Year In Review - 2023 Returns

The last update in the year in review series is on my returns in 2023. In the short run, the returns might seem high or low, but in the long run it should match my expectation of 10%. That was the assumption I used when I decided to retire early. As long as I can keep my expenses inflation to around 6% and my returns to around 10%, I should be able to manage to live a decent retired life. Since it has only been about six years since my financial independence, there isn’t a lot of data to go with. But as you saw from my update on expenses, we have managed to keep our inflation to below 6%. Now the question is, were we able to keep our returns to above 10%? Lets find out.

Portfolio vs index

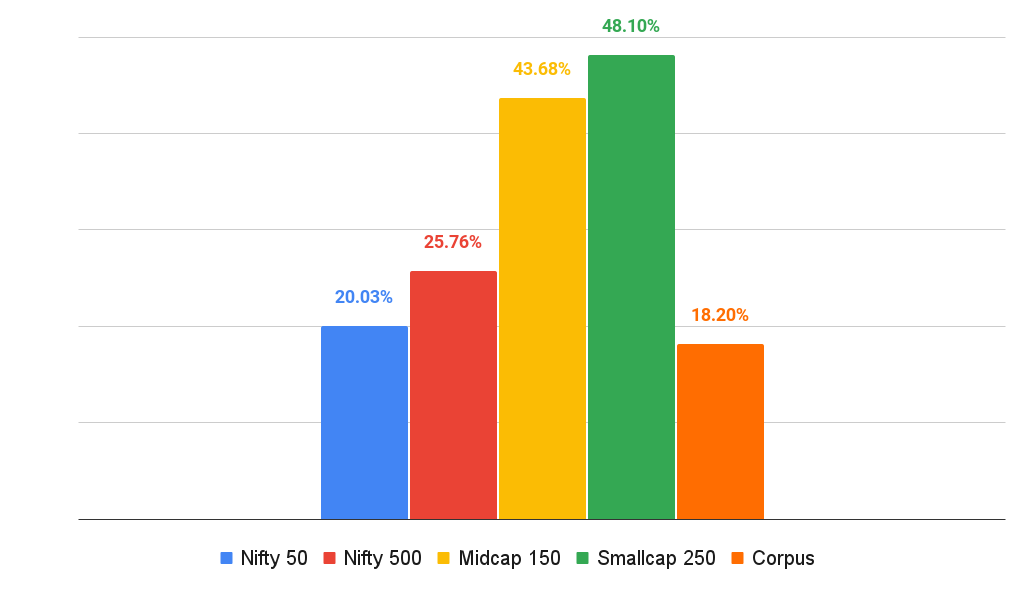

Take a look at the graph shown below. My portfolio returns were 18.2% in 2023, which is lower than all the other indices. I think it is to be expected since I am not fully invested in equity mutual funds. If I look at just my equity part of my corpus, then the returns are 33.4%. Not too bad. It was able to beat the Nifty 50 and Nifty 500 (my benchmark) indices. But the heros have to be Nifty Midcap 150 and Nifty Smallcap 250! Both of them gave a stellar 40+% returns. In a role reversal from 2022, the Nifty Smallcap index outperformed Nifty 50 index by a huge margin.

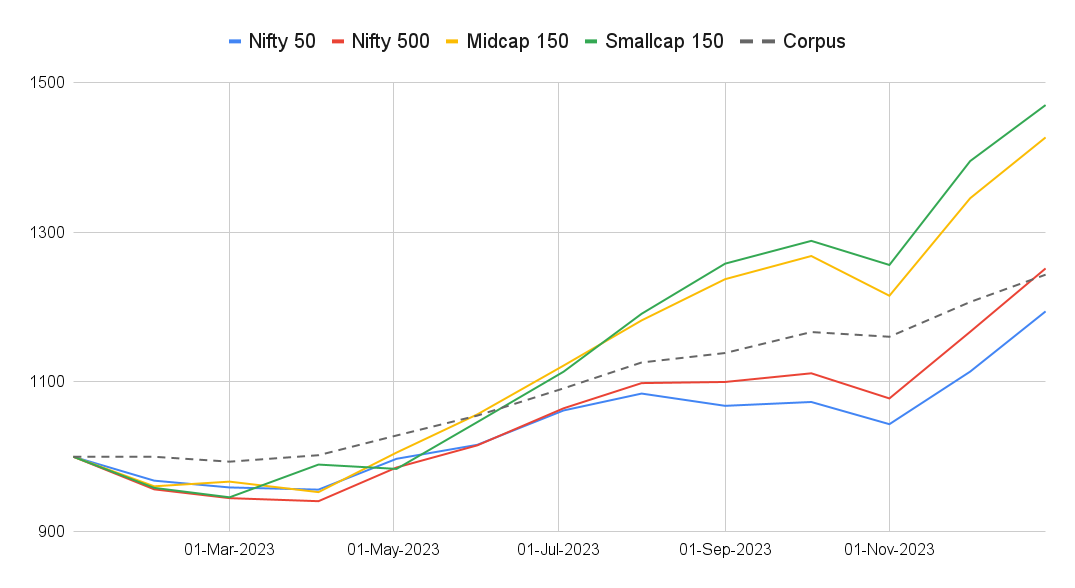

For me, the returns don’t mean much really. I am more interested in volatility. As long as my portfolio is close to my projections with the least amount of volatility possible, I will be happy. If you look at the volatility (see chart below), you will notice that while my portfolio was following the general up trend that the markets were exhibiting, it is less volatile. Neither does it go up too fast, nor does it come down fast. That is the magic of asset allocation.

As has always been the case, my asset allocation is the reason my returns never swing too much in either direction. Last year, I felt that the market was too high and did not get much chance to invest in equity MFs. However, thanks to great performance by the stock market, my asset allocation is now 46% in equity MFs and the rest in debt mutual funds. So I am still “fixed income” heavy. My asset allocation to equity was 40% in 2022.

