Stock Market Is Down By 20%

Yes, stock market is down once again. But what else is new anyway? It is doing it’s job going up and down as it likes. We are the only ones anticipating or hoping it would always go up. Anyway, the reason I am writing this post is not because of the market correction in the recent past. I don’t analyze why the markets go up or why they fall because most of the times it is unpredictable. In spite of various news reports trying to answer why the markets behaved the way they did, most of them don’t get it right. Whether we know the “why” or not, we do want to know how it effects our portfolio.

My portfolio was at it’s highest value in September 2024. At this time, the asset allocation was 51.4% in equity and the rest in debt. As you can see, the equity component is not that high and as a result, the effect of the market fall on my portfolio would only be half as bad as it looks. The indices fell anywhere from 13% to 23% from their respective highs depending on which index you are looking at.

| Index | Returns |

|---|---|

| Nifty 50 | -13.25% |

| Nifty Next 50 | -22.40% |

| Nifty Midcap | -17.03% |

| Nifty Smallcap | -21.43% |

Since I don’t track my portfolio on a daily basis, I only have crude data. My equity side of the portfolio lost about 13% while my total corpus (including both equity and debt mutual funds) lost about 6%. So nothing to worry much about really. Anyway, the stock market fall is so small that it cannot even be considered a fall according to me.

That little fall does not affect my mental peace or sleep at all. Not even the slightest bit really. To tell you the truth, I am quite excited and happy about it because finally the market is getting back to its right valuation. In fact, it is still too expensive if you ask me, but hey, what do I know. There is still a lot of scope for correction, but I am not saying that is what the markets will do. They are just crazy, so they may resume the upward journey again and become more expensive. Or they may correct and come back to more reasonable valuations. Who knows?

The reason I am happy about the situation is that I am taking this opportunity to clean up my portfolio a bit and doing some capital loss harvesting to reduce tax. I’ve been selling some equity funds into which I intentionally entered into early last year because I wanted to capture losses when the opportunity presents itself. So what I did was I found a couple of these equity funds with very short exit load days (one fund with 15 days and another with 30 days) and invested in them. Where did I get the money to invest? I sold some other equity funds which I felt have run up too much (think small cap equity funds). If the market tanks from there on, then I can harvest losses. If it continues to go up, then I still make money. I do this every time the market is too high because to harvest losses you need a new folio, otherwise due to first-in first-out method of mutual fund investments, you generally can’t capture losses.

Since the last few months I have been waiting and hoping for the market to crash some day so I can exit and take losses without paying any exit load (since they are less than 30 days). Finally that opportunity came a couple of months ago. And since I invested at almost the peak last year, I started to have losses now which I am offsetting with the gains I made during the last financial year. This is all a little bit tricky and needs a bit of your time to analyze and execute. But fortunately, given that I am retired and have no other “important and time sensitive” work, I could spent as much time as I want on it.

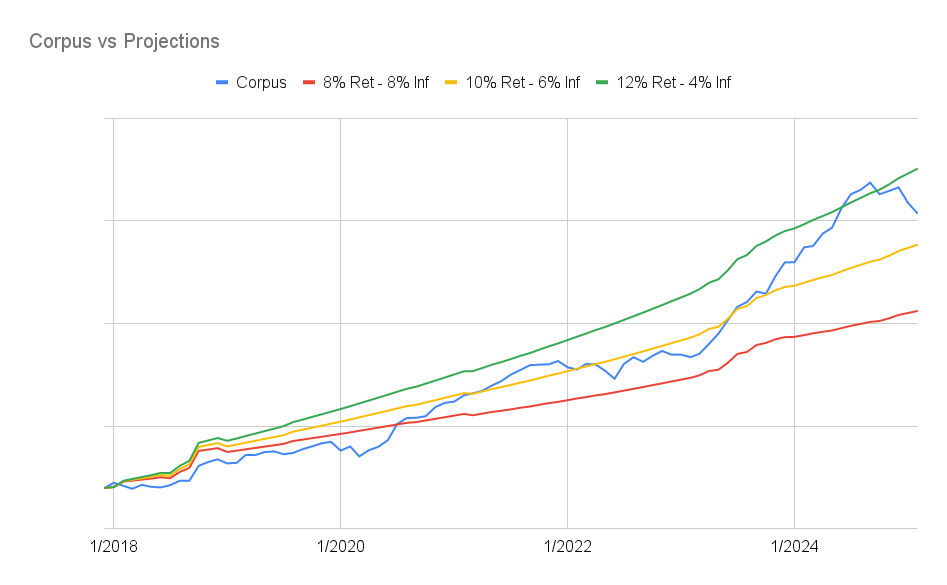

The reason, I did not lose sleep over the correction is because, while I lost quite a bit of money in absolute terms (given my corpus size), in percentage terms it was not that much. Generally I don’t look at absolute numbers. In fact I don’t pay a lot of attention to percentage losses either. I almost always rely on my projections to make sense of a situation. It is a habit that I picked up in 2011 way before retirement, when I first started investing. So where is my corpus in comparison with my projections? Below you can see my corpus (blue line) as compared with projections for 8% returns and 8% inflation (red line), 10% returns and 6% inflation (yellow line) and 12% returns with 4% inflation (green line).

If you notice, I’ve been through far worse in the first few years of my retirement when the corpus was below even the lowest projection. The past few months might seem bad with the corpus line dropping like a stone, yet it is still above the normal projection line. So I have nothing to worry, especially if I could survive the deep loss in the corpus in my early retirement years. In fact, I wasn’t perturbed even at that time because I know this is what markets do. So my expectations were already set to handle such situations. Otherwise, do you think I could have retired early? You need conviction, courage, and a certain mindset to retire early.

My asset allocation to equity is now at 46%, a drop from the 51% during the peak season. Yet, I am not convinced enough to change the allocation any higher because I think the market is still a little expensive, especially mid and small caps. I sell debt mutual funds to handle my expenses, which are giving a stable 7% or so returns even as the stock market is doing its thing. So my expenses are taken care of irrespective of the market condition. Well, that is all there is to know about my situation.