How to Choose a Mutual Fund

We've all heard it -- don't choose a mutual fund just based on past performance or star rating. Then, how does one go about choosing a good fund? That is the question I want to answer today. While I am not expert at picking a good mutual fund, I did have my share of bad pickings and hence have had some wisdom knocked into me. So here are some tips on how to choose a good mutual fund based on my experience.

Disclaimer: Information provided in this blog is to help educate you. I am not suggesting that is the right way to do it. Any names mentioned within the post are used only as examples, and should not be considered as recommendations or advice. Use the information to improve your knowledge, and make decisions based purely on your understanding.

Get the Basics Right

First, find a source with good information about mutual funds. I find Value Research and Morningstar to be good sources, but I am sure there are many other websites which give a lot of information about mutual funds that you want to research.

Next, your will need to figure out how long you are going to invest. If you are nearing retirement, and will not have any source of income to do a SIP (Systematic Investment Plan) post retirement then you have to be conservative with your investments. My advice is that you should be investing regularly and consistently for at least 7 years to even out any ups and downs in market cycles.

Then, figure out what kind of investor you are. Are you risk averse or aggressive? Would you want an average returns of say 10% with your portfolio never dropping below 75% of the peak, or would you rather have 14% return with a roller coaster ride where your portfolio might lose up to 50% of its value within a few days?

Based on the above two factors, figure out what your equity to debt split should be. For aggressive portfolios you can go up to 90% equity and 10% debt funds and for conservative portfolio you can go for 50:50 split. I suggest a mildly aggressive 70% equity and 30% debt split for early retirees.

Use the Signals

Now that you have determined your equity and debt split, and your risk profile, you need to find some good funds. For debt funds, I would suggest that you choose ultra short term funds. If you are too conservative go for liquid funds and if you are aggressive go for short-term funds. For equities, my suggestion is that you choose multi cap funds. If you are conservative, add some large cap funds and alternatively, if you are aggressive, add some mid-cap or small cap funds. Choose 2-3 funds for each category (ultra short term and multi-cap for example) from different fund houses and start your SIP. How do you select those funds? Follow along.

Fund Rating (aka sin #1)

There are way too many mutual funds to choose from, so we have to start somewhere. You cannot browse through, read and research through hundreds of funds. For that reason, I suggest that you use fund rating (most people advice against it, but that is how I roll) to get a first cut of the funds. You can easily search for 3 star and above rated funds based on last 5 year performance of multi-cap funds using Value Research. Similarly Morningstar has gold, silver and bronze rated funds (although the number of funds reviewed are very few). Don't just select 5-star funds. The rating might have dropped to 3-star because the fund performed poorly compared to peers in the recent past, or may be the fund is more volatile compared to peers, but in the long run it probably performed well overall. So keep a wider net.

Past Performance (aka sin #2)

From there, I suggest you do the other thing that most people advice against, which is to look at past performance. Be careful with this metric though, there are a few nuances. Sort the funds by 10 year return and select a few top funds. Be careful since some mid-cap and small-cap funds might have been recategorized into multi-cap funds (Value Research marks these with Erstwhile something). Since mid-cap and small-cap returns are usually better than multi-cap funds, they might have topped the list. But returns after recategorized may not be as good. When in doubt, eliminate all recategorized funds (but you might miss out on some good funds).

With the above procedure, you might miss out on funds that have improved their performance in the recent years. If you want to include those as well, then sort again by 5 year return, and merge the top funds from this list with the 10 year return topper list. Another nuance here is that with the 10 year topper list you may not see any direct funds. Most or all of them are regular, because fund houses started offering direct funds only since 2013. So in the 5 year list there may be more direct funds than regular ones, since direct funds perform better than their regular counterparts. Keep that in mind when comparing the 2 lists. Hey, I warned you that there are some nuances :).

As you compare the 2 lists you will notice some names keep appearing in both lists. These would be good candidates. For example at the time of writing this blog these were some such funds

- SBI Magnum Multicap Fund

- Aditya Birla Sun Life Equity Fund

- ICICI Prudential Multicap Fund

Expense Ratio

Finally, use the expense ratio as a way to further filter out funds if the list is too long. Generally, good funds have higher expense ratios too, given that they can charge more if they are performing better. So don't get too attached to expense ratio. If an equity fund in direct plan charges more than 1.5% then you may choose to filter those funds. In the case of ultra-short term debt funds, the effect of expense ratio can be higher. So prefer lower expense ratio funds where possible.

