Year In Review - 2024 Monthly Expenses

Another year and another review of our monthly expenses. Time to check where we have spent the most in 2024 and see if we are with in the budget. I will also be going over our inflation numbers starting from my financial independence till date, which is a good 7 years. At the end of the post I will prepare a new budget of monthly expenses for the year 2025. Let’s get started.

Monthly expenses for 2024

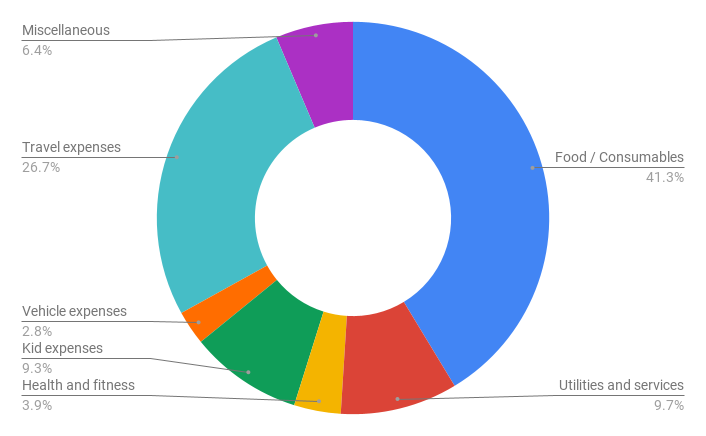

The budget for 2024 was Rs. 71,000 per month. Our average, monthly expenses were Rs. 50,124 which like every year, since our retirement, is below the budget. First let’s take a look at where we were spending (see picture below).

We spent the most on food and consumables at 41% of our total expenses. These expenses not only include what we eat but also what we use on a more regular basis like soaps, paste and other household needs. Makes senses that we are spending a good percentage on this category right? That should always be the first priority.

Unfortunately though, I cannot say the same about our second most expensive category which is travel. We spent a whopping 27% on it, compared to a subdued 13% last year. This expense is something that I am unable to keep in control and I have a feeling that it will only continue to grow in the future. Other than those two big expense categories, the rest of them are under 10%. A couple of honorable mentions are utilities and services expenses at 9.7% and kid expenses at 9.3%.

Expenses vs Budget for 2024

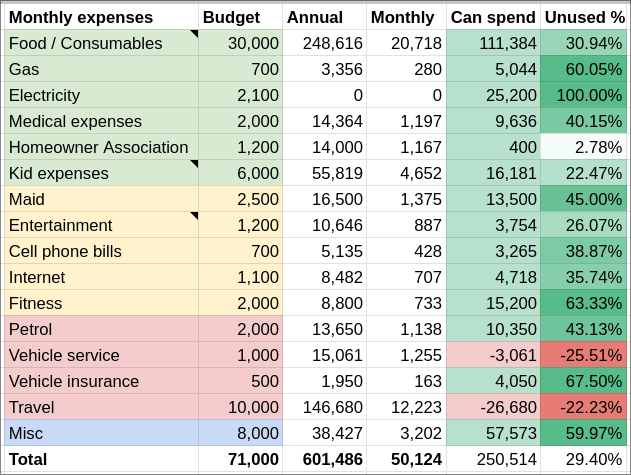

Next, we take a deeper look at the expenses, and check whether we were able to stay within our budget in each of the individual categories.

You will notice that two expenses have exceeded their allocated budget. They are “vehicle service” related expenses and “travel”. Our vehicle service expense was unusually high because a rat went into our car and died. So we had to get that removed. Then I got the service center to install some rat mesh to help prevent it. Moreover, this was our first paid service which was also expensive because they had to do air duct cleaning etc to get rid of the rat smell.

Rest of the expenses were all below budget. One unique thing about this year’s electricity expense is that we paid zero rupees for our electricity bills. This is in thanks to free electricity for anyone who uses less than 200 units of power in Karnataka. My solar panels helped get us to this state and you can read all about it over in an earlier post

Inflation for 2024

I have been tracking my average monthly expenses for the last seven years since we retired. So we have some information to check how our expenses are inflating in the long term. Take a look at the inflation table below

| Year | Expenses | Inflation |

|---|---|---|

| 2018 | 41,100 | - |

| 2019 | 42,871 | 4.31% |

| 2020 | 41,633 | -2.89% |

| 2021 | 47,455 | 13.98% |

| 2022 | 51,937 | 9.45% |

| 2023 | 42,310 | -18.53% |

| 2024 | 50,124 | 18.47% |

| Inflation since 2018 | 3.36% |

Compared to previous year, our inflation is quite high at 18% but that was only because the previous year’s (2023) expenses have been so low. The year 2023 was an exception.

Our expenses have slowly been creeping up from Rs. 40K per month expenses on average to Rs. 50K. This is quite normal because the cost of things we buy slowly keeps going up due to inflation. The overall inflation from start of 2018 to end of 2024 has been about 3.36% which in my opinion is alright. Not the best but certainly not too bad.

I have expected my post retirement inflation to be between 4% and 8% and as of now it is closer to the lower bound. Of course you cannot read too much into it because 7 years is still a short duration to generalize a long term inflation.

Budget for 2025

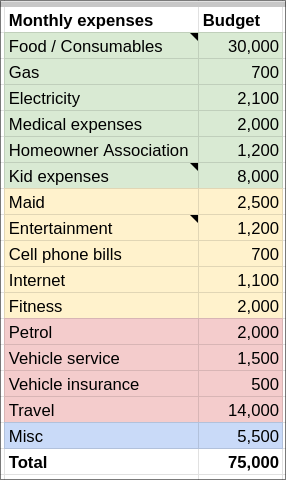

Like every year, I increased my budget by approximately 6% for 2025 as well. Since the budget was Rs. 71K last year, I increased the budget to Rs. 75K an increase of Rs. 4,000. The reason for using 6% for inflation is because that is what I projected my inflation to be after retirement. But as you know from the table above, some years the inflation is lower and some other years it is higher. On average, hopefully, the inflation will hover around 6% in the long run.

Last year, the expenses went over the budget in travel and vehicle expenses. So I decided to allocate more for those two categories. I have allocated the whole of Rs. 4,000 extra that I can spend in 2025 to travel expenses. I took away Rs. 500 from miscellaneous expenses and allocated that amount to vehicle service.

Then I took away Rs. 2,000 again from miscellaneous expenses and allocated to “kid expenses”. The reason is that our kid has started to go to an alternate school for a couple of days a week and the school fees expenses will rip through the kid’s allocated budget.

What this means for us is that we need to spend less on miscellaneous expenses in 2025. The miscellaneous expenses is generally some sort of discretionary spending, so it should not be a major problem. Famous last words I suppose. We will see about that. Anyway, here is the final budget allocation for 2025.

That is all.