The equity part of the corpus gave a return of 33.4% while my fixed income component gave a return of 8.1% in 2023. It is interesting that both sides of my corpus gave better than long term average returns. What does that tell you about the future returns? The higher returns from equity was all in thanks to mid and small cap mutual funds and funds that invest in foreign countries (specifically US markets). That is all well and good, but the real question is how am I doing with respect to my projections?

Portfolio vs projections

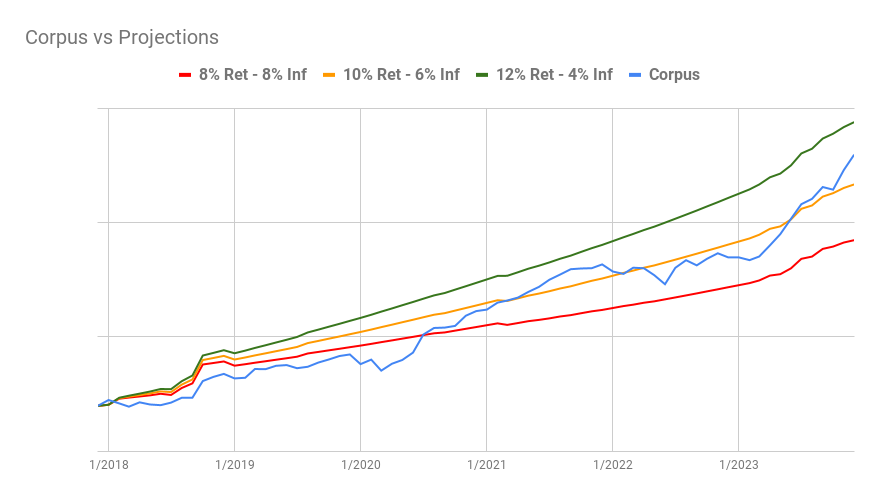

For those of you who don’t know, I have 3 kinds of projections which I use to compare my portfolio with. The first one is how my corpus should look like if my portfolio gave a return of 8% while my expenses grew by 8% (inflation) year over year. This is the lowest projection line. If my portfolio is performing worse than this projection, then I am in trouble.

The next projection is for a growth of 10% with an inflation of 6%. This is my real and ideal projection. That is the basis for my early retirement. I assumed that my portfolio would grow 10% year over year on average while my inflation would be 6%.

The last projection is based on a 12% return and 4% inflation. Obviously this is an aggressive projection. It is unlikely that I can maintain a 4% inflation given how much the cost of things are going up. On top of that a 12% return on investment is quite unlikely too. Anyway, here is how my portfolio performed in comparison with my projections.

This is only the second time that my corpus is above my median projection line at least for some part of the year. The earlier one was in 2021. Since my retirement, there has not been a single year where my corpus is above my projection of 10% returns and 6% inflation for the full year. That is how bad my financial planning is :). And people ask me for advice for their retirement and personal finance! Still, I am not worried at all. Hopefully in the long term my average returns will be around 10%.

As of now, these are my returns from Jan 1, 2018 to Dec 31, 2023.

Total corpus returns: 10.9%

Debt MF returns: 7.5%

Equity MF returns: 18.8%

Equity asset allocation: 46%

Note that my corpus consists of only equity and debt mutual funds and I have no other investments. No real estate, bitcoins, direct stocks (other than RSUs which I don’t consider part of my corpus, explained below), derivatives, gold, SGB, PF, NPS, FDs, RDs, fine arts, or anything else. Hard to believe I know, but trust me, those are exactly the only two investment classes I have.

Exclusions from corpus

As I have mentioned in several of my posts earlier, I do have a small portion of my RSUs from the time when I worked. Those RSUs are with a US stock broker and I left them there. I don’t count those as part of my retirement corpus because I left them as money I would use when I plan foreign trips. I don’t report any foreign vacation expenses in my blog. So neither the vacation corpus nor the expenses are ever tracked anywhere in my posts.

I am not too concerned about how my RSU perform. If it performs well, then we can have more vacations before we die ;). If it performs poorly, that we will have fewer vacations. To be clear, I have RSUs from just one company and I have no other investments in the US. So I am extremely concentrated basically into just one company stock. It is an extremely risky behavior I know, but as I said, I am not banking on that money to do anything meaningful to my retirement plan. It is money that I can just blow off on material aspects of life, which we are trying to avoid like plague.

If we have too much money left after we die, I can have it donated to a causes(es) or have it gifted to my daughter. Again, neither of them are in my plan or are active goals. If it happens, let it happen. If it does not happen, that is fine too, since we never even thought about them. I’d rather donate to causes I like while I am still alive. Just to clarify, while our donation expenses are part of our retirement corpus, they never get mentioned anywhere and just hide away in miscellaneous expenses.

Finally, lets come to the elephant in the room. We have some real estate but we never consider that as investment because either we, or our parents are living in the houses we own. My better half has a house in her home town which intermittently provides her some income in the form of house rent. It is again not part of our retirement plan. All that money she was saving was to buy a farm.

I don’t consider the farm we purchased as investment because we have no plans to sell it while we live. It will be a legacy for our daughter after we develop it. We want to live in the farm and enjoy the natural and organic fruits and vegetables. No plans (yet) to sell the produce and make money. If we do sell, we want to at least breakeven since we are spending a lot on the farm. Those details will eventually come in my blog as several posts.

So there you have it. All the details that I could think of. If I’ve missed out on some details that you’d like to know, please leave a comment below. That is all there is to talk about the returns from 2023. It certainly was a good year. Not sure if I can say the same for 2024.