Is It Better To Buy Or Rent A House?

There are already tons of articles about which is better -- buy or rent. In this post I will give my perspective on this subject. The topic is about buying a house to live in as compared to renting a house. If you are looking to compare investing in real estate vs equity investment, you might want to read my other article. The problem with making this kind of comparison is that it depends on a lot of factors. Lets take an example to help understand.

Buying a house

Say you want to buy a house instead of renting. Lets assume that you want to buy a house that is similar in size to the one you are currently renting. Then

Price of the house (approximately) = Annual rent / Rental yield

So if you are paying Rs. 25K per month, the annual rent is Rs. 25K * 12 = Rs. 3L. Assuming a rental yield of 4%, the cost of the house you want to buy will be in the ball park figure of Rs. 3L / 0.04 = Rs. 75L. Of course you will need to plugin your own numbers for the rent and yield.

Loan

Next you will have to decide on how much down-payment you are willing to make. Assume a 20% down payment which is the minimum banks usually expect before giving out a loan. In that case your down payment will be Rs. 15L and the loan will be Rs. 60L. In addition, lets assume a loan interest rate of 8% for a duration of 20 years. Your EMI will come out to be around Rs. 51K per month. When paying home loan, you can claim tax deductions on both principle and interest. Lets assume you don't save anything on principle repayment because it falls under section 80c which has a lot of other deductions. You can claim up to Rs. 2L on interest repayments. If you are under the 30% tax bracket, you will save up to Rs. 60K per year.

Rent

On the other hand, lets say you don't want to buy a house and instead continue paying a rent. The money that you save by not paying the EMIs can be used to invest after paying your rent. Similarly you could invest the down-payment that you would otherwise use to buy the house. Lets assume an investment return of 10%. Remember that your rent might increase every year. However the EMI stays constant. Lets assume the rent increases by 7% every year. Now after a few years, do you think renting is better or owning a house is better? Lets find out.

But there's more

You might wrongly assume that this is the end of calculation. But there is more. For example, after the duration of loan, the house eventually becomes yours and you will never have to pay anything anymore. However, if you decide to rent then you will be losing money on rent forever. So in addition you also have to figure out how long you will live. Lets assume you will live another 30 years from now. In this example, after paying EMI for 20 years, you live rent free for the next 10 years if you decide to buy a house today. On the other hand you will be paying increasing amount of rent for 30 years if you choose not to buy a house.

Use a calculator

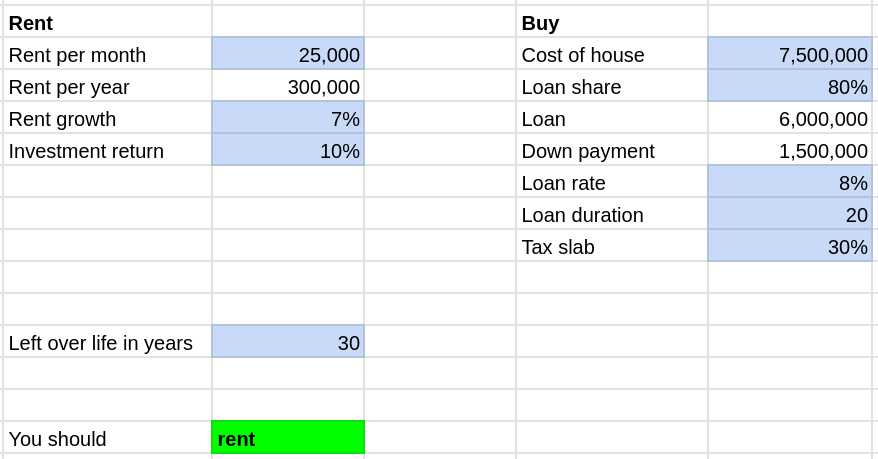

I have put all the assumptions in a spreadsheet that you can make a copy and modify as needed. Modify all the cells marked in blue as per your requirements. And the green cell will tell you whether you should buy or rent.

In this example, you will note that the calculator is suggesting that it is preferable to rent than buy a house. But if you make just one slight adjustment and change the rent growth from 7% to 8%, then it will suggest that you should buy. So even small changes in your assumptions can make a huge difference in the outcome.

My thoughts

As you can see from the example above, it is extremely difficult to make the right assumptions to get the correct advice. This is one of those occasions where it is better to be approximately right than precisely wrong. Don't go into as much analysis. My advice is quite simple. Don't buy a house and instead go for rent if

- you are don't intend to settle where you currently live after retirement

- your job requires you to frequently change locations (transfers)

- you like to travel and experience different places

- you don't like to buy and sell houses once in a while

For everyone else, I suggest that you buy a house. You may have to move to a different location after you retire, but you will just have to buy another house and sell the current one. You will reduce your expenses in retirement and will always have a roof on your head. No one can ask you to vacate. Did I miss something? Do you want to add more to what I said? Please leave your comment.