A Confusing Time In Stock Market

The Indian stock market has been unrelenting in its growth. It feels like yesterday when I wrote that Sensex crossed the 60,000 milestone. Now, just 2 years later it is about to cross 70,000. But there is nothing impressive about it because that is a relatively low growth rate of 8%. Hardly anything to write about since we expect markets to do at least double digit growth. What is really impressive is that the market doubled in just three and a half years, which is a solid 22% growth. In June 2020, Sensex was around 35,000. The long term Sensex returns are around 13-14%. So should we be worried about a market crash?

Of course, I have no idea where the stock market is heading. We only have past history to look at and see if we can infer something from it. Foreign institutional investor (FII) as well as Domestic Institutional Investors (DII) are pumping money into the market. Some market analysts attribute this to stable government and the anticipation that there will be political stability in the upcoming general elections. Whether that is true or not, this is an exciting time indeed! While the markets are reaching new highs almost everyday, some say that a crash is imminent, while others say that there will be growth for the next 12 months.

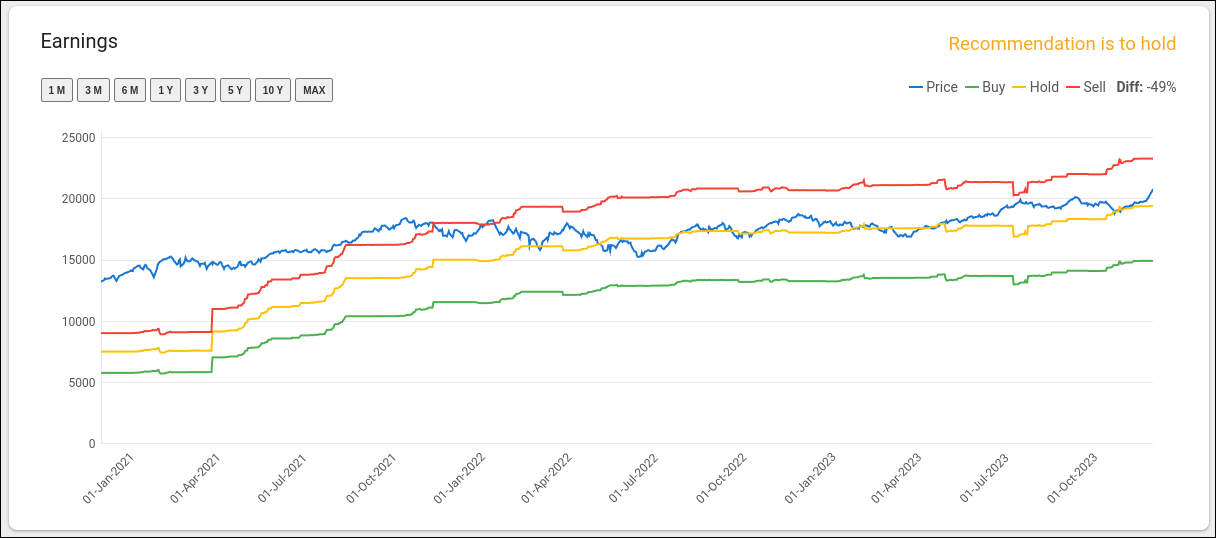

From all the crude models that I have, it feels like we are neither here nor there. The market does not seem to be too expensive nor too cheap. May be slightly overvalued that is all. But as Nassim Taleb said “All models are wrong, many are useful, some are deadly”, I am not sure if my models are deadly or just wrong. Having said that, if I look at the price to earnings for Nifty 50, it seems like the stock market is neither overvalued nor undervalued.

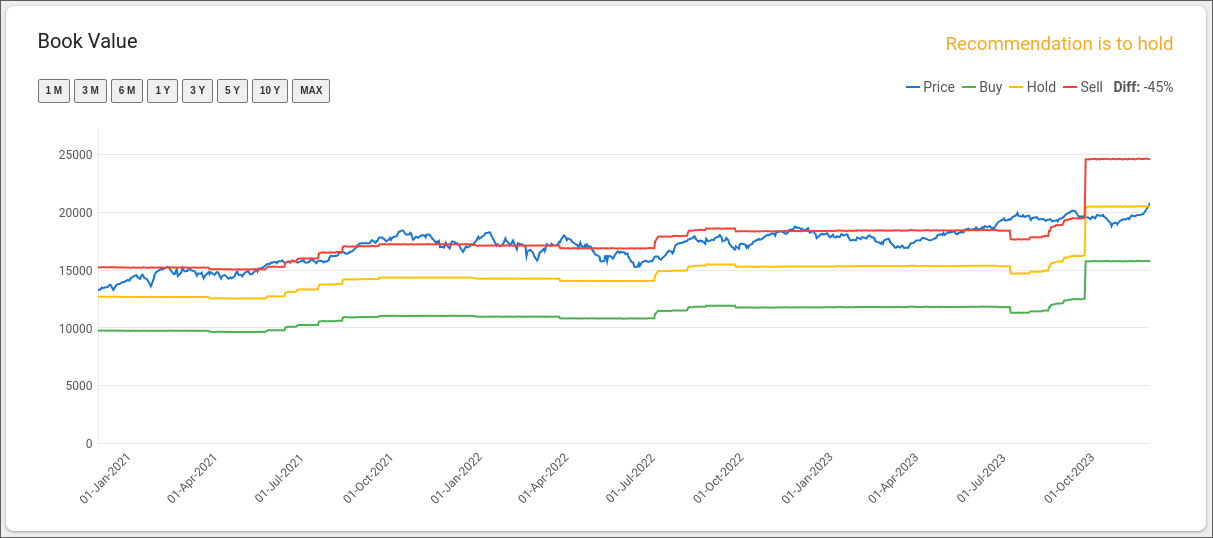

Then I looked at price to book to see if there are any clues there. Again the number is at about long term average. Neither expensive nor cheap. At least I am glad that the book value is going up because the price was running ahead of book value for the past 2-3 years. Since we are talking about the Nifty 50 companies, I am assuming they are not cooking the books, but you never know. When times are good, everything seems to be right. As Warren Buffett said, “You only find out who is swimming naked when the tide goes out.”.

