Sensex Touched 60,000. What Should I Do Now?

I never imagined that BSE Sensex (Bombay Stock Exchange Sensitive Index) would touch 60,000 so soon! Especially given the uncertainty due to COVID-19 pandemic. It took just 8 months to go from 50,000 to 60,000. Which is a 20% gain in that short duration. We have all heard of stock markets giving great returns, but this one is special because it is happening at a time when economic situation isn’t that great and we are still fighting a virus without cure. Oh well. Markets will do what they do best – surprise everyone. So what should an investor do in such a situation? My response may not give the answers you are looking for, but that doesn’t stop me from writing now will it?

How long does it take to double?

It feels like yesterday (well it has actually been 1.5 years) when I was writing a post after Sensex dropped more than 30% in relatively short duration. At the time Sensex was 30,000 and was still in the nosedive phase. So forget about the fact that it grew 20% in 8 months. It practically double in a year and half. That is the kind of lumpy return from equity markets that we typically talk about when it comes to investing.

What should an investor do now?

Nothing as usual :). I know you hate that answer, but if you are following your financial plan, that is pretty much all you ever need to do. Remember that 60,000 is just a number. It does not have any significance just by itself. It is no more dangerous than say 59,968. In fact, if you look at some markers, it seems like it can go higher from here. For example, if you follow the moving average tactic, then it seems like you should still buy.

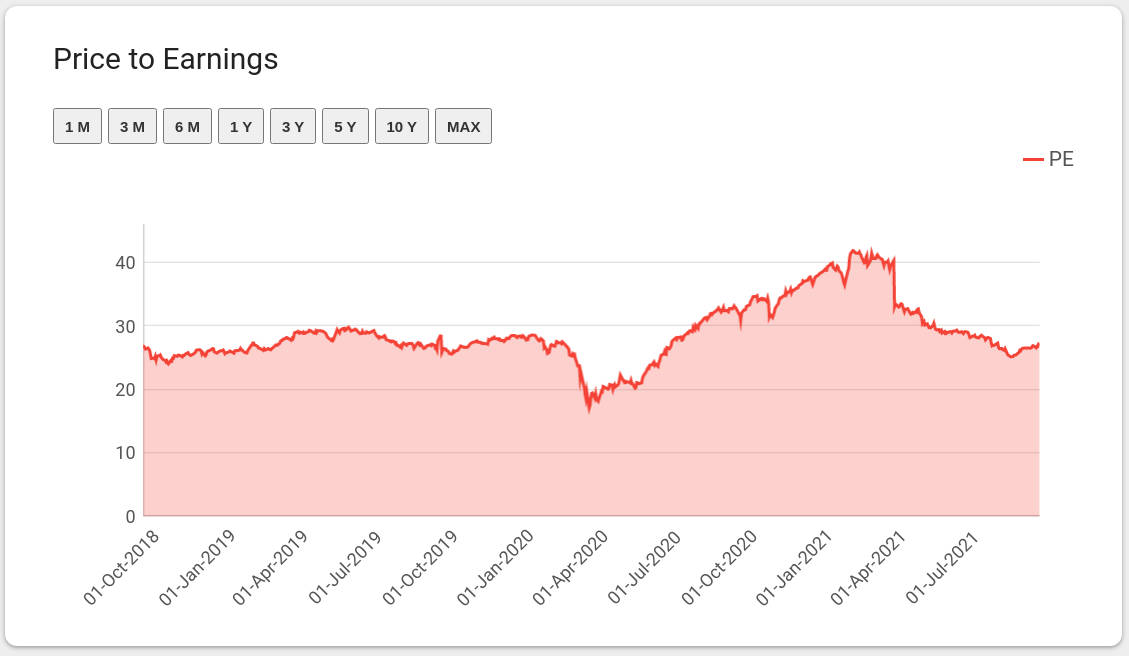

How about the price to earnings ratio? That too is showing a down-trend indicating that the price is more reasonable compared to earnings. Why is that? Well because the earnings were pretty good the last few months, far outpacing the growth in price of index.

No really, what should an investor do?

There is something you can do. It depends on how close you are to your goal. If your goal is nearing and you have more than what you need for the goal then take out the money right away from equity mutual funds. Move that to a safe FD or debt mutual funds. You’ve done the hard part of growing the money. Now protect the investment at all costs. Like Buffett said “Rule Number One: Never Lose Money. Rule Number Two: Never Forget Rule Number One”.

In all other cases, you should just rebalance. For example if your goal is supposed to be at 50:50 asset allocation, then check you asset allocation now. Is it off by more than 5% in either direction? Now is a good time to rebalance. In fact, you should have balanced it a long time ago, not when Sensex is at 60K. If you have been rebalancing already, then there is nothing to do now like I said before. For more information on how to change asset allocation based on goals, read my post on goal based investing.

Can things go wrong from here?

Sure why not? But really, I don’t know. The stock market can continue to keep moving up, or may crash, or may just move sideways. And a lot of factors determine the direction. It could come in the form of a third wave of COVID-19. Or may be the Chinese Evergrande debacle will spill over to other markets. It could be the collapse of Bitcoin that undoes the financial market bull. How about FED tapering or RBI action on liquidity or interest rates? No one knows for sure. All we know is that we are riding a wave. Have fun surfing while you can!