Year In Review - 2021 Monthly Expenses

By now you already know about the two kinds of expenses that I track – monthly and annual expenses. You probably also know that I publish my expense report for the past year and mull over it a bit. Then I create a new budget for the expenses for current year. Following the tradition, here is a post about my monthly expenses in 2021 and the budget for 2022.

Monthly expenses for 2021

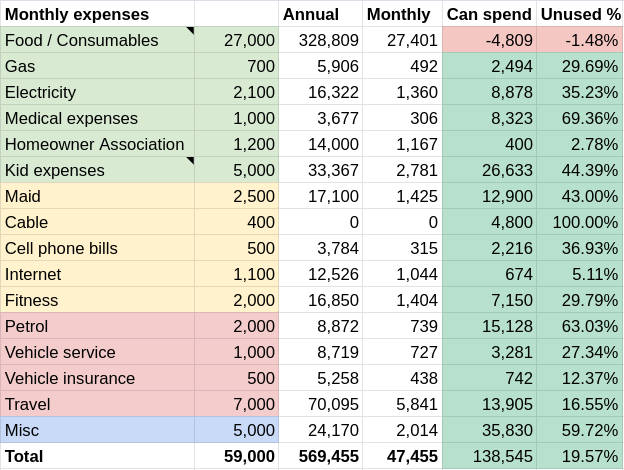

These are expenses that repeat many times with in an year, like food, petrol or vacation expenses. The budget for last year was Rs. 59,000 per month. Our average, monthly expenses were Rs. 47,455 which is well below the budget. This is the 4th year in a row we have managed to stay within the budget since our retirement. However, this year was the highest increase in expenses when compared to the year prior to it. That is basically what we call as inflation and the inflation was quite high and in the double digits!

| Year | Expenses | Inflation |

|---|---|---|

| 2018 | 41,100 | - |

| 2019 | 42,871 | 4.31% |

| 2020 | 41,633 | -2.89% |

| 2021 | 47,455 | 13.98% |

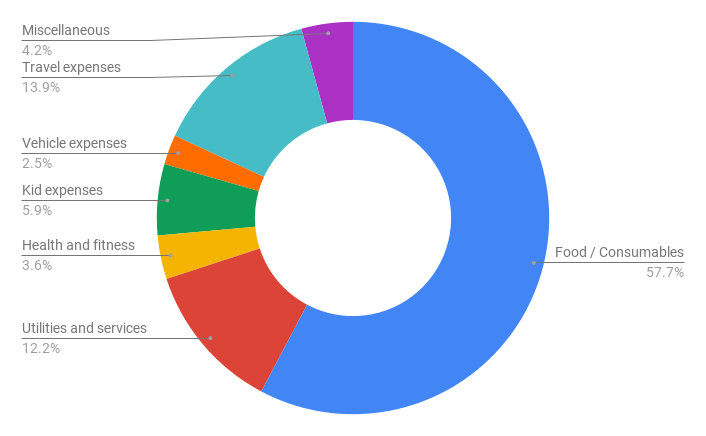

I never expected a 14% inflation, just like I did not anticipate a negative inflation in 2020, but that is life. Lets bring out the spending donut and see where we are spending the most.

Hmm, seems like we are spending a bunch on “Food / Consumables” which is perfectly fine. You can’t put a budget on healthy eating, at least not yet :). The next major expense right after food is travel! Can you believe it? This is the price you pay for upgrading to an upper class lifestyle. Once you have moved away from the middle class style of using trains or buses as your primary means of travel to flights, your expenses simply hit the roof. As usual, I was not involved in any of the travels :). That was just my family (parents, wife, sister and kids) travelling to various places over the year.

The next major expense was in “Utilities and Services”, basically internet, electricity, maid, cell phone bills, LPG, homeowner association fees etc. Beyond that, all other expenses are quite small, so no point getting all worked up :).

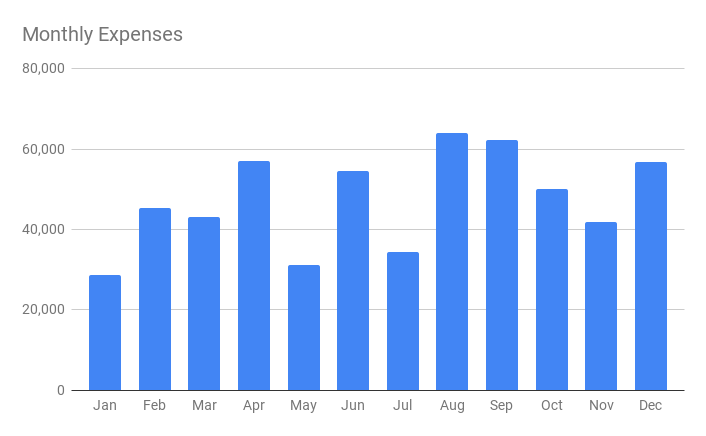

The month-wise expenses are quite uneven unlike in 2020 when almost all the months looked about the same given that we were all stuck at home thanks to various lock-downs. In 2021 however, there was some travel so the expenses have also been uneven going from as low as Rs. 28K in January to as high as Rs. 64K in August. Then coming to spending in each category, we were mostly within budget except for food.

So while travel expenses were high, it is not something unexpected. The food expenses on the other hand were above expectations, but that is alright. We overspent the budget by a measly Rs. 4809 for the year. However, you might have noticed something very interesting. We did not spend anything in the cable budget. You might wonder what happened there. Well if you remember, I wrote a post on why we gave up satellite TV.

The next category where we have most unspent amount (nearly 70%) is medical expenses which is good. And the final big savings came from petrol budget. Rest of the categories have nothing much to write about.

Budget for 2022

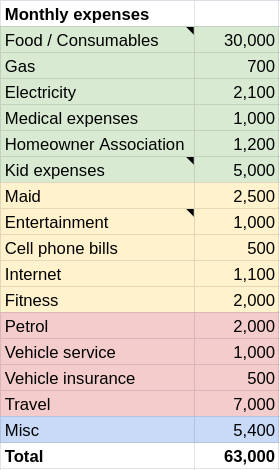

Like every year, I increase my budget by approximately 6% for the current year. Since it was Rs. 59,000 last year, this year the budget is Rs. 63,000. The reason for using 6% for inflation is because that is what i projected my inflation to be after retirement. But as you know from the table above, some years the inflation is lower and some other years it is higher. On average, hopefully the inflation will hover around 6% in the long run. We will have to wait and see.

Finally, having seen the spending style of last year, I allocated a bit more budget to food expenses when compared to last year. I replaced the cable expenses (which I don’t have anymore) with entertainment expenses. I will be recording any monthly expenses related to entertainment which include purchasing games (you haven’t heard?, I started playing games again), OTT bills (amazon prime subscriptions is the only one we have), eating out (which we rarely do) etc. Budget for all other categories remained the same.

That is all for today. I will be going over my annual expenses in an upcoming post.