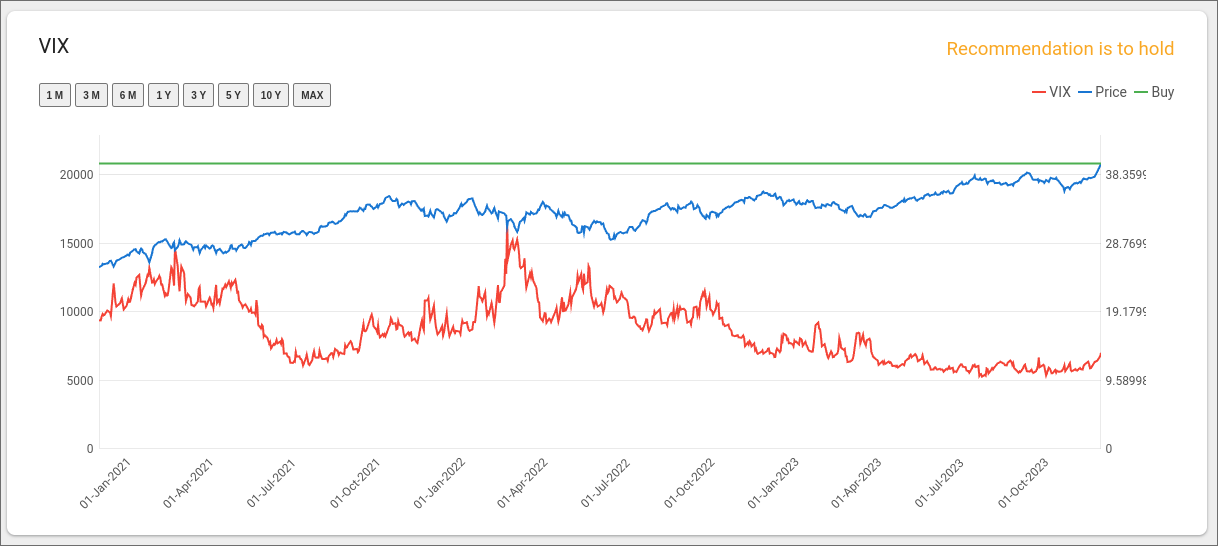

If you look at the volatility index, it is almost at historical low. Yeah, there is almost no volatility since the market is smoothly going up and no one knows the reason. Does that mean the markets can crash soon? No idea. Will the calm prevail for much longer? Not sure.

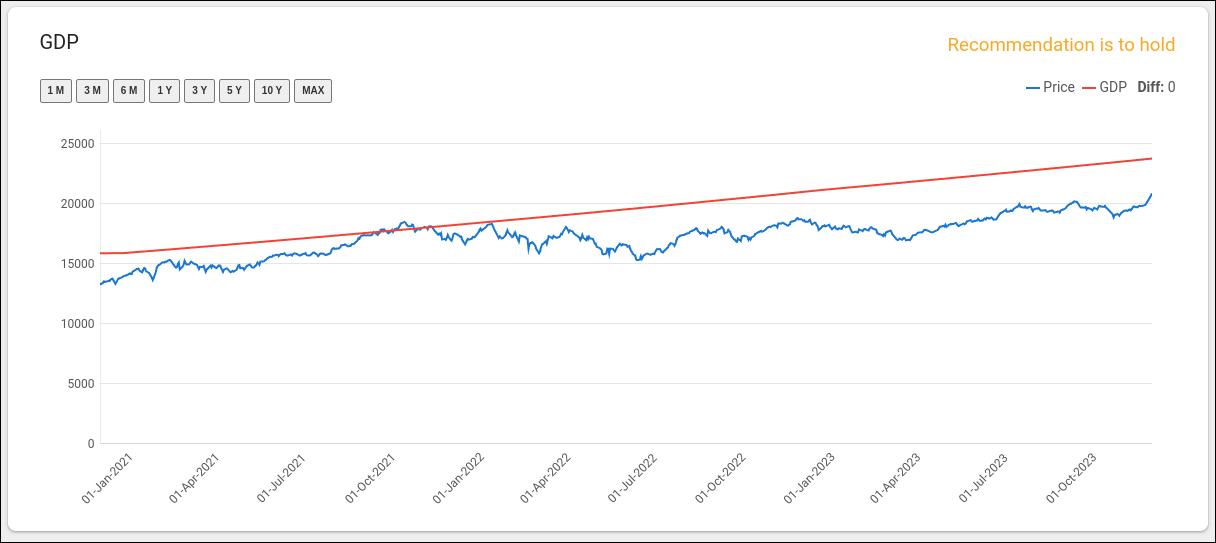

Finally, I looked at the price to GDP graph and according to that, we have more runway for the market to go up. I don’t trust this graph too much especially because we are forecasting the GDP in the near future and forecasting is never accurate.

I am not really sure how the markets will behave, but it is mostly irrelevant. All we should really care about is our asset allocation based on our risk and goals. For working folk SIP is still the way to go. If you have an asset allocation in mind, stick to it and rebalance as and when needed. Whether you are still working or retired, that is all that matters.