Year In Review - 2025 Monthly Expenses

The monthly expenses for the year 2025 were inline with the budget. Nothing much to write, but here are some details for those who are interested. It has been 8 years since I started tracking monthly expenses and that is a long enough time to make sense of any inflation we have been facing. Let’s get right to it.

Monthly expenses in 2025

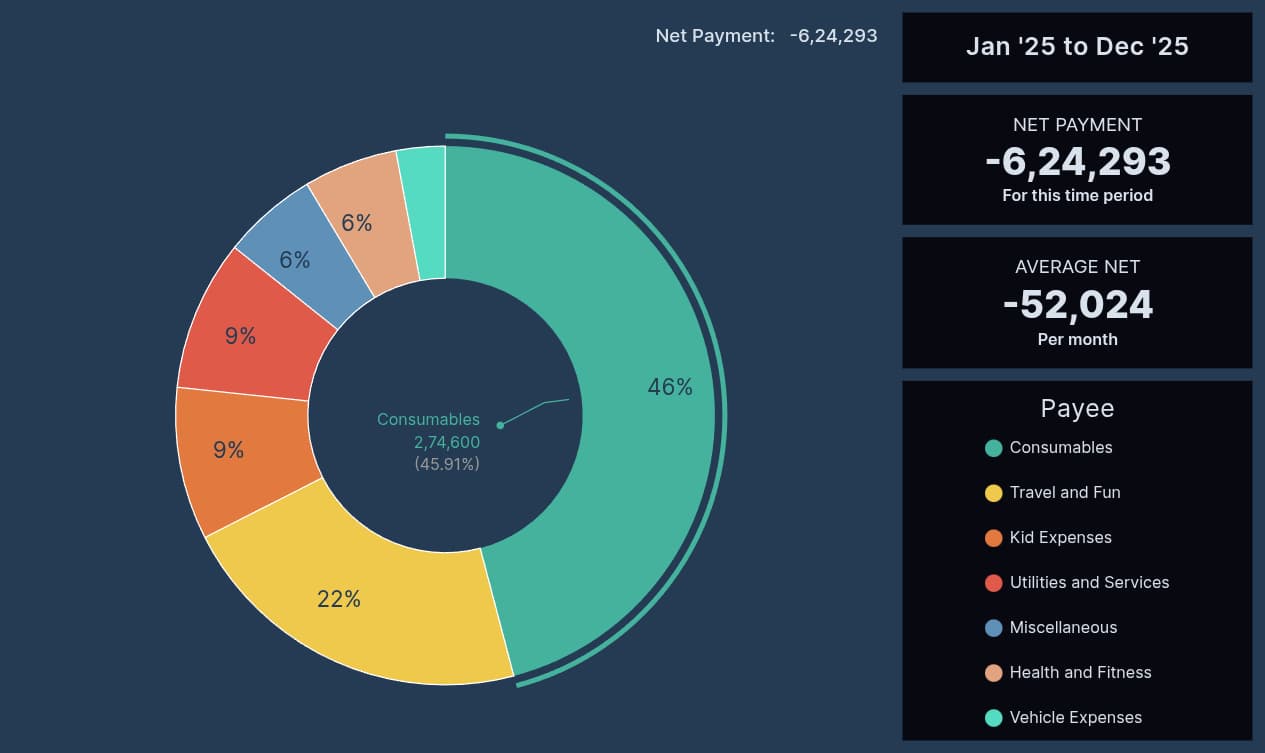

The budget for 2025 was Rs. 75,000 per month. Our average monthly expenses were Rs. 52,336 which like every year, since our retirement, is below the budget. First let’s take a look at where we were spending (see picture below).

We spent the most on food and consumables at 46% (compared to 41% from last year) of our total expenses. These expenses not only include what we eat but also what we use on a more regular basis like soaps, paste and other household needs.

