Year In Review - 2022 Returns

Continuing on in the year in review series, I now take a look at my returns in 2022. Although this is not really important since investments are for long term and there is no point looking at returns every year, I like to review it nonetheless. Last year, the stock market contrary to its general nature, did nothing interesting really. It was mostly flat with the market touching the peak around January and went down to the lows in June and back up by December. In the end, most of the indices that I track have ended slightly higher than where they started the year. My corpus performed inline with the indices, nothing too high or low. Enough talking lets start by comparing my portfolio returns with some of those indices.

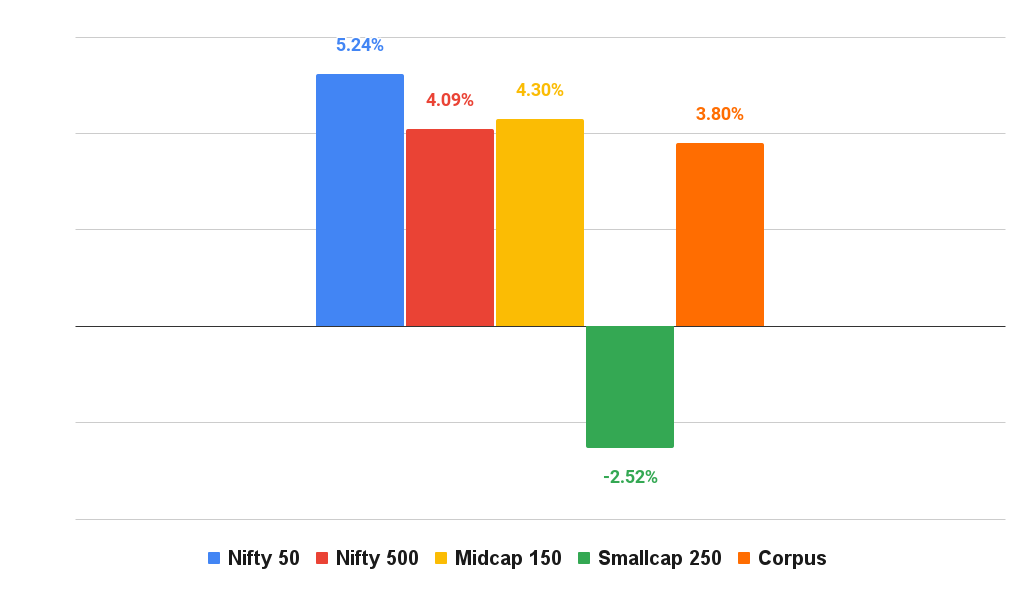

Portfolio vs index

While all the indices moved up slightly, my portfolio gave a return of 3.8% last year. Nifty 500 which is my benchmark gave a return of 4.09%. It is the worst performer behind Nifty 250 small cap index with a return of -2.52%. The best performing index was Nifty 50 at 5.24%! Interestingly, Nifty small cap index was the best performer in 2021 with a whopping 60.4% return while Nifty 50 was the worst performer. How the tables have turned :). It would have done you good to have been invested in small caps in 2021 and in large caps in 2022. But who would have that kind of foresight?

As you can see, my portfolio gave a return that is similar to all the indices minus the nifty small cap index of course. My returns could have been better if my asset allocation was skewed more towards equity, but I did not get enough opportunities. Other than a couple of months last year, for the most part I felt the markets were either over priced or just about right. So did not aggressively switch to equity. I started 2022 with around 29% in equity MFs and slowly increased to 40% by the end of the year.

The equity part of the corpus gave a return of 2.70% while my fixed income component gave a return of 4.43%. So either way I was screwed. The debt fund returns were low because of the RBI action to increase repo rates quite aggressively which put a lot of pressure on the longer duration funds like gilt mutual funds which I hold. The rate hikes also affected short and ultra short term mutual funds too which forms the major part of my fixed income portfolio. That was unfortunate.

At the same time, the equity markets in the US were struggling quite a bit. So while the Indian stock market was doing fine, my exposure to foreign equity via some mutual funds that invest in US markets, the effect was compounded. I don’t have any regrets, just mentioning for the sake of completeness. This is what one should expect from investing in volatile funds. They just did what is expected of them. If your experience is different, then you need to change your expectation :).

