Difficulties Of Predicting The Stock Market

Every time we talk about the stock market, we either say it is overvalued or undervalued or fairly valued. The valuation may depend on many macro economic factors. One of them is GDP. Normally one would expect market value to be inline with GDP. So if GDP is up, market cap will be up, which basically means stock market is up. However, that is rarely true. Either the market is running ahead of GDP or the GDP is ahead of the market. And the worst part is that it is extremely difficult to predict when the trends will reverse.

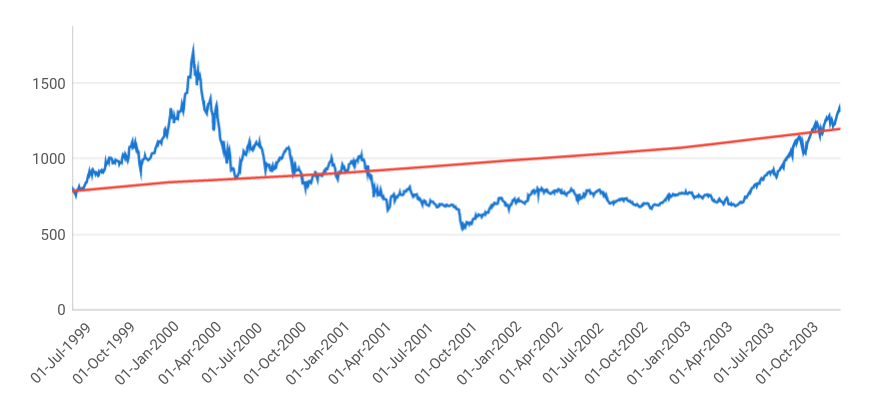

The 1999-2004 period

For example take the case of GDP vs market of Nifty 500 from 1999.

Nifty has been going up faster than GDP growth rate. Which basically means that the market participants expect businesses to do well and grow much faster than current GDP. The hope is that the GDP will eventually catchup to the market in future to meet the growth expectations. Remember that GDP always lags market because market cap is the expectation of future returns while GDP is the actual output in the past. So one is forward looking and the other is backward looking. Neither of them show the state of the present.

So if we continue with our story in 2000, the market is going up way too fast and no one really knows if such a ridiculous growth is possible. There is fear of missing out (FOMO) and more “investors” keep buying pushing the market to even higher numbers. Eventually a few failed businesses bring the market much lower than GDP in 2001. It laid low for a couple of years before breaking above GDP again in late 2003.

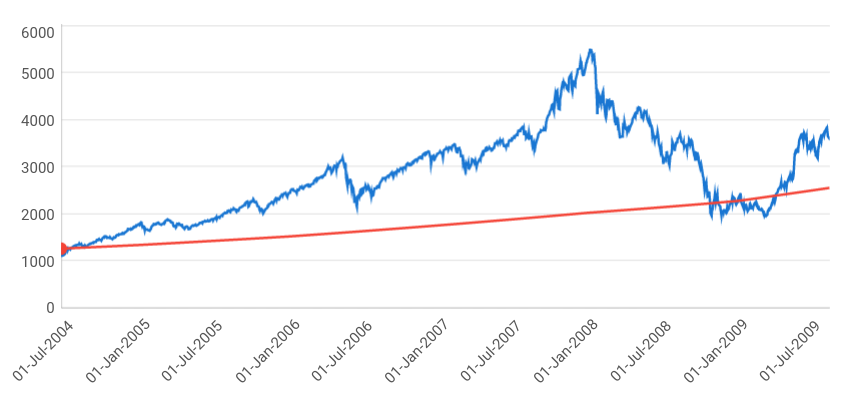

The 2004-2009 period

Now look at the period from 2004 to 2008. Similar story unfolds.

It was a nice bull run from 2004 all the way till 2008. There were some market falls in between, like in 2006 and 2007, but the market was still pushing faster than GDP growth. By 2008 investors were expecting a huge growth in businesses. Then another trigger of bad practices in the market led to the downfall. Stock market went below the GDP line.

This time instead of letting the market forces take their course of action and letting some poorly run business die like in 2000, the FED got involved. So thanks (but no thanks) to the FED and a few other governments pumping money into the system, the markets recovered quickly and went above GDP line once again. When there is too much liquidity in markets where the interest rates are low, the money moves to emerging markets like India pushing the market higher.

The 2012-2020 period

We then arrive at the latest period where we have seen a crash (if we can call that).

This period was interesting in that the Nifty 500 was hugging the GDP line more often than not. I like that, but for most market participants this could be a boring phase, because they want excitement like market going up quickly or falling quickly. I was lucky to have started my investing journey during the beginning of this period and retired too when the markets were quite sanguine.

The only way we could get the markets to act any differently was when a catastrophic event in the form of a pandemic hit us. The markets dropped very quickly, but then recovered much quicker than in the 2008 crash. The reason is again quite simple – thank the governments all over for handing our free money. I am actually not against it this time around if it reached the right people. In 2008 it went to protect big companies. At least in 2020 it (hopefully) went to the common man who could not run his or her small business on account of lockdowns. But the liberal policy was kept running for far too long and there is too much money in people’s hands at least in the US.

What next?

What happened next is the crazy stock market run up. Like before in 2008, all the liquidity that could not find a good place in fixed income assets (because of low interest rates all around the world) found their way to equity markets and especially in the emerging markets. Thankfully some of the money got diverted to bitcoin otherwise equity might have been further inflated, or perhaps gold might have been inflated. Not much money might have gone to real estate because everyone was fearful that the real estate value may drop because of the work from home culture.

Now if the GDP catches up with the market valuations, the stock market can go even higher. In fact, by some estimates, India’s GDP will be higher for the next 2 years. That gives more ammunition to the markets to go even higher. Remember, the markets are looking at past GDP and making predictions about future growth, so they will always be higher than GDP. When the tide will change, no one knows. At some point the output may come down and the stock may over correct but when that will happen is difficult to predict. Sometimes there may be a transient dip in output because of some factors like chip shortage. But no one can be sure how much of the chip shortage accounts for the lower output as against the drop in demand. It is a futile exercise to predict the future.