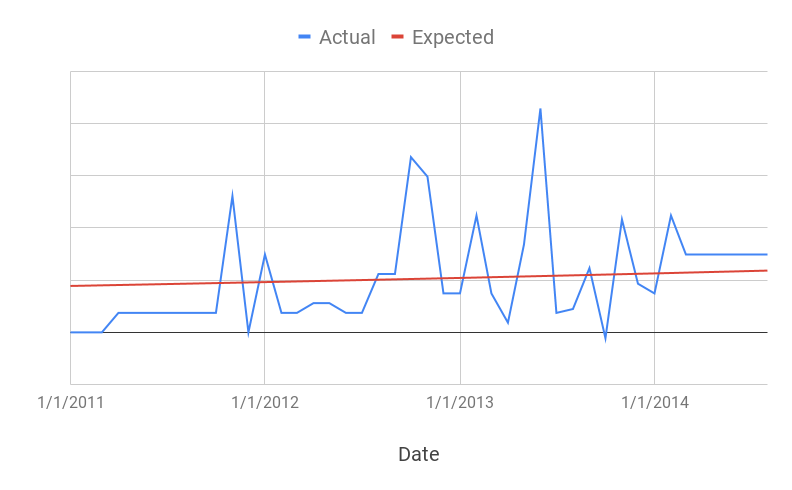

As you can see, there is a huge gap between the projected corpus and my actual corpus. It was not because of the market performance, but primarily because of my inability to save enough. Below, you will also notice that I did not do a proper smooth investment and most of the time the monthly investment was below expectations. Sometimes if I had less savings, the investment would be less. At other times if I got a bonus or monetary gift the investment would be more.

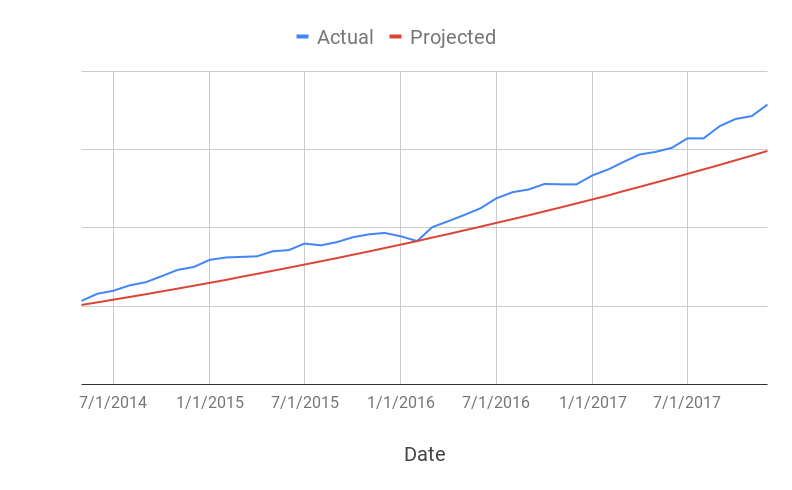

But the important thing to note is that having a goal and projection helps you track where you in the journey and it gives you a chance to course correct. That is precisely what I did. I found ways to cut down expenses and increase income. Luckily, by coincidence, the stock market also started to improve beyond 2014 and that helped me close the gap and achieve the goal. So if you have recently started investing and worried that your corpus is not growing according to your plan, don't lose heart. My advice is, have a plan and a projection. Give investments some time, don't panic and in the mean time, find ways to close the gap. For the curious, this is how my corpus and monthly investment looked like in the later part of my investment journey.

As you can see, my investment process was more mature. I guess experience and time makes you wiser. Interestingly, my post retirement corpus as compared to the projections is looking similar to the early days of my pre-retirement, i.e. well below my projections. But nothing to fear, since my advice applies to myself too :)