Second most expensive category continues to be travel like every year. We spent 22% (compared to 27% last year) on it. Other than those two big expense categories, the rest of them are under 10%. Just like last year utilities and services and kid expenses are around 9%. In fact almost all the expenses match pretty closely with previous year.

Expenses vs Budget

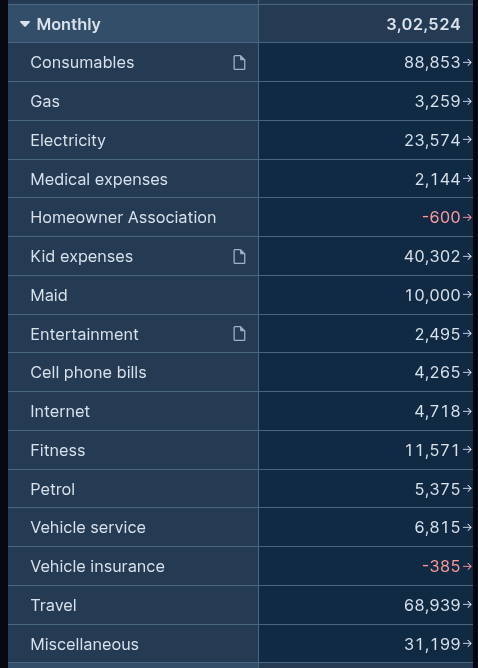

Next, we take a deeper look at the budget left over at the end of the year in each of the categories, and check whether we were able to stay within our budget.

You will notice that two expenses have exceeded their allocated budget. They are “vehicle insurance” and “homeowner association” related expenses. Increase in both those expenses were not in our control and are just inflationary. More details can be found in the screenshot below. The middle column is the total for the whole year for each category and the last column is the monthly average.

Inflation

I have been tracking my average monthly expenses since we retired. So we have some information to check how our expenses are inflating in the long run. Take a look at the table below

Compared to previous year, our expenses have gone up by 5%. The overall inflation from start of 2018 to end of 2025 is about 3.24%. I have expected my post retirement inflation to be between 4% and 8% and as of now it is closer to the lower side.

Budget for 2026

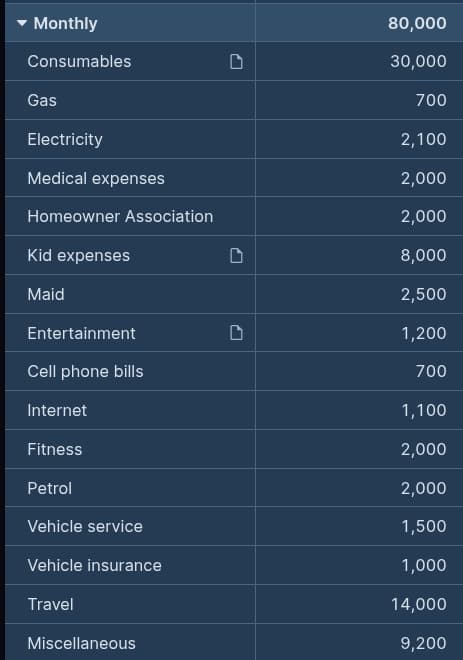

Like every year, I increased my budget by approximately 6% for 2026 as well. Since the budget was Rs. 75K last year, I increased the budget to Rs. 80K – an increase of Rs. 5,000. The reason for using 6% for inflation is because that is what I projected my inflation to be after retirement. But as you know from the table above, some years the inflation is lower and some other years it is higher. On average, hopefully, the inflation will hover around 6% in the long run.

Last year, the expenses went over budget in homeowner association and vehicle insurance. So I decided to allocate more for those two categories. I increased homeowner association expenses by Rs. 800 per month and vehicle insurance expenses by Rs. 500. I allocated the remaining to miscellaneous expenses. The miscellaneous expenses are generally some sort of discretionary spending.

Here is the final budget allocation for 2026.

That is all.