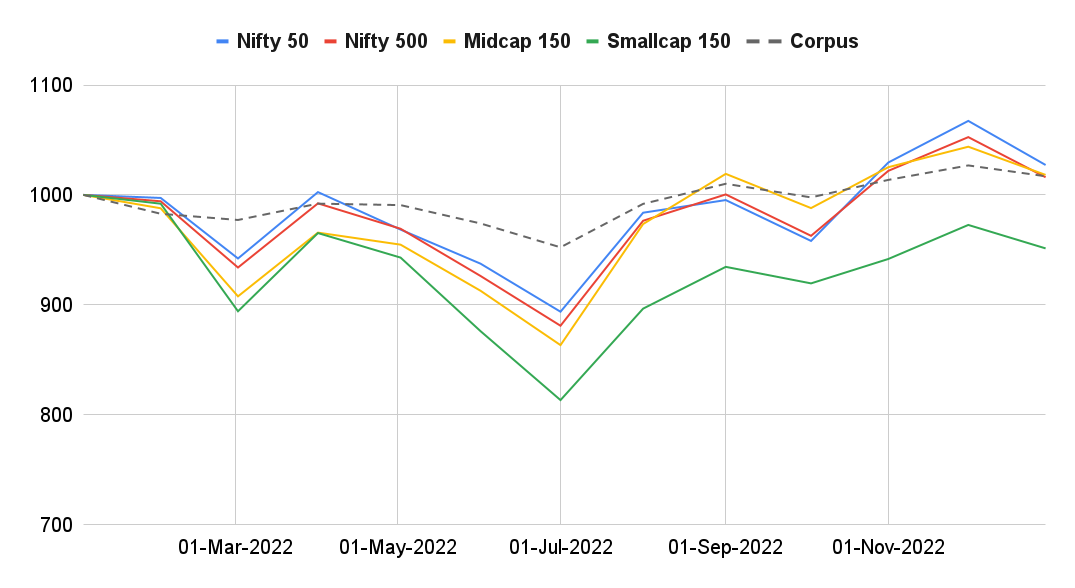

For me, the returns don’t mean much really. I am more interested in volatility. As long as my portfolio is close to my projections with the least amount of volatility possible, I will be happy. If you look at the volatility (see chart below), you will notice that my portfolio is less volatile than the rest of the indices

That is all well and good, but the real question is how am I doing with respect to my projections?

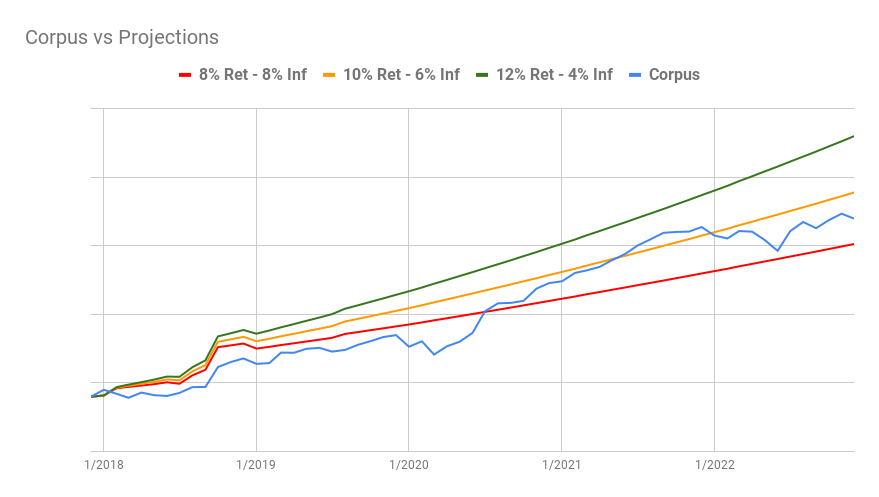

Portfolio vs projections

For those of you who don’t know, I have 3 kinds of projections which I use to compare my portfolio with. The first one is how my corpus should look like if my portfolio gave a return of 8% while my expenses grew by 8% (inflation) year over year. This is the lowest projection line. If my portfolio is performing worse than this projection, then I am in trouble.

The next projection is for a growth of 10% with an inflation of 6%. This is my real and ideal projection. That is the basis for my early retirement. I assumed that my portfolio would grow 10% year over year on average while my inflation would be 6%.

The last projection is based on a 12% return and 4% inflation. Obviously this is an aggressive projection. It is unlikely that I can maintain a 4% inflation given how much the cost of things are going up. On top of that a 12% return on investment is quite unlikely too. Anyway, here is how my portfolio performed in comparison with my projections.

As you will notice, my portfolio is right in between my minimum expected returns and ideal expected returns for all of last year. While I would like it to be above the ideal returns, it is still better than the first 2.5 years after my retirement where my portfolio was lagging even then minimum projection. Those were tough early years, but I was least concerned because you expect the corpus to match the ideal expectations in the long run if you don’t do anything stupid. And I have done so many stupid things :).

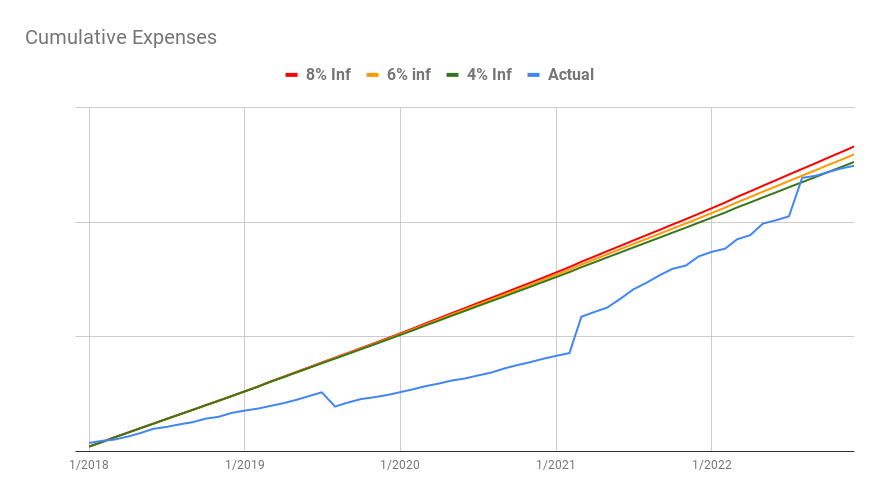

Expenses vs projections

While we kept a tight lid on our expenses since we retired until last year, our expenses finally caught up with the projection with the purchase of a new car. You can see our cumulative expenses since we retired below. The projections are based on 4%, 6% and 8% inflation. The gap between our real expenses and the projections is the amount that we did not take out from the corpus. So if not returns, at least our expenses are matching the projection I made 5 years ago :).

That is all there is to talk about my returns. As I mentioned before, my asset allocation is currently 40% in equity MFs and 60% in debt MFs.