Improving Returns On Investment

A few days ago I wrote a post on how to start on a simple investment plan. The reason I wrote that post is to help you get started because it is easier to start on a simple plan. The more complex a plan, the more we procrastinate. But what if you have already started on your investment journey and want to improve the returns? Continuing from where we left off with the simple investment plan, here are some things you can do to improve returns.

Invest in active funds

Many argue that passive investing aka index funds generally beat active funds. But from my personal experience, active funds have done better than passive funds in the past. Things have changed in the recent past especially in the large cap space. Active large cap funds have failed to beat nifty 50 index funds.

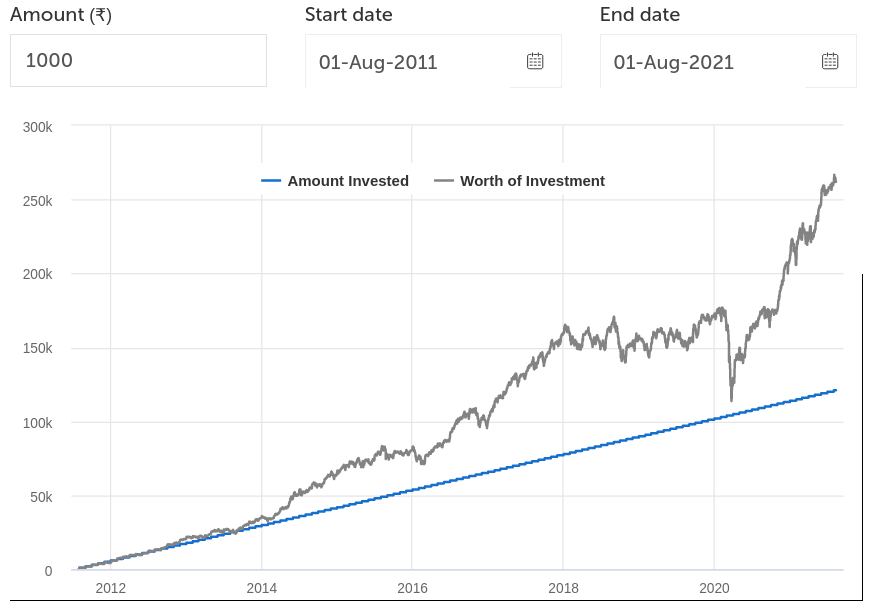

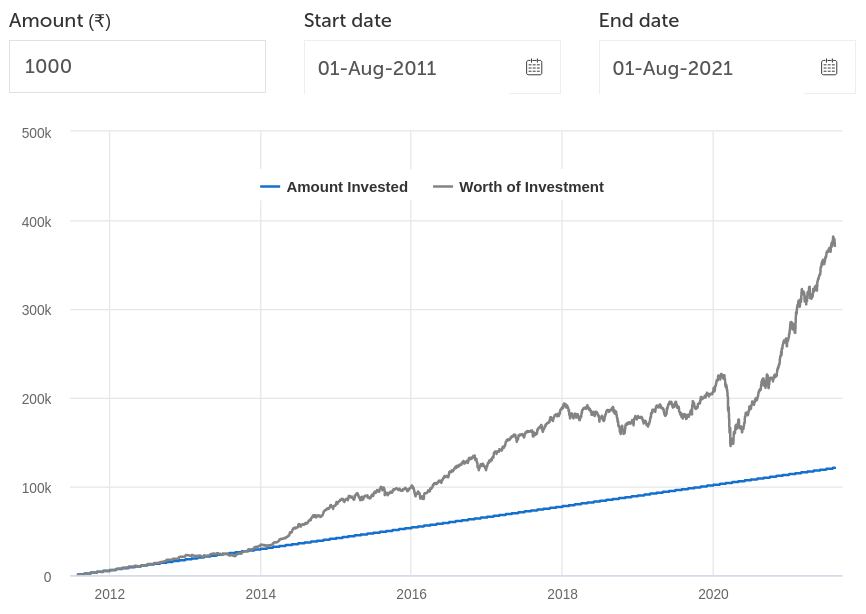

However, I still believe that mid and small cap funds will beat Nifty Next 50 Index. See charts below. Of course it is entirely possible that the range chosen (2011 to 2021) may have something to do with the result. Ideally, rolling returns would be a better choice. Still, this is one way to make better returns than the basic plan.

Of course you will need to put some effort into finding an active fund. I wrote a post on how I choose an equity mutual fund. It may or may not work for you. You can add your own twist when looking for some good funds. Again the important point is not to go on a quest to find the absolute best fund. Just find a fund with good history. The ranks keep changing.

Timing the market

Another way you can improve your returns is by timing the market. You will need some basic understanding of economics and market cycles. The idea is to change your asset allocation depending on the market conditions. Lets say you start with a 50:50 equity:debt allocation. Then when the markets are expensive, you may choose to go with 30:70. If they are cheap you could go with 70:30.

You will need to come up with your own set of indicators to figure out the market cycle. I already wrote about the indicators that I use. This is even more work than finding a good mutual fund.

Investing in stocks or sectors

If you know how to value businesses, you can try your hand at picking some good stocks. You should also be aware of current affairs. For example, when COVID-19 started, it would have been a good guess to say that pharmacy sector will do well. You could invest in that sector.

This brings me to an interesting observation I have been making recently. When I drive around Bangalore I am noticing a lot more driving school cars plying the roads than before COVID. Ola and Uber cars have come down. It does seem like more people want to own a personal vehicle instead of taking a risk with cabs. Is that an indication of improving automobile sector? Maybe it is a good time to jump into the auto sector, or may be I am already late. Remember – what the wise do in the beginning, fools do in the end.

Conclusion

These are some of the methods I believe can give you better returns than a simple plan. There may be a few other ways to increase your returns, but I don’t believe in them. You could try your luck with real estate, crypto-currency, IPOs, etc.