At this point you can stop your search. But if you want to be more careful with your selection, and can invest some time and effort, continue further.

Fund Manager

While a fund is not managed by just the fund manager (there is usually a research team that does the work), it is good to know a bit about the fund manager. What is their style, for example, do they take contrarian bets? Do they prefer to be fully invested in equities all the time or adjust asset allocation based on market conditions? Have they been long enough with the fund to have impressed their style and thus have a resulting good return?

Investment Objective and Style

Read the investment objective and investment style of the fund and make sure you understand the risks. For example Mirae Asset India Equity Fund has this objective

The investment objective of the scheme is to generate long term capital appreciation by capitalizing on potential investment opportunities through predominantly investing in equities, equity related securities. There is no assurance or guarantee of returns.

Which clearly points to the fact that the fund will try to time the market with thematic and sectoral stocks. That means the fund will be more volatile with a higher upside if the fund manager gets the calls right and may be a big downside if the call is wrong. This goes back to the question about what kind of investor you are. If you are a conservative type of investor then this fund may not be for you.

Standard Deviation and Sharpe Ratio

This is a good tie breaker metric, but don't get too attached to it. The numbers can vary over the years. Take a look at Standard Deviation and Sharpe ratios of funds that you want to compare. For example, in Value Research you can find the numbers (based on 3 years) in Performance tab. A higher standard deviation means a more volatile fund. A higher Sharpe ratio means the fund has given better returns for a given volatility.

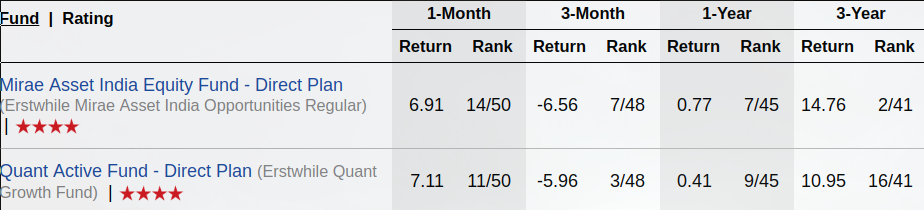

When comparing funds, if you find a fund with high standard deviation, it means the fund is more volatile. So naturally, you would expect a higher return for the additional risk of volatility. Which means the Sharpe ratio should be higher compared to the other fund. For example, take the case of Quant Active Fund and Mirae Asset India Equity Fund. At the time writing this post, they have similar standard deviation of 14.87 but the Sharpe of Mirae Asset India Equity is much better at 0.51 compared to 0.39 of the other fund. So naturally Mirae Asset India Equity gave better returns (14.76%) in the last 3 years compared to Quant Active Fund (10.95%).

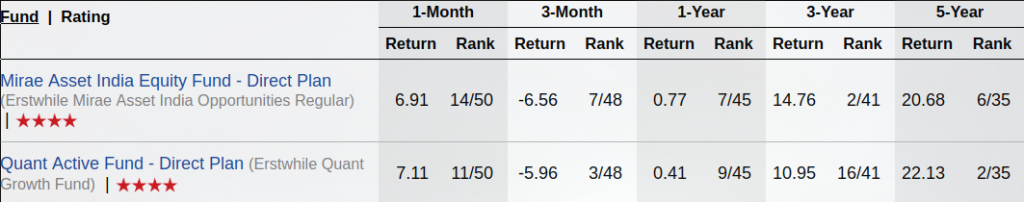

But wait, there is more! Don't just depend on these numbers, because as I said earlier, these numbers (Standard deviation and Sharpe) are based on the last 3 year returns. If we look at the 5 year returns then the tables would have turned and Quant Active Fund returns (22.13%) look better than Mirae Asset Fund returns (20.68%).

Nothing is ever straight forward when it comes to investing :).

Summary

If you followed along, you probably found 2-3 funds in multi-cap and 2-3 funds in Ultra-short term from different fund houses. You can start SIP using the 70:30 allocation style in those 4-6 funds and reap the benefits. Remember that a fund cannot be #1 for ever, they keep moving in the ranks. So review your mutual funds every 6 months and make sure they still check off all the check boxed based on the above signals. If you are a more aggressive investor, add a couple of mid-cap and small-cap funds to your list. I will discuss more on how to select mid-cap and small-cap funds, and in what allocation, in my next post.

There you have it. Fund selection my way. Now there are many other factors that can go into a fund selection and you should find your style. This worked for me so far. While I did not invest in the best funds, nor did I have fabulous returns, I am pretty happy with my